Bitcoin Price Hits $11,000 Global Average as Altoin Markets Shatter Records

It has been a historic week for the cryptocurrency markets. Led by the bitcoin price’s march to $10,000, a litany of coins and tokens have posted record highs, and — despite concerns that the charts are heating up too fast — the rally has yet to show any signs that it is slowing down.

Bitcoin entered mid-week trading with a vengeance, and the cryptocurrency market cap made an astounding 24-hour increase of $26.2 billion. At present, the total crypto market cap amounts to $334.3 billion; needless to say, this is a new all-time high.

The crypto market cap now needs to add just $17 billion to surpass the total valuation of bitcoin-bashing JPMorgan, whose CEO has taken to calling bitcoin a “fraud“.

Bitcoin Price Reaches $11,000 Global Average

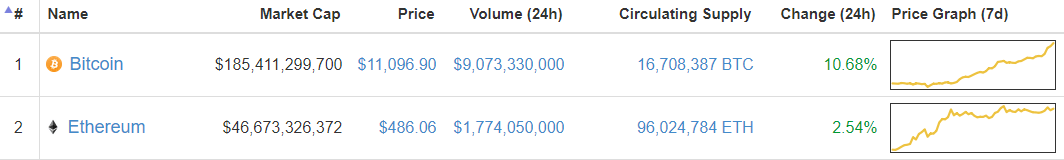

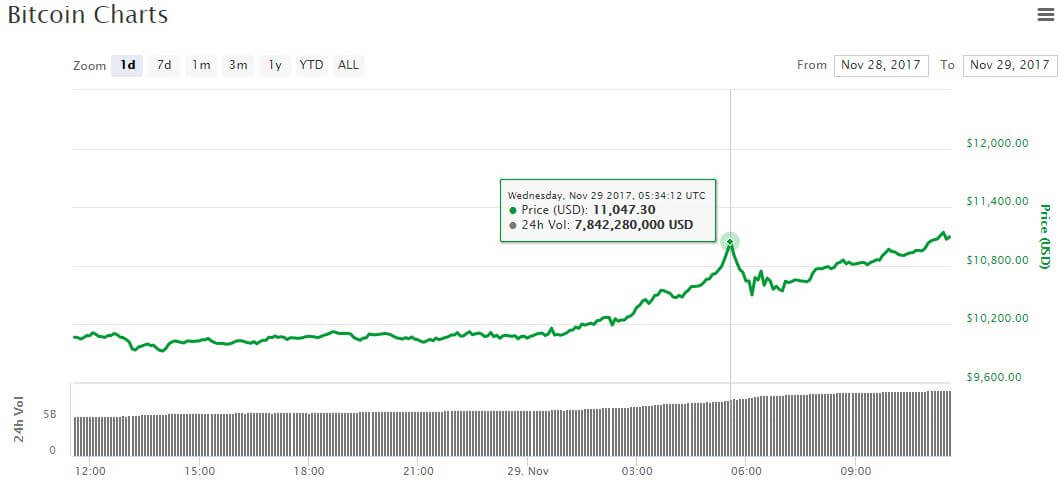

As CCN.com reported, the bitcoin price completed its triumphant march to $10,000 on Tuesday, led by insatiable demand from Asian traders. The rally continued on Wednesday, and the global average bitcoin price blazed past $11,000 as Korean traders bid bitcoin up to domestic prices of nearly $12,000. At the time of writing, bitcoin was trading at a global average of $11,096, which represents a 24-hour gain of 11 percent and translates into a $185.4 billion market cap.

As has so often been the case during 2017, bitcoin has entered uncharted waters. The rate of the bitcoin price’s November ascent is unprecedented, and no one quite knows where it will go from here. Many analysts expect to see a short-term correction as traders take profits, but, at least for now, that pullback has yet to materialize.

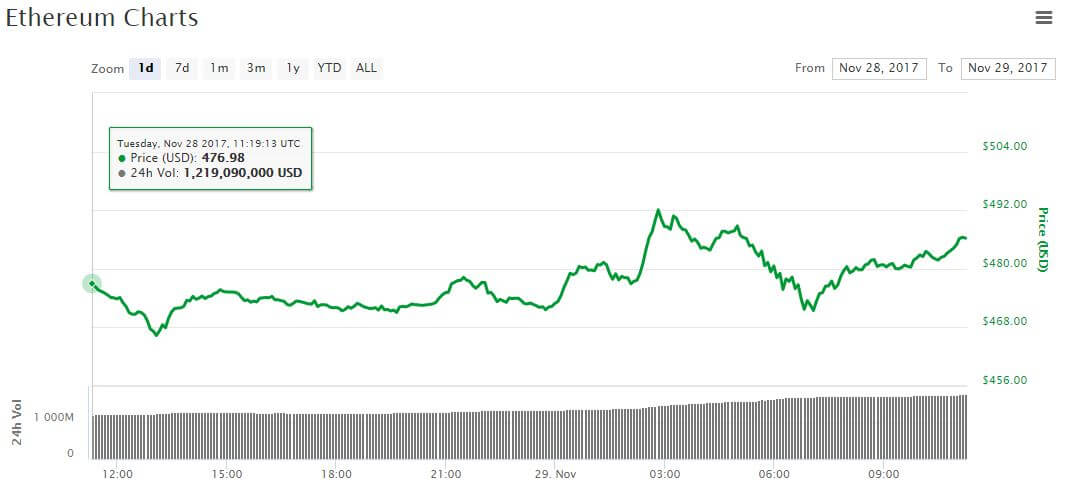

Ethereum Price Eyes $500

Ethereum, on the other hand, exhibited a relatively calm day of trading. The ethereum price posted a two-and-a-half percent gain for the day, bringing it to a present value of $486. This places ethereum close to the all-time high it set earlier this week, making it plausible that the second largest cryptocurrency will pierce $500 in the near future.

