Will Bitcoin’s Looming Halving Ignite a Recovery Before 2020?

Will Bitcoin's looming halving ignite a substantial recovery before the end of 2019, or has the supply drop already been priced in? | Source: Shutterstock

By CCN.com: Every four years, the Bitcoin network executed a block reward halving, which reduces the rate at which new coins are introduced to the network by 50%. Historically, block reward halvings have led the dominant cryptocurrency to experience large extended rallies.

Based on data provided by one cryptocurrency analyst, block reward halvings in 2012 and 2016 correlated with ten-fold bitcoin price rallies – from $10 to $100 and $1,000 to $10,000, respectively.

Although the historical performance of BTC does not guarantee future prices movements of the cryptocurrency, many analysts foresee the asset adhering to its previous trend and rising in value in anticipation of the halving.

Is the BTC block reward halving already priced in?

Due to its direct impact on the supply of bitcoin , the block reward halving is considered to be one of the few fundamental factors that could have a long-lasting impact on the bitcoin price.

On the other hand, halvings are regularly scheduled events – not surprises. Consequently, the market could have already priced in the supply rate cut, even though it’s still eight months away .

According to a report by Grayscale, a cryptocurrency investment firm with $2 billion in assets under management, many investors are still not familiar with the halving. That’s especially true of investors that bought their first BTC within the past 12 months.

“The halving is close enough that it’s time to start talking about it more seriously, but far enough out in the future that it’s unclear whether it’s priced into the market efficiently. In fact, based on anecdotal conversations with market participants, we were surprised to learn that many of them were not even aware of this event,” the report read .

How miners could spur a halving-related bitcoin price recovery

While it’s difficult to know for sure how far the halving has already been priced in, analyzing the behavior of bitcoin miners provides significant clues.

BKCM founder Brian Kelly said that miners have begun to hoard BTC in advance of the halving, anticipating that they will be able to unload those coins at substantially higher prices. If Kelly is correct, the supply-demand curve should shift in favor of the bulls leading up to the halving.

But when?

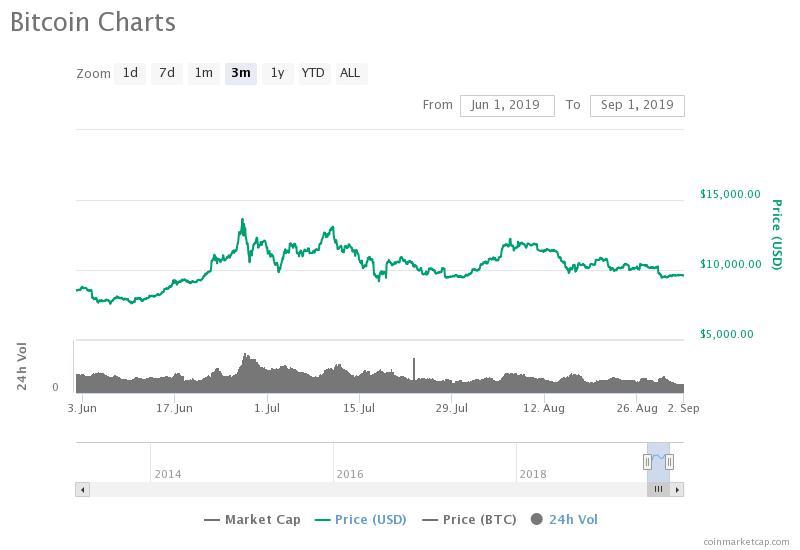

In recent months, bitcoin has struggled to climb over key resistance levels above $10,000, demonstrating short-term weakness in its price trend.

Consequently, while the upcoming is certainly a bullish catalyst, it remains unclear whether the market will see a substantial recovery before the new year.