$500 Million a Day: Facebook’s (FB) Mark Zuckerberg Is $5 Billion Richer in 2020

The sharp appreciation in Facebook stock has made Mark Zuckerberg $5 billion richer in 2020. | Image: REUTERS/Erin Scott

- Mark Zuckerberg easily takes the award for one of the fastest wealth increases this year.

- Facebook’s growth prospects in 2020 look favorable as it benefits from political advertisers that Twitter and Google turn away.

- Wall Street is looking favorably on the stock but will Main Street follow the cue?

With Facebook (NASDAQ:FB) up 6% in 2020, Mark Zuckerberg’s net worth has ballooned by $4.8 billion in a span of under ten days. That’s an average daily gain of $500 million!

Less than a month before Facebook releases its Q4 and full-year results, the company’s fortunes look favorable as the year wears on. Barring a major catastrophe, the FAANG stock is set to continue climbing as its social media dominance persists.

Here are three reasons why Zuckerberg’s net worth is set to rise this year.

1. Facebook is now the go-to platform for political ads

As November’s general election approaches, candidates are expected to spend extensively on online ads. Facebook is going to be a major beneficiary, especially as its appeal among political advertisers grows.

Unlike some of its rivals such as Google (NASDAQ:GOOG) and Twitter (NYSE:TWTR), Despite controversy, Facebook has elected to leave its political ad policies largely unchanged. Twitter banned political ads on its platform last year. Google also recently updated its approach on political ads by limiting targeting based on categories such as postal code, age and gender.

Facebook still allows micro-targeting. The social media giant will also not fact-check political ads . While this will no doubt anger critics, investors will be pleased.

2. Facebook’s growth prospects remain strong

Despite setbacks such as the Libra fiasco in 2019, Facebook still remains on a promising growth path. Even as its daily user base approaches saturation, income streams are broadening. Some of the new services are now posing a threat to established players. As an example, Facebook Gaming, which competes with the likes of Twitch, now has an 8.5% market share compared to just 3.1% in 2018.

During an earnings call in October , Zuckerberg reiterated that the company’s most recent initiatives were making good progress. With regards to Facebook Dating, for instance, Zuckerberg revealed that it “is doing quite well” in the U.S. As for its video-on-demand service launched two years ago, he indicated that it was “growing quickly” before going on to predict that “hundreds of millions of people” will using Facebook Watch.

3. Wall Street sees more upside potential for FB stock

Despite the negative press Facebook keeps generating over its ad policies and privacy abuse, the stock continues to be a Wall Street darling. Last year, FB surged over 50%.

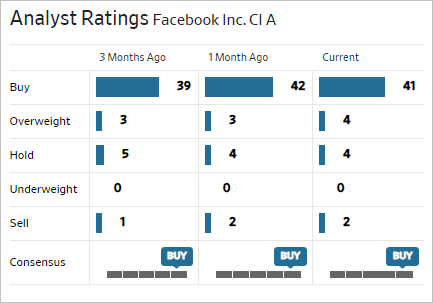

Among Wall Street firms covering the stock, 41 analysts currently rate it a ‘buy’ . Only two analysts have issued ‘sell’ calls.

The highest price target for the stock is $324, representing a potential gain of 57% from the current price. The average stock price target is $241.70, representing a potential gain of slightly over 10% from Thursday’s close.

Disclaimer: This article expresses the opinions of the author and should not be considered trading or investment advice from CCN.com.