Altcoins Shatter Records

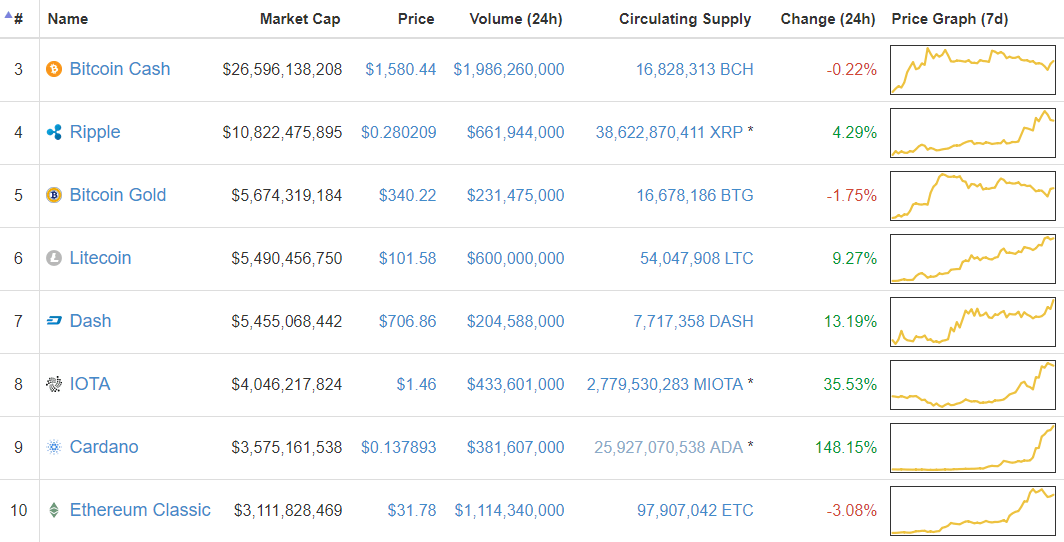

Altcoins added a combined $6 billion on Wednesday, and that increase propelled numerous cryptocurrencies to all-time highs. Notably, one result of this movement is that every top 10 cryptocurrency now has a market cap of at least $3 billion.

Despite the overall bullish movement, the two largest bitcoin forks — bitcoin cash and bitcoin gold — declined for the second consecutive day. Ripple, the fourth largest cryptocurrency, rose by four percent to $0.280 and a $10.8 billion market cap.

Litecoin, ranked sixth, followed bitcoin into record territory and ultimately barreled through the $100 mark for the first time.

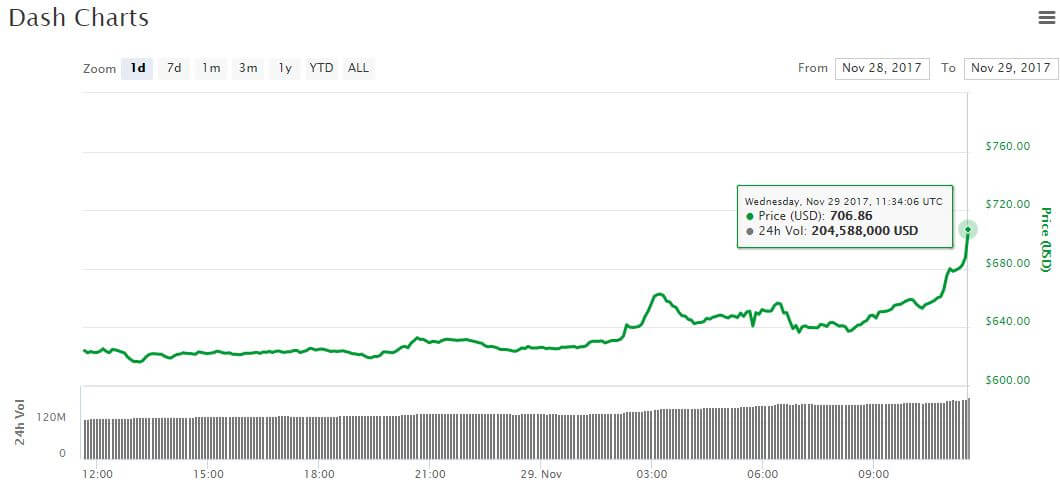

Not wanting to be outdone, the dash price posted a 13 percent gain of its own, enabling it to surge past $700 to a present value — and new all-time high — of $707.

From here, the charts start to look dizzying. IOTA rose 35 percent, while cardano stormed into the top 10 with a 148 percent rally. Stellar — ranked 14th — leaped by 48 percent, and numerous other coins posted gains as the bullish mood reverberated throughout the markets.

Featured image from Shutterstock.