Binance Suffers Crippling Lag, Angry Crypto Traders Lose Thousands

Heavy crypto trading volume caused Binance to suffer crippling lag, and angry Bitcoin traders losts thousands amid the outage. | Source: Shutterstock

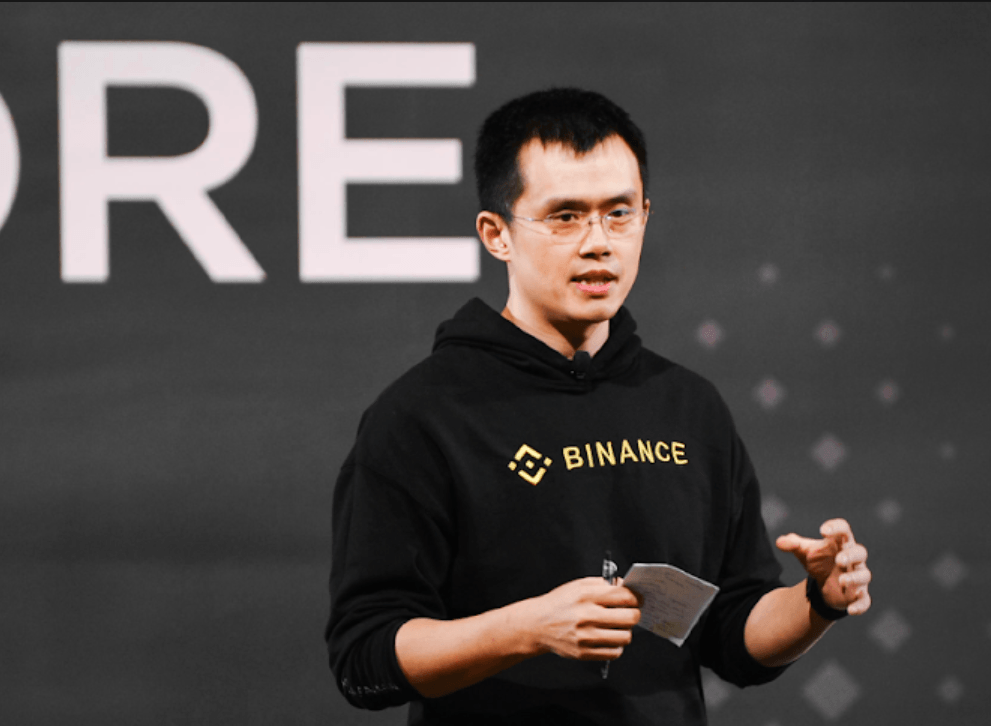

By CCN.com: Binance users experienced extreme lag this morning, specifically with trade settlement and balance syncing. CEO Changpeng Zhao confirmed the issue on Twitter and promised the crypto exchange was working on it.

Bitcoin Traders Scream Bloody Murder as Binance Succumbs to Lag

Consequently, several crypto traders got stuck in trades they would otherwise have canceled, which meant unintended losses.

At least five users reported losses in the thousands of dollars. One person said they lost around 3 BTC.

Chanpgeng Zhao, often referred to as “CZ,” is an unstoppable Twitter user, but he did not immediately respond directly to any of these public complaints. He blamed the lag on heavy order volumes.

https://twitter.com/cz_binance/status/1131262596219265024

This reporter confirmed the issue and found himself unable to cancel a BNB trade. Similarly, although trades seem to have gone through, balances were not updated. This meant that further trades could not be made.

Binance Crypto Trading Bots Unaffected

Binance explained that API users, or mainly bots and trading software, were not affected. Regular users who enter trades manually were affected for at least a couple of hours.

The incident spells out the fickle nature of the crypto economy, where small software glitches can cost many thousands of dollars. Who is to blame? It’s tough to decide.

On the one hand, traders shouldn’t place orders they wouldn’t want to be executed. On the other, the software should work as intended, and there should be no cancel button if the user is not expected to utilize it.

A couple of hours after the initial problems, CZ posted again to say that things should be working smoothly now. However, some transactions would still be backlogged.

https://twitter.com/cz_binance/status/1131254609643630592

The funds lost today are relatively trivial compared to the funds that Binance lost just a couple of short weeks ago. A security breach at Binance resulted in the theft of around 7,000 bitcoins, for which Binance was forced to foot the bill.

Fortunately, the exchange had planned for such an occasion. The actual owners of the accounts compromised have never come forward, and the events led to some very interesting talks in the cryptosphere.

First a 7,000 Bitcoin Theft, Now Technical Difficulties

For one thing, Changpeng Zhao caused a stir when he spoke of “reorganizing” the Bitcoin blockchain to bereave the thieves of their funds. He later apologized for saying that.

Then he said the exchange might instead resort to using a cartel of Bitcoin services to “freeze” the funds, which raises other issues, such as fungibility. Are some bitcoins good, and others bad?

Adam Back was roused to comment on the What Bitcoin Did podcast about the ridiculous notion of invalidating BTC transactions.

Binance remains one of the top crypto exchanges, despite recent hiccups. The long-term dominance of the platform is something that can only be determined in hindsight after things have returned to normal.