Bitcoin Price Breaks Toward $4,600 as Ethereum, Altcoins Lag Behind

The bitcoin price rose another 3% on Monday, bringing it within $20 of the $4,600 threshold and enabling it to raise its total market share above 50%. The ripple price joined bitcoin in its ascent and extended its rally by another 10%. Unfortunately, the rest of the markets were not so lucky. The ethereum price posted a minor decline, and the majority of other top 100 cryptocurrencies followed its lead.

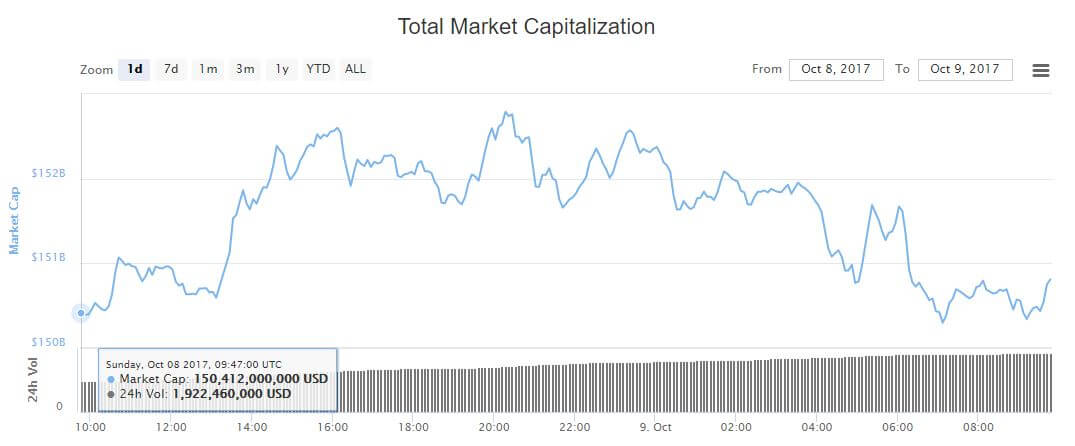

After a mid-day rally, the total cryptocurrency market cap ended the day trading sideways, although it did add about $800 million to bring the total value of all cryptocurrencies to a present value of $151.2 billion. However, the total market cap of cryptocurrencies — excluding bitcoin — fell by about $900 million, and if you remove ripple from the equation, it drops another $800 million.

It is not immediately clear what is causing this trend, although some — including prominent trader and economist Tuur Demeester — have speculated that investors are positioning themselves to receive the coins that will be airdropped if the SegWit2x hard fork executes as scheduled. However, the hard fork will not take place until November — if at all — so, as Demeester noted, it’s possible something else is at play.

Bitcoin Price Presses Toward $4,600

Either way, the bitcoin price managed to surpass the psychologically-important $4,500 threshold. After entering the day at $4,456, the bitcoin price rose as high as $4,630, although it ultimately tapered to a present value of $4,584. This represents a 24-hour increase of 3% and gives bitcoin a market cap of $76.1 billion.

Significantly, today’s market movements enabled bitcoin to raise its share of the total cryptocurrency market cap to 50.5%, which is the first time bitcoin dominance has crossed 50% since mid-August.

