Bitcoin Price Has ‘Already Bottomed Out’ in Retail-Driven Crypto Market: Research

Retail investors are dominating cryptocurrency trading and prices have hit a bottom, according to data from Binance Research. | Source: Shutterstock

By CCN.com: In case there was any doubt, the bitcoin price has found a bottom. Binance has released a comprehensive research repor t on the state of the crypto market, finding that the worst for crypto is probably over, which suggests it’s onward and upward for prices from here. That’s good news for investors and everyone who would like to see blockchain technology take off.

“Having emerged from a period of the highest internal correlations in crypto history, the data may support the notion that the cryptomarket has already bottomed out,” the Binance report states.

Binance also published a recent report in which it explained internal correlations .

Meanwhile, not everyone in the crypto ecosystem is as bullish. Derivatives trader Tone Vays believes that a new bottom might still be formed.

As the bitcoin price continues to hold the $5,000 level, it seems increasingly likely that Binance, which made its case based on more than five years of data, is correct and there will not be lower lows.

Crypto Funds Oversee $10 Billion in Assets

Retail investors still dominate trading in the crypto market.

“The cryptomarket’s frequent periods of extreme correlation are inseparable from the market’s highly retail-driven participation.”

The Binance report compares the dynamics in crypto to the Chinese stock market, suggesting that both markets are comprised largely of retail investors.

“[In] 2017, retail investors accounted for more than 99.8% of the Chinese stock market by number of accounts, more than 40% by market value, and more than 80% by trading volume.”

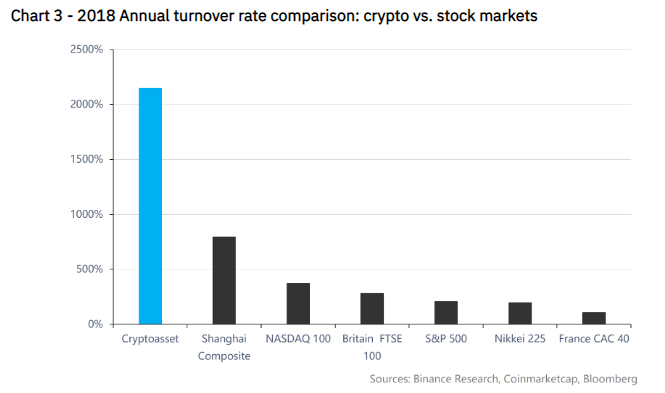

Both crypto and the Chinese stock market also suffer high turnover rates.

The crypto market is comprised of approximately “700 crypto funds” that combined “[represent] a total of just under $10 billion in assets as of January 2019.”

In a scenario in which their portfolios are 100% comprised of bitcoin, “this would account for an upper bound of only 14% of the total market value of bitcoin.” Throwing altcoins into the mix changes the results so that the “institutional proportion overall could be less than 7% for the cryptoasset market,” which is a fraction of the dynamic in the stock market.

“Meanwhile, crypto’s estimated 7% institutional participation rate represents only one-thirteenth of that for the U.S. stock market.”

On the plus side, institutional investment is likely to rise as new bitcoin trading platforms such as regulated Bakkt launch.

Crypto Investor Mentality

The report addressed the emotional trading that takes place in crypto:

“Generally speaking, non-professional investors are prone to becoming overconfident or overly pessimistic in reacting to market trends, leading to higher potential transaction volume, more volatile prices, as reported in numerous studies.”

On a positive note, however, crypto investors are more likely to hold their assets during a market decline.

“In the face of market downtrends, unlike many momentum-driven institutional investors, most investors in the crypto asset market may prefer to “HODL” through a prolonged decline in prices.”