Apple Earnings Preview: Why This Stock’s Best Days Are NOT Behind It

Apple bears are sounding the alarm ahead of the company's earnings report this week. However, this stock's best days are NOT behind it. | Source:. AP Photo/Mark Lennihan, File

Apple’s first two quarters this year have been less than stellar, and bearish experts predict that the iPhone maker’s stock could register a sharp plunge when it announces its fiscal third-quarter results.

A Yahoo! Finance survey of 35 analysts reveals an earnings per share (EPS) estimate of $2.10. This figure is a 10.3% decrease from the previous quarter’s EPS of $2.34. The survey also predicts a revenue estimate of $53.39 billion, which is slightly lower than last year’s top line of $53.43 billion for the same fiscal quarter.

In other words, experts have less-than-optimistic expectations. The sentiment has been fueled by two factors: the US-China trade war and lackluster demand for iPhones.

However, even with these two major headwinds, Apple remains a strong tech company.

Two Factors That Can Negatively Impact Apple Stock

The trade war between the U.S. and China made a major impact on Apple’s sales in the fiscal second quarter in China, which accounts for a fifth of the company’s revenue.

Due to the trade war, sales for the fiscal Q2 dropped by 22% . Given that trade tensions escalated from April to June this year , it won’t come as a surprise if sales suffered during fiscal Q3.

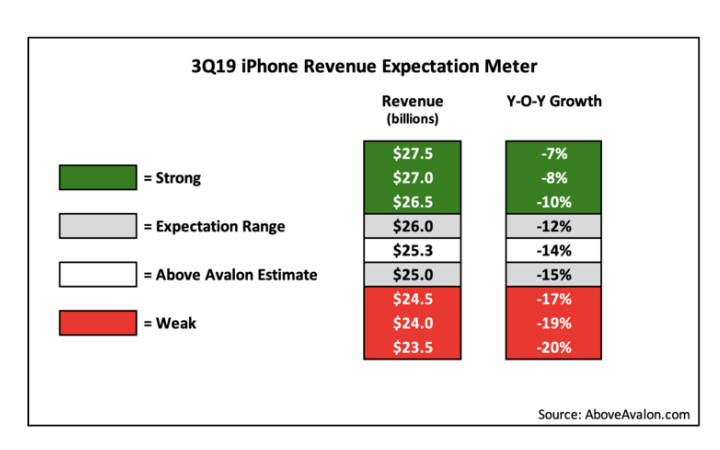

On top of that, Neil Cybart from Above Avalon wrote that FYQ3 is “historically Apple’s weakest quarter for iPhone sales.” The analyst predicts an iPhone revenue of $25.3 billion, which is a 14% nosedive from the same quarter last year.

Unfortunately, it would appear that other analysts are also advising caution, as overall smartphone sales have been less than impressive as of late.

Market intelligence firm International Data Corporation revealed that iPhone volumes dropped by 3.2% in 2018. Apple must tell a compelling story this year, or else it could fall prey to factors that instigate downward pressure on the Silicon Valley giant’s stock price.

Services Will Buoy Tim Cook & Co. Until the Arrival of 5G Technology

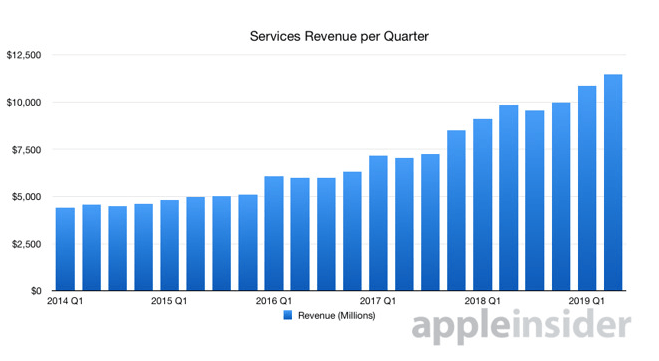

While iPhone sales may have stagnated, the tech giant is relying on one area of its business to keep the company afloat: Services.

In the second quarter of 2019, the segment brought in revenue of over $11.9 billion. The figure has grown 16.6% year-over-year .

Apple CEO Tim Cook said that the company is on course to double its Services category from 2016 to 2020.

The chart above tells us that the Services segment is in a strong uptrend and that we can expect a strong 2019 Q3 report. That might be enough to keep Apple’s stock stable until the launch of iPhones equipped with 5G technology.

On July 25th, Apple announced that it is set to acquire the majority of Intel’s smartphone modem business . The $1 billion acquisition is seen by experts as a strong push to prepare the iPhone for 5G technology. The next generation of wireless connectivity should provide internet speed that’s at least 40 times faster than 4G LTE.

Apple’s Forecast Remains Bright

It’s true that iPhone sales may be facing downward pressure, but overall, Apple remains strong. Its Services category can keep the company’s head above water while it continues to innovate. The acquisition of Intel’s smartphone modem business will likely help the company in the future. 5G-ready iPhones should resurrect the company’s flagship product and boost the tech giant’s sales – and stock price – in the coming years.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.