3 Signs that a Modern-Day Gold Rush has Arrived

Central banks and the ultra-wealthy are clamoring to get their hands on physical gold. Here are the reasons why. | Image: shutterstock.com

- Several countries across the world have been repatriating gold to eliminate counter-party risk.

- Central banks have been buying the precious metal at a record pace and the ultra-rich are hoarding the yellow metal in secret bunkers instead of buying ETFs.

- These three signs point toward a modern-day gold rush.

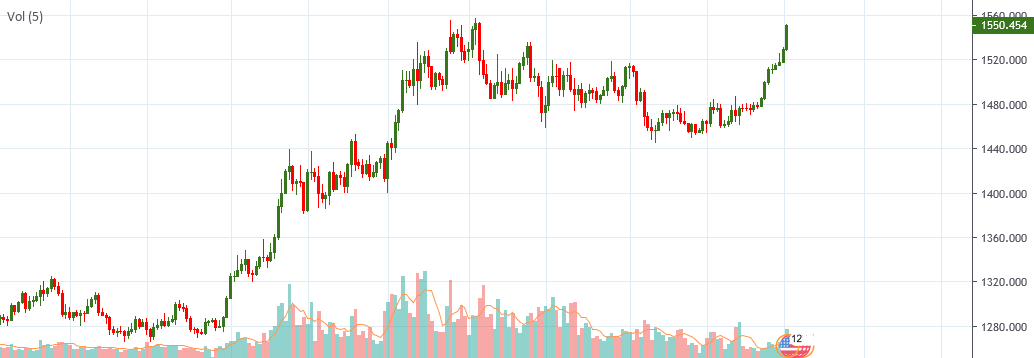

Gold has entered the new decade with a bang. The yellow metal is building on the December rally and currently sits at roughly $1,550 per ounce. If the gold price manages to break through the critical resistance of $1,550 convincingly, the rally will likely gain further pace.

Given the recent fundamental developments, it’s no surprise that the precious metal is on a roll. The demand for gold is increasing rapidly worldwide, and we may be witnessing a modern-day gold rush.

Gold Repatriation is Trending

One of the most popular adages among gold bulls is ‘if you don’t hold it, you don’t own it.’ The premise behind this proverb is that governments or ‘too big to fail’ financial institutions can always seize the wealth of the people in times of crisis.

Consequently, precious metal bugs encourage people to buy physical gold (instead of ETFs or other paper instruments) and store it in their homes instead of with financial institutions. By owning physical gold, people can eliminate all counter-party risk and will have complete access to their holdings in case of a financial crisis.

While this advice may seem too gloomy at first glance, it’s exactly what several countries have been doing. Last year, Hungary announced that it was planning to repatriate 100,000 ounces of gold from the Bank of England.

Following Hungary’s lead, Poland also repatriated 100 tons of gold from the Bank of England in November 2019. These recent developments aren’t unusual as the likes of Germany, Austria, Belgium, Netherlands, and Venezuela have repatriated their yellow metal holdings from various locations.

This trend is wildly popular among the Eastern European countries as the likes of Serbia and Slovakia are also considering repatriating from the Bank of England.

The repatriation-trend clearly suggests that all these countries don’t trust other institutions, especially the Bank of England, to hold onto their gold.

Countries across the world rushing to get their gold back seems like a modern-day equivalent of a gold rush.

Central Banks’ Buying Spree is Aiding the Gold Rush

Central Banks across the world are buying the bullion rapidly. After being net sellers for decades, central banks have started buying at a record pace.

Central banks across the globe added close to 375 tons of the yellow metal to their reserves in the first half of 2019. Plus, a report published by the World Gold Council indicates that the trend persisted in the second half of the year as well. The central bank spree hitting 50-year highs is indicative of a modern-day gold rush.

The Ultra-Rich are Hoarding the Yellow Metal

Due to their vast wealth, the ultra-rich of the world have better and faster access to information. Since they’re on the ‘inside.’ they tend to be more informed, and it often pays to follow their actions. And the wealthy have also been accumulating the yellow metal as well.

A recent report by Goldman Sachs suggested that the ultra-rich have been buying physical gold. Not only that, trust in paper alternatives has also been dwindling.

Just like the countries repatriating their reserves of the precious metal, the ultra-rich are also buying the recession-proof asset. And following the wisdom of precious metal bugs, the ultra-rich are storing it in secret bunkers.

The desperation of the central banks and the wealthy to get their hands on the yellow metal indicates that we may be witnessing a new gold rush that should push price higher.