Bitcoin Price: BitMEX CEO Doubles Down on Bear Call, Says BTC Could Fall to $2,000

What a difference a few months can make. It seems like a lifetime ago that Arthur Hayes, CEO of cryptocurrency derivatives platform BitMEX, predicted that the bitcoin price could reach $50,000 in 2018. In fact, it has been less than six months, though the events that have occurred during that interlude have been sufficient for Hayes to slash his short-term crypto forecast by more than 95 percent.

CCN.com reported earlier this week that Hayes, a former Citigroup trader, is now predicting that the bitcoin downtrend could last another 18 months, mirroring the “nuclear bear market” the crypto industry experienced in 2014 and 2015. Writing in Friday’s edition of the BitMEX Crypto Trader Digest, Hayes doubled down on that portentous outlook.

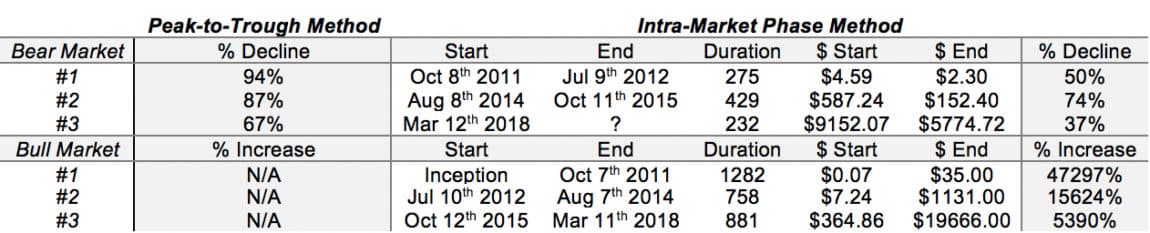

While chart-watchers often treat bear markets as beginning as soon as an asset dips below its cyclical peak, Hayes said that a better strategy may be to mark the beginning of the bear market as the date at which the bitcoin price falls below its 200-day moving average (DMA). By this metric, bitcoin entered bearish territory on March 12 when it was priced at $9,152 and has only seen a 37 percent decline since dropping below the 200 DMA.

Given that past bear markets have seen bitcoin break much further below its 200 DMA, he argued that it’s likely we still have a long way to go before the bears finish twisting the knife, potentially dropping BTC as low as $2,000 before the bulls regain their footing.

“How low can we go?” he asked. “A 75% fall from $9,152 takes us close to $2,000. $2,000 to $3,000 is my new sweet spot but don’t tell Michelle Lee just yet.” [Note: Hayes is likely referring to CNBC host Melissa Lee]

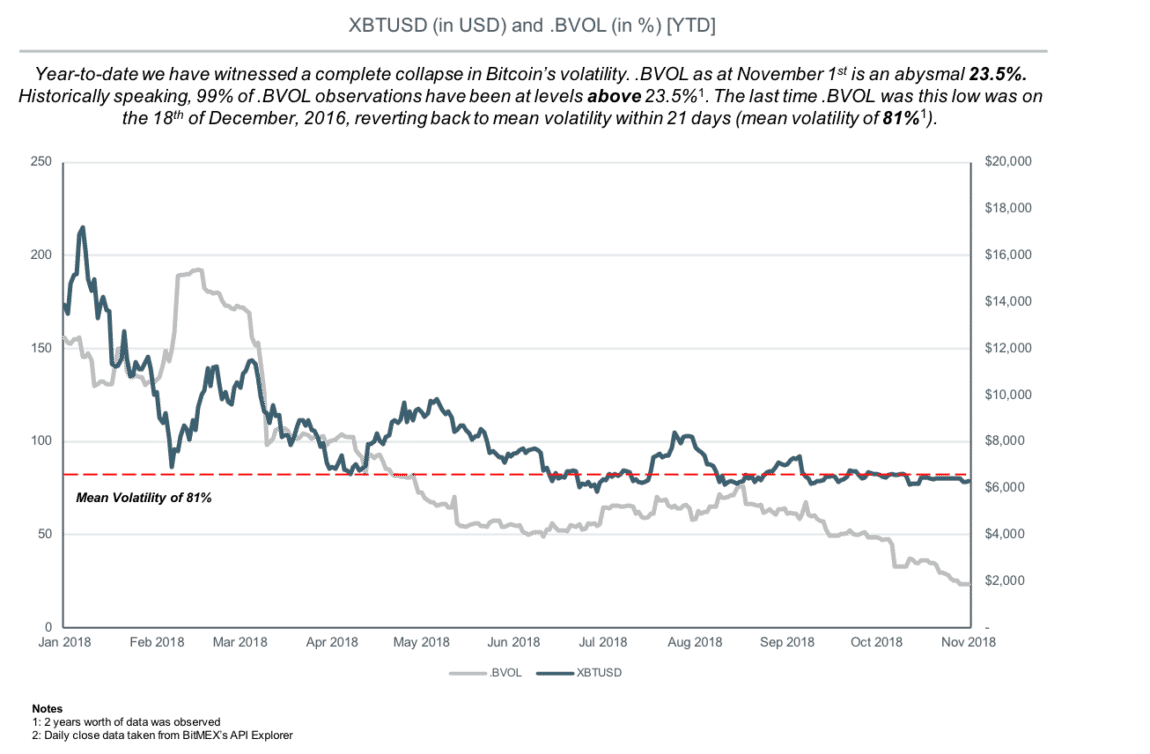

Hayes also cited the decline in bitcoin volatility as justification for his bearish outlook, taking a different tack from Fundstrat founder Tom Lee, who said that he was “pleasantly surprised” to see the decline in volatility given conditions in the broader equities markets.

He wrote:

“Contrary to popular belief, Bitcoin requires volatility if it is ever to gain mainstream adoption. The price of Bitcoin is the best and most transparent way to communicate the health of the ecosystem. It advertises to the world that something is happening–whether that is positive or negative is irrelevant.”

“The Bitcoin price volatility is the gateway drug into the ecosystem,” he continued. “If volatility stays at these depressed levels, the price will slowly leak lower. For those of us who lived through the 2014-2015 bear market, we all await that nasty ass candle that breaks the soul of the bulls. Then, and only then, will volatility and the price ratchet higher.”

In the meantime, Hayes said that the best traders could do is attempt to call the bottom, though they probably won’t have the fortitude to act when their instincts tell them that the floor is in.

“The key consideration to ‘calling the bottom’ is the price action around the last gasp of the bears. You will know it when you see it,” he concluded. “And the best part is, you probably will be too chicken to click that oh so scary Buy button.”

Featured Image from Shutterstock