Australia Chases Crypto Investors for Every Tax Dollar Owed in Shakedown

Australia's tax man is cracking down on cryptocurrency investors. | Source: Shutterstock

By CCN.com : It will now be harder for Australians to under-declare or over-declare the taxes they owe on their crypto holdings or transactions.

This follows an announcement by the Australian Taxation Office (ATO) that it will collect bulk records from cryptocurrency businesses in the country. In a statement , the tax collection agency indicated that this will be done to enhance accuracy in tax compliance:

The Australian Taxation Office (ATO) is collecting bulk records from Australian cryptocurrency designated service providers (DSPs) as part of a data matching program to ensure people trading in cryptocurrency are paying the right amount of tax.

Some of the information that the ATO will obtain from Australia’s crypto-related businesses will include purchase and sale records.

By law, cryptocurrency businesses in Australia are required to keep certain critical records. These include digital wallet records and keys, exchange records, and receipts of transfer or purchase of crypto assets.

Prior to any compliance action being taken, the relevant tax payers will be contacted by the tax collection agency after the data matching exercise to verify the information obtained.

Australia’s law on crypto taxes

Per Australia’s tax laws, capital gains made after disposing of cryptocurrency holdings are taxed. However, if the capital gains or losses are made in a situation where the cryptocurrency is considered to be ‘a personal use asset, there is no tax payable.

Where cryptocurrencies are disposed as a normal business operation, the profits generated are treated as ordinary income, not capital gains. Additionally, in such a business the cost of purchasing cryptocurrency that is used as trading stock is deductible. The cryptocurrency businesses that fall in this category include exchanges, miners and trading firms.

This is not the first time that the ATO is taking steps to ensure tax compliance in Australia’s crypto sector. Last year in January, the ATO announced that it was setting up a task force charged with monitoring cryptocurrency transactions. Just like in the current scenario, then the tax collection agency collaborated with other regulators in tracking money flows related to cryptocurrency investments.

https://twitter.com/PDFStreaming/status/950913948248928257

Currently, the tax collection agency is working with the Australian Securities and Investment Commission (ASIC). It is also partnering with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Rate of cryptocurrency adoption in Australia growing

This comes at a time when the number of cryptocurrency hodlers in Australia has risen. A survey by HiveEx cryptocurrency exchange in 2018 revealed that the percentage of Australians owning cryptocurrency had grown to 13.5 percent. About 50 percent of those holding cryptocurrency then had purchased it as an investment.

On the other hand, 34 percent of the hodlers had purchased cryptocurrency out of FOMO – fear of missing out.

https://twitter.com/blockbid_io/status/1039281135786909697

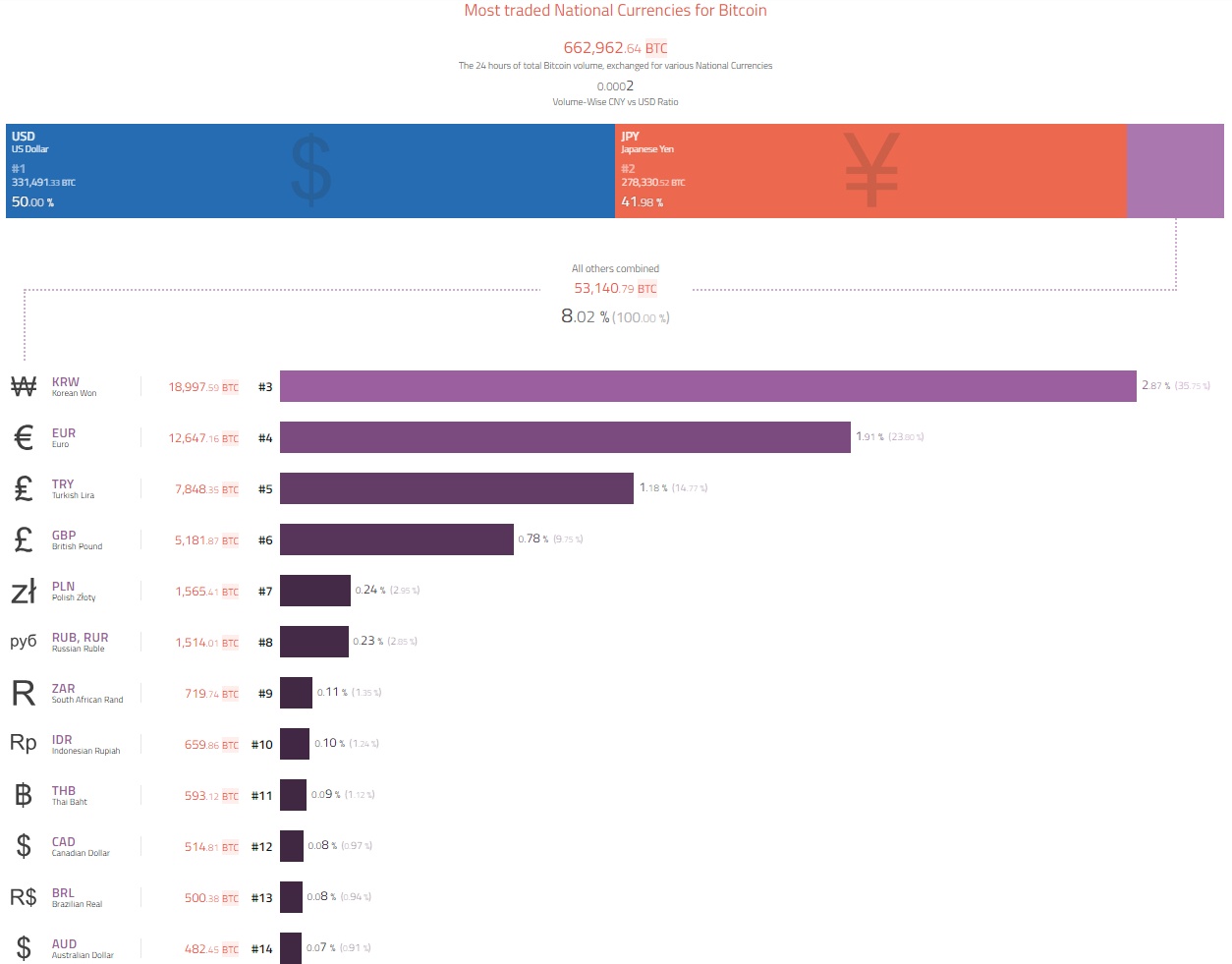

The tax collection agency estimates that there are between 0.5 million to 1 million Australians who have invested in cryptocurrencies. Per Coinhills , the Australian dollar is currently ranked the 14th most traded national currency in the cryptocurrency markets. It has a 0.07 percent market share.