Bitcoin Price Profits 153% on Average After 30% Drops, Buys Ahead: Analyst

Buy bitcoin when it dips to profit when it soars, says an analyst. | Source: Shutterstock

By CCN.com: Throughout the past three years, the bitcoin price has demonstrated relatively large pullbacks averaging 30 percent following a large upside rally.

https://twitter.com/Josh_Rager/status/1131039202286755845

Every pullback, however, was followed up with an average gain of more than 153 percent, as cryptocurrency trader Josh Rager explained.

“Reward of buying pullbacks Previously examined how Bitcoin often experienced 30%+ pullbacks during last uptrend But we didn’t discuss how buying these pullbacks can reap rewards. The average gain after a 30%+ pullback was over 153% profit before the next strong pullback,” said Rager.

While some investors expect bitcoin and the rest of the crypto market to retrace following a 100 percent year-to-date recovery, it is important to consider the historical performance of the dominant cryptocurrency.

Bitcoin moves by cycles

As said by many industry executives including former Coinbase CTO Balaji Srinivasan, bitcoin tends to move by cycles.

Thomas Lee, a co-founder at Funstrat Global, recently reported that bitcoin generally generates all of its performance within 10 days of any year, primarily because it is heavily driven by market cycles.

“Reminder that BTC generally generates all of its performance within 10D of any year. –ex the top 10 days, BTC is down 25% annually since 2013,” Lee said in April.

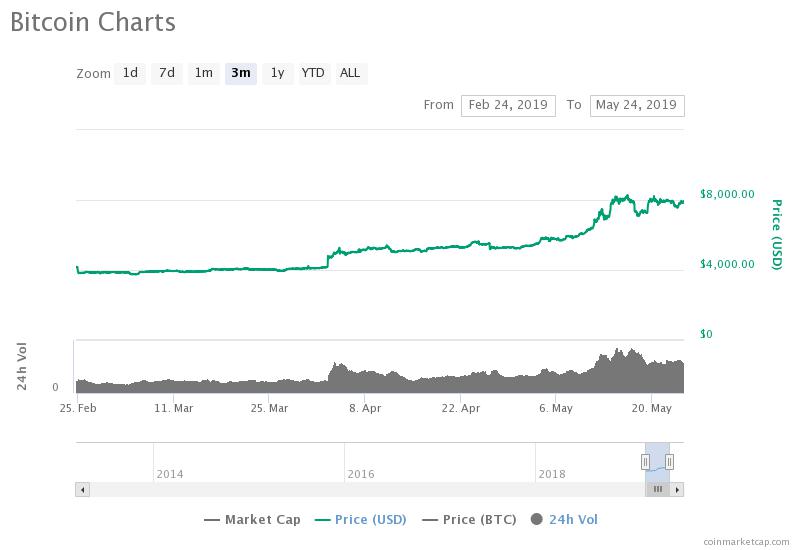

Since then, the bitcoin price has increased from $4,200 to nearly $8,000, by around 90 percent against the U.S. dollar.

As the bitcoin price recovered to $8,000 subsequent to a dip to around $7,500 earlier this week, it surpassed May 2018 levels, trading higher than where it was 12 months ago.

“Today was the first day in more than 200 days that Bitcoin closed higher than 1 year prior. Throughout its history, it trades higher year-over-year 75% of the time. Quite odd behavior for an asset that keeps dying,” one crypto analyst said.

Bitcoin has not seen a large pullback yet after it climbed from $4,000 to $8,000 in the past two to three months.

Hence, in the near-term, although the strong momentum of the crypto market could prevent a significant downside movement, a 30 to 40 percent retracement is a possibility considering the performance of bitcoin in the past several years.

However, Rager noted that even in an unlikely event that bitcoin falls more than 30 percent in the near-term, its historical trend suggests that it is likely to recover swiftly from it.

The clear rise in the interest in and demand for bitcoin from accredited investors and institutions as portrayed by the substantial increase in the volume of regulated platforms such as the CME bitcoin futures market could serve as a short-term catalyst of the asset should it correct in the upcoming weeks.

Rising adoption

On May 23, as reported by CCN.com, AT&T officially integrated crypto payments through BitPay, enabling its clients to pay for its services using cryptocurrencies like bitcoin.

Kevin McDorman, the vice president at AT&T Communications Finance Business Operations, said:

“We’re always looking for ways to improve and expand our services. We have customers who use cryptocurrency, and we are happy we can offer them a way to pay their bills with the method they prefer.”

As positive news coverage surrounding the crypto market supplements the rising prices of crypto assets, the sentiment around the asset class is expected to improve.

Click here for a real-time bitcoin price chart.