Barry Silbert Gives Fox Business’ Maria Bartiromo Sales Pitch on Bitcoin

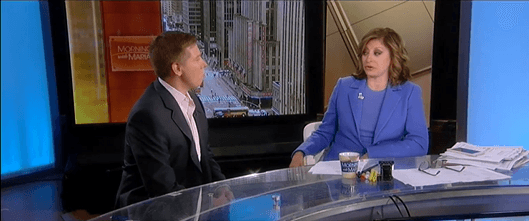

Grayscale Investments CEO Barry Silbert visited Maria Bartiromo on Fox Business to discuss the case for bitcoin versus gold as a store of value. | Source: Shutterstock

By CCN.com: Barry Silbert, who is at the helm of Grayscale Investments, is taking his firm’s ‘Drop Gold’ campaign to Wall Street, or at least to Midtown. Grayscale’s Silbert was a featured guest on Fox Business’ “Mornings with Maria” program featuring host Maria Bartiromo, who prior to joining Fox Business rose to fame at CNBC. The last time that the crypto investor was a guest on Maria’s show, the bitcoin price was trading at $500. Now with the price perched above $5,000 and barreling for $6,000, the financial media’s interest in cryptocurrencies has once again been piqued.

Grayscale’s Silbert pointed out that the bitcoin price had skyrocketed approximately 10% over the last 24 hours. He pointed to potential catalysts such as the trade talk tensions between the U.S. and China, bullish technicals, or the perhaps Grayscale’s “Drop Gold” campaign resonating with investors. Bartiromo wasn’t convinced, considering the bitcoin price remains a far cry from its peak of $20,000, asking Silbert for a “sales pitch to buy bitcoin today.”

“Bitcoin is the younger generation’s version of gold. It has all the same characteristics as gold. It’s scarce…divisible…portable. But it actually has real utility. The bitcoin community is creating an entire new payments and financial rail network that I think is going to transform the financial markets,” said Silbert.

Volatility

Still, bitcoin remains a much more volatile asset than gold, its amazing use case notwithstanding. For an investor seeking shelter from the whims of the stock market, gold is a proven hedge while bitcoin’s price is a proven risk. Bartiromo points out that “Grayscale Investments [is] looking to challenge a $1 trillion institution, encouraging people to drop gold from their portfolios in favor of bitcoin.” But why?

“There’s $8 trillion of gold held today. What’s interesting is that the younger generation of investors, the people who have not yet allocated it to gold, don’t view gold as the same way as our parents or grandparents did. We grew up after the gold standard. So, the biggest buyers of gold right now…are central banks,” said Silbert.

Bartiromo points out the challenge, which is to “change an entire generation of thinkers.” Silbert just wants to see the conversation happening.

Meanwhile, mainstream adoption of bitcoin is ramping up, including the likes of tech giant Facebook. This certainly gets the attention of Wall Street.

“You see what Facebook is doing, You see what Square is doing. You see what Fidelity is doing. Even the New York Stock Exchange They’re all getting involved in creating infrastructure to support this new ecosystem. Even Jamie Dimon who ‘hates bitcoin’ is launching the JPMorgan coin,” said Silbert.

Bartiromo chimed in that Dimon hated bitcoin “until his daughter scolded him.”

Bitcoin in 20 Years

Giving bitcoin price predictions is a dicey game, but Silbert managed to avoid it in his conversation with Bartiromo. Instead, they discussed where bitcoin will be in two decades, in response to which Silbert stated:

“It’s going to displace gold as the store of value investment that goes into portfolios. But really, more importantly, there’s amazing innovation that’s happening right now. Thousands of companies have been funded, $5 billion have been raised into companies over the past five years that are building infra to make it really, really easy to get on and off the cryptocurrency superhighway. And once you have access to digital money, the sky’s the limit.”

The bitcoin price is currently hovering at $5,946 and has nearly doubled year-to-date.