Bitcoin Grinds to a Halt as 200,000 Transactions Get Stuck

The bitcoin network broke down last night for 200,000 transactions which continue to wait this morning for inclusion within the blockchain so that value can be transferred through the bitcoin network.

Bitcoin’s transaction space measured in bytes is limited for every ten minutes and can handle less than a floppy disk could 30 years ago. Demand, however, has clearly increased considerably as shown by a recent near doubling in price.

But, as supply has not increased to meet demand, congestions are now periodically being formed similar to packed 9 am rush hour busses or tube trains. Luckily for bitcoiners, they can jump the queue by paying a higher fee or, in our metaphor, by ordering a taxi. Unlucky for them, those fees are now getting very expensive.

According to the bitcoin company 21.co, the current suggested fee for a 250 bytes transaction is $1.82 worth of bitcoin. However, 250 bytes transactions are somewhat rare, with the most common being around 400, requiring a fee of $3-$4.

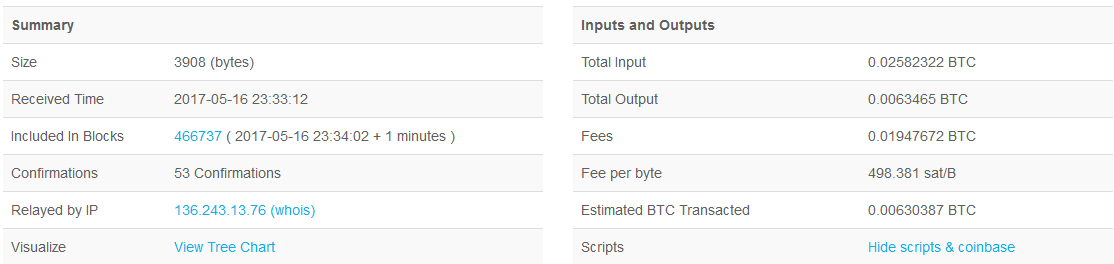

All sorts of numbers are flying around, with some saying they paid $10 for their transaction, while this unlucky individual or entity below had to pay $33 to move around $43, leaving the poor guy with just $10 worth of bitcoin.

His/her transaction was big at nearly 4kb, but it is doubtful you had to pay $33 for 4kb even in 1986, when the first 1.3MB floppy disk was shipped, at the beginning of a new digital age.

The “Debate” Keeps on “Debating”

As you might expect, all bitcoin spaces are consumed by this new all-time high in congestion which has grinded the network to a halt for those affected. The usual arguments are being made, some shouting segwit, some shouting UASF, some shouting BU, some shouting “just do something.”

What Coinbase has decided to do is warn its customers that bitcoin transactions are being delayed due to a significant increase in activity which may cause longer than expected delays. In effect, a free advert for Ethereum.

On the other hand, Luke Dashjr, an “Open Hash Contractor” (what on earth does that mean?) at Blockstream, a company which Blockchain.info thanks for the current congestion, threatened Jihan Wu, Bitmain’s co-founder, with a flag day soft-fork otherwise known as UASF.

While Stephen Pair, BitPay’s CEO, says he can support the “simplest HF to 2mb soft limit / 8mb hard limit,” which is interesting because it continues the way bitcoin previously operated with a 250kb softlimit, which was then increased by miners to 500kb and 750kb, then, on top, the current 1MB hard limit, but the proposal is not really on the table.

So, everyone kind of has their own idea of how to solve the problem which means the problem isn’t being solved. Moreover, around 30% of miners seem happy for the problem to not be solved as they are not choosing any of the solutions. Probably enjoying the more than half a million dollars they now receive daily for just 1MB of space every 10 minutes.

On the other hand, developers insist their way or the highway while businesses, which really could by themselves solve this problem if they got their heads together, are either warning their customers to, in effect, stay out of bitcoin after having hedged with other coins, or are making all sorts of nice suggestions which are not even on the table, or are supporting segwit or are supporting Bitcoin Unlimited.

In the end, the practical effect of this great big mess is that no one is actually supporting anything because nothing is being implemented. Except for massive congestion, huge fees, packaged in endless arguing where you get called all sorts of things for the pleasure of wondering why your magic internet money is taking hours or days to move through the internet tubes.

Welcome to bitcoin where you can now enjoy the rush-hour nightmare in a digital form.

Featured image from Shutterstock.