Bitcoin Experiences Its Busiest Week Ever

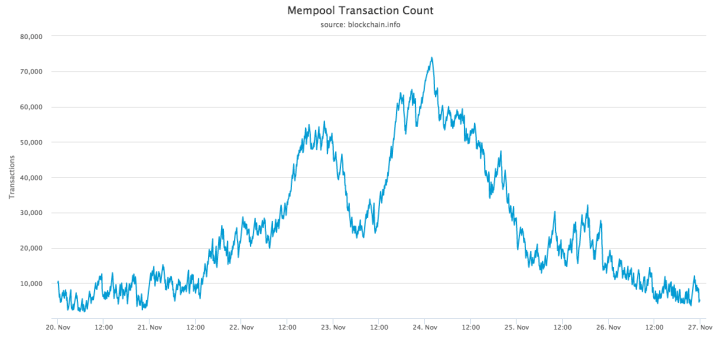

Blockchain.info, one of the biggest and oldest bitcoin wallet provider, publicly stated that bitcoin experienced its busiest week ever from the 20th to the 27th of November. Antoine Le Calvez, a software engineer at the company, stated:

“Between Nov 20th and 27th, Bitcoin faced its busiest week ever with 2 million transactions, a near-constant backlog of tens of thousands of transactions to confirm, and a record 333,466 transactions processed in a day. This resulted in average confirmation times reaching an unusually slow speed of more than 2 hours.”

The spike coincides with Black Friday, one of the busiest shopping day of the year when billions are spent in preparation for Christmas. Bitcoin had its own version, with the now traditional Bitcoin Black Friday held on the 25th of November. As I reported in an article covering the event, around 150 merchants were expected to participate “offering a wide range of products from video games, diamond jewelry, cryptoart to new computers.”

Le Calvez seems to suggest that the network also experienced unusual behavior as “the proportion of transactions creating 17 outputs was three times bigger than usual (0.96% versus 0.32%) during the congestion period” which added around 5 to 6MB of transaction data. He further states that the network behaved more strangely as “the number of misbehaviors related to non-standard transactions skyrocketed and seemed to have followed the highs and lows of the mempool.”

It is not clear whether such behavior was intentional or a product of long confirmation delays, but the more than quadrupling of bitcoin’s price since summer 2015 has clearly brought in more users, and thus an increase in demand for transactions and blockchain space.

Boxing day is likely to see an even higher peak as bitcoin users may try to cash out some of the value gains through purchasing one or more of the now many goods and services on offer for bitcoin. However, the increased demand is likely to bring the network to a near halt for many, mirror-reflecting the long shopping queues that we have now come to expect for the busiest shopping day of the year.

Solutions to resolve these queue forming bottlenecks have been discussed for nearly two years, with no proposal finding wide acceptance. Recommendations by numerous developers, including from the most conservative 1MB next year, increasing by 17% each year, to segwit, to a manual increase in a decentralized fashion through Bitcoin Unlimited and to the more optimistic increase of an initial 8MB, doubling every two years for the next 20 years, have all failed to reach “rough consensus” so far.

Even to observers, it is difficult to say what solution may be implemented, if one is implemented at all as the bitcoin scalability debate has now become toxic with the latest metaphorical casualty Gregory Maxwell’s, Blockstream’s CTO, Reddit account. Although it is now generally understood that both sides have good arguments to make and a compromise is necessary, with some suggestions of a 2MB maxblocksize increase plus segwit, which would probably not please anyone, the lack of leadership in the space makes any compromise appear unlikely.

We will therefore, continue to experience these peaks, but for how long remains to be seen.

Images from Shutterstock and Blockstream.