Why the Bitcoin Halving is Bullish for Every Single Cryptocurrency

Bitcoin's upcoming "halving" is bullish for the entire crypto market. Here's the proof. | Source: Shutterstock

By CCN.com: The old adage “a rising tide lifts all boats” appears to be more applicable to the crypto market than perhaps any other asset class. Need proof? Just look at the resounding impact the looming bitcoin halving is having on virtually every major cryptocurrency.

The Halving is Bullish for the Bitcoin Price

For those who are not familiar, the bitcoin halving is a much-anticipated event in which BTC block rewards are reduced by 50 percent. One halving happens every four years.

From an economic standpoint, the bitcoin halving is a bullish event because it significantly reduces the inflation rate of the asset that has a fixed supply of 21 million. The third halving will drop BTC’s annual issuance rate from 3.70 percent down to 1.79 percent, which is lower than the inflation rate of some wealthy nations. For instance, the inflation rate in the US is 1.90 percent.

Market participants have responded by frantically buying the asset after every halving event, as inflation rate decreases intensify demand pressure.

In the first halving, bitcoin’s price rose from $12.31 at the time of the halving to $994.21 a year later for a 7,976 percent rise. In the second halving, the price soared from $650 to $19,535 over a year later for a 2,902 percent surge.

Almost Every Cryptocurrency Benefits From Bitcoin Halvings

We looked at the altcoin market cap to see if other crypto tokens also benefited from the bitcoin halving. Unsurprisingly, other cryptocurrencies enjoyed significantly higher gains than BTC.

During the first bitcoin halving, the altcoin market cap rose from $45.89 million in June 2013 to $2.02 billion by December 2013 for an increase of 4,302 percent. In the second halving, the altcoin market cap appreciated from $1.74 billion in December 2016 to an all-time high of $555.91 billion in January 2018 for a meteoric rise of over 31,849 percent.

There were other reasons for the market cap increases, and correlation does not mean causation. However, there is strong evidence to suggest that BTC halvings catalyze massive price increases across the overall crypto market.

The link between the bitcoin halving and the overall cryptocurrency market is strong. In fact, a 2019 analysis revealed that the prices and volume of cryptocurrencies are highly correlated. In other words, if bitcoin skyrockets, other cryptocurrencies are likely to follow suit. This led to the conclusion that “if you own one cryptocurrency, you own them all.”

Other Factors That Drive Crypto Growth

Further research shows that cryptocurrency growth is also driven by two factors: media coverage and investor attention. One study on bitcoin and media hype concluded that returns are likely to be elevated when media outlets mention the cryptocurrency more frequently and when Google searches increase.

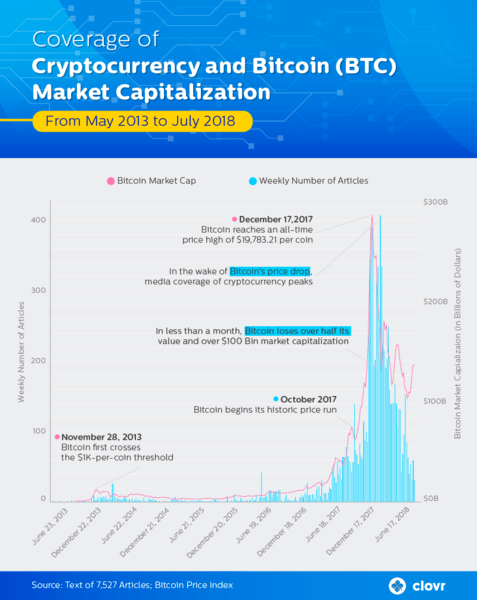

This phenomenon happened in 2017. Media coverage soared as bitcoin surged. As more articles chronicled bitcoin, more people searched for it on Google. The chart below shows how the weekly number BTC-related articles spiked while the cryptocurrency’s price climbed.

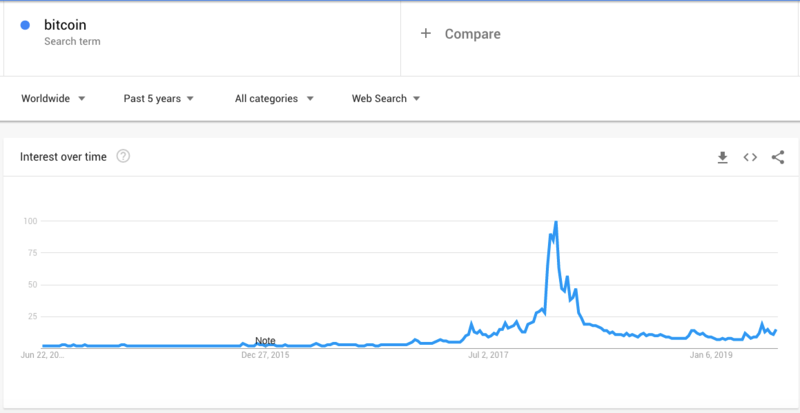

In addition, the number of searches for the term “bitcoin” on Google also spiked during the 2017 bull run, coinciding with the rising weekly number of articles.

The Bottom Line

Historically, bitcoin halvings ignite a strong upward cycle that lifts the overall cryptocurrency market. With the price of bitcoin climbing, media hype and investor attention balloon. The surge in investor attention likely leads to more people buying BTC and other cryptocurrencies. As prices increase, more articles are written, and the cycle continues.

In short, the bitcoin halving is a massive tide that lifts all boats.