‘Bitcoin Is the Greatest Scam in History,’ Says Founding PayPal CEO. Wrong.

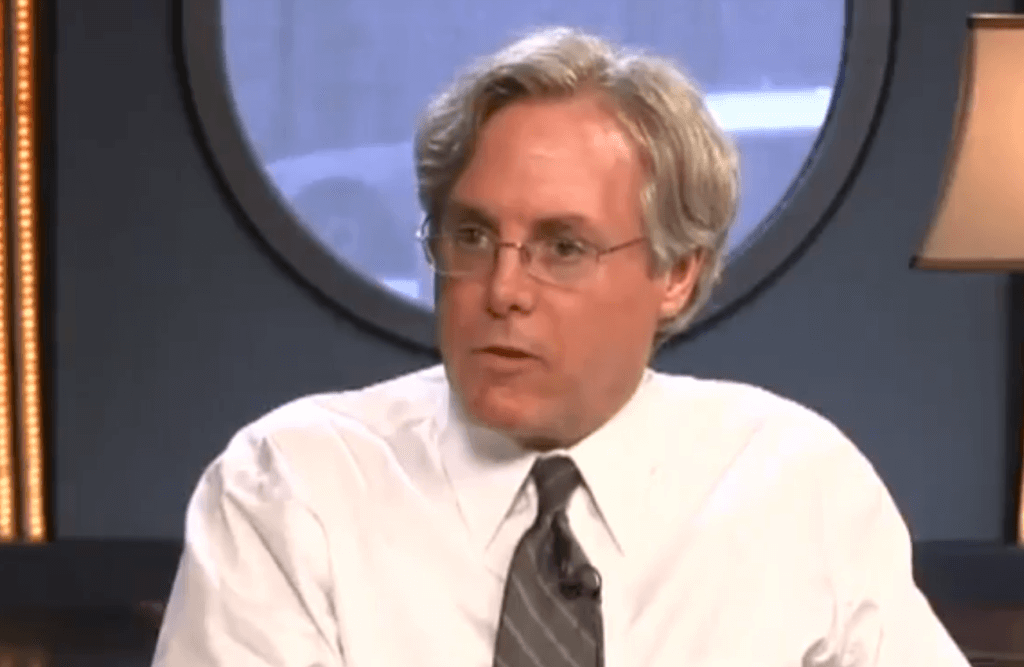

One could say that former PayPal chief executive Bill Harris is not fond of Bitcoin, but that would be an understatement.

Writing in an op-ed published by tech outlet Recode , Harris argues that Bitcoin is not only a bad investment but is also a “colossal pump-and-dump scheme, the likes of which the world has never seen.”

Harris does not break any new ground on the Bitcoin-bashing front, and he quickly retreats into stale arguments from opinion pieces authored in 2013 — and better left there.

Let’s run through a quick checklist:

- Bitcoin mining is “absurdly wasteful of natural resources.” Check.

- Virtually no one accepts Bitcoin payments. Check.

- Bitcoin is not a store of value. Check.

- Bitcoin has no intrinsic worth. Check.

- Bitcoin transactions are too slow and expensive. Check and check.

Here’s the kicker, which is all the more comical now that the Nasdaq — the world’s second-largest stock exchange — has said that it is open to launching a cryptocurrency exchange once the market reaches greater maturity.

“Cryptocurrency is best-suited for one use: Criminal activity,” he claims at one point. “Most heavy users of bitcoin are criminals, such as Silk Road and WannaCry ransomware.”

That’s a curious claim, not only because institutions are increasingly warming to this nascent technology but also considering the fact that Silk Road — an infamous dark web marketplace that was among the first large platforms to employ Bitcoin payments on a large scale — has been shut down for years.

Meanwhile, WannaCry — despite the vast media attention it garnered — netted hackers just $116,000 worth of BTC, according to research that will be presented this June at the 17th Annual Workshop on the Economics of Information Security (WEIS).

Indeed, even the office of the Quebec government’s chief scientist has acknowledged that criminal activity involving Bitcoin is quite minuscule.

“Bitcoin is not above the law, nor is it a magnet for illicit transactions: it forms only a tiny part of the criminal money circulating around the planet,” the agency said in a fact-check published on its official website.

Harris’ claim is patently false, and it’s to the publication’s discredit that they published it without an editor’s clarification.

Notably, his view stands in marked contrast to those of PayPal co-founder and successor CEO Peter Thiel, who is extremely bullish on the flagship cryptocurrency. Thiel, like many investors, sees Bitcoin as a viable digital replacement for gold.

Meanwhile, PayPal itself has patented a Bitcoin wallet intended to reduce both the time and cost it takes to execute transactions, though it is unclear whether the company will build out this idea into a functional product.

The op-ed goes on to make several other tired claims, and Harris repeatedly conflates Bitcoin with initial coin offerings (ICOs).

“In what rational universe could someone simply issue electronic scrip — or just announce that they intend to and create, out of the blue, billions of dollars of value?,” he writes, referencing Telegram’s $1.7 billion ICO. “It makes no sense.”

That may or may not be a valid criticism of ICOs — indeed, many within the cryptocurrency community have levied similar arguments — but it has little to do with Bitcoin. Nevertheless, he repeatedly harps upon ICO fraud and other related criticisms as though they reflect on Bitcoin itself.

“All of this would be a comic sideshow if innocent people weren’t at risk. But ordinary people are investing some of their life savings in cryptocurrency. One stock brokerage is encouraging its customers to purchase bitcoin for their retirement accounts!,” he says, referencing Robinhood — which does not actually offer retirement accounts.

The horror.

I wonder if anyone has told him that two regulated exchanges have listed Bitcoin futures contracts — or that numerous Wall Street firms actively working to list the first Bitcoin ETF.

Now that I think about it, perhaps a better title for this article would have been “Old Man Yells at Bitcoin .”

Featured image from Youtube/TWiT Netcast Network .