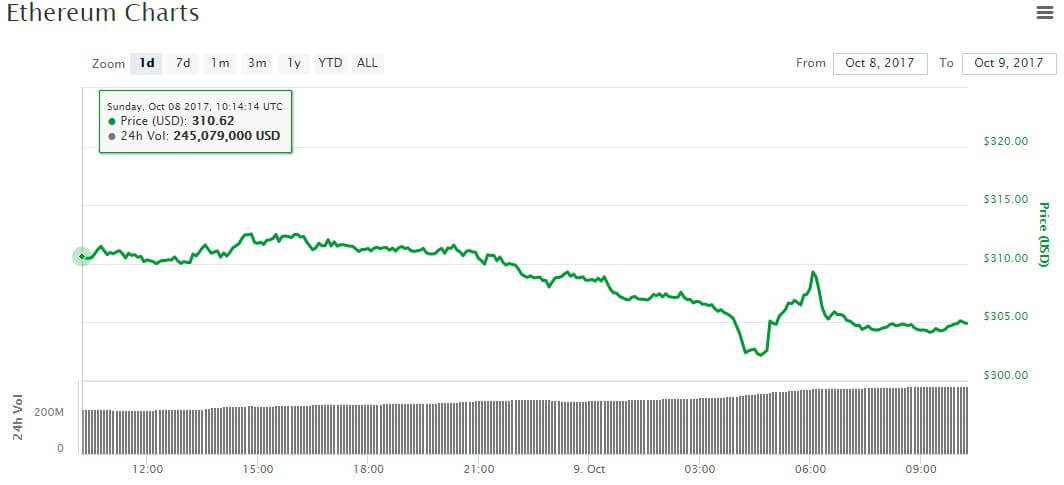

Ethereum Price Dips 2%

The ethereum price posted a minor decline for the day, dipping 2% from its previous-day level of $311. At present, the ethereum price is trading at a global average of $305, which translates into a $29 billion market cap.

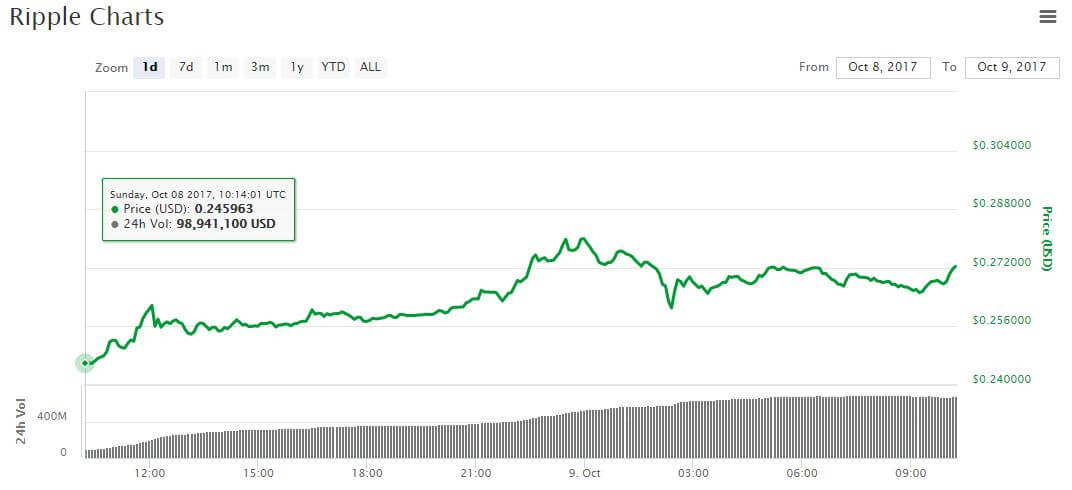

Ripple Price Swells Ahead of Conference

The ripple price extended its rally into the new week, adding another 10% to its already burgeoning market cap. The ripple price is now trading at $0.267, its highest point since late August. Ripple now has a market cap of $10.3 million, which is nearly 81% larger than that of bitcoin cash.

As CCN.com has pointed out in recent market roundups, the impetus for the ripple price rally appears to be anticipation of “Swell,” the upcoming conference that FinTech startup Ripple is hosting in Toronto next week. Investors believe the firm will make an announcement that will have a long-term positive impact on the XRP price, and they are pricing that news in ahead of time.

Altcoins Post Unified Retreat

Altcoins posted a near-comprehensive retreat on Monday, with more than 80 of the top 100 cryptocurrencies posting single-day declines.

The bitcoin cash price has tracked inversely with ripple in recent weeks, and it carried that trend into Monday. The bitcoin cash price fell 6% to $339, reducing its market cap to just $5.7 billion.

The litecoin price fell 1% to $52, while dash and NEM each declined 5%. NEO posted the worst performance among top 10 cryptocurrencies, plunging 16% to $30. IOTA and monero rounded out the top 10 with respective declines of 8% and 3%.

Featured image from Shutterstock.