This Country Has Fewer Poor Than America, 80% Of Bitcoin Transactions

Which country has fewer poor than America and 80% of the Bitcoin transactions? Although it might come as a surprise, the answer is China. Despite a stock market and currency crisis, China has fewer poor than America, according to a Credit Suisse report. Yet, there is one thing of which this report falls a bit short: good data. Much of the data in the report is from government bodies and international bodies. People with firsthand knowledge of each country might take contention therewith. Nonetheless, CCN.com wondered if Credit Suisse’s numbers could explain China’s large Bitcoin volume.

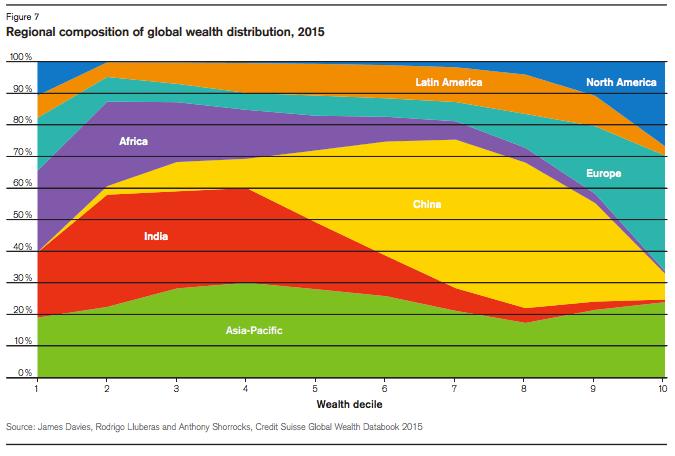

According to the Credit Suisse Wealth Report, there are more poor people in the United States than in China. For instance, nobody in China is in the bottom 10% of the world’s population by wealth, while North America is home to 10% of such people. Here is a chart for perspective.

North America is home to some of the 10% poorest in the world and 30% of the richest. As Tim Worstall writes for Forbes, “…China has pretty much none of the world’s poorest people and say 7 or 8% of the world’s richest.” The Credit Suisse report states:

To determine how global wealth is distributed across households and individuals – rather than regions or countries – we combine our data on the level of household wealth across countries with information on the pattern of wealth distribution within countries. Once debts have been subtracted, a person needs only USD $3,210 to be among the wealthiest half of world citizens in mid-2015. However, USD 68,800 is required to be a member of the top 10% of global wealth holders, and USD 759,900 to belong to the top 1%. While the bottom half of adults collectively own less than 1% of total wealth, the richest decile holds 87.7% of assets, and the top percentile alone accounts for half of total household wealth.

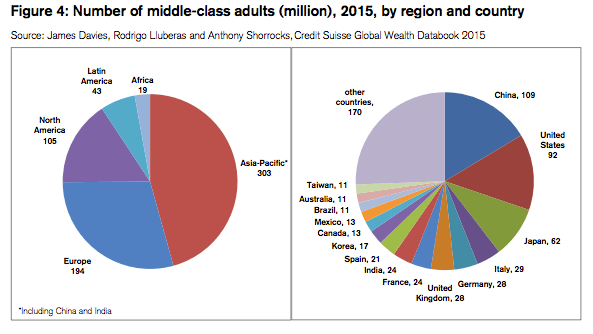

Although North America contains the highest percentage of middle-class inhabitants (31%), the region holds just 105 million middle-class adults (16% of the global total), far less than 303 million

members (46%) in the Asia Pacific Region and fewer than the 109 million in China and the 194 million middle class residents in Europe. The middle class is associated with the United States in the collective conscious. That’s why the following graph might come as such a surprise:

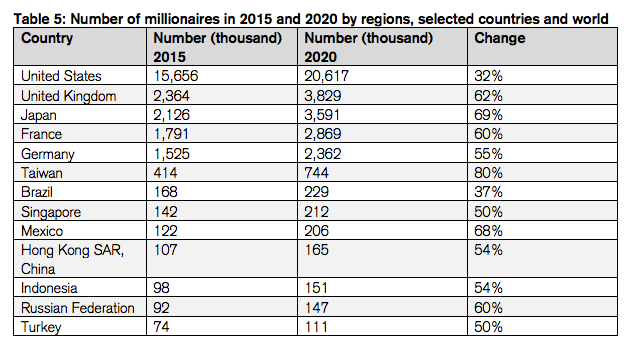

Further, the predicted 32% increase in the number of millionaires in the US by 2020 is among the slowest increases in the world:

80% Of The Bitcoin Transactions

A Goldman Sachs report found that 80% of bitcoins are now exchanged via Chinese yuan. That means the US Dollar, counterintuitively, is the second highest traded currency, not the first.

This despite a contentious history between the Chinese government and Bitcoin technology. China banned bitcoin transactions in December 2013, yet still grew into a major mining hub thus leading to the high Bitcoin transaction volume, according to the U.S.-China Economic and Security Review Commission .

Interest in China could also be on the rise due to a crisis in the Chinese yuan which in part led to a collapse in China’s stock this past summer. The Chinese people’s confidence in the yuan seems to be waning. Although it is unlikely that these greater circumstances are contributing to as much interest in Bitcoin yuan as the huge mining complexes that have developed there, some in the Bitcoin community see it differently. Bitcoin is simply popular in China amongst the population, this group contends. As SecondMarket CEO Barry Silbert wrote, “Huge bitcoin volume in China over past 24 hours (1 million bitcoin traded).”

So what do you think? What leads to China’s high Bitcoin volume?

Images from Shutterstock.