3 Reasons Gold’s Meteoric Rally is Suddenly Losing its Dazzle

A growing number of fund managers claim gold is overvalued in its current prices as legendary investor Mark Mobius suggests investors should wait for a correction before buying gold. | Source: DAVID GRAY / AFP

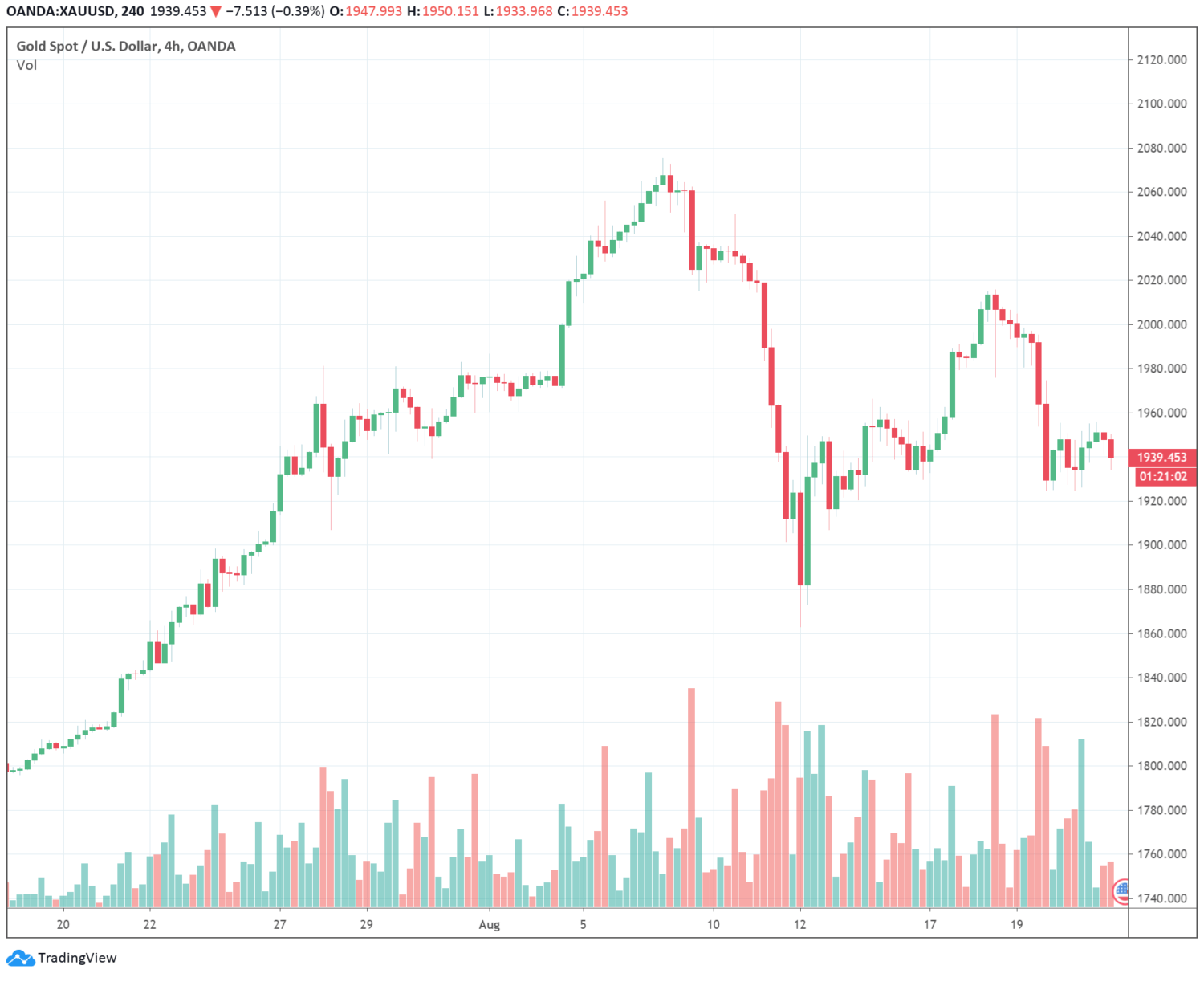

- The price of gold has sharply rejected at $2,085, as the U.S. dollar index began to recover.

- Fund managers remain positive about gold but anticipate a pullback after a strong rally.

- Data show the precious metal saw a spike in sell volume in the past week.

The price of gold has declined by more than 6% since it peaked at $2,075 on August 6. Analysts attribute the fading momentum of gold to the recovery of the U.S. dollar.

Three factors appear to be leading the sentiment around gold to change. The catalysts for a further downtrend are the rising dollar, fund managers turning cautious , and the sharp rejection of the precious metal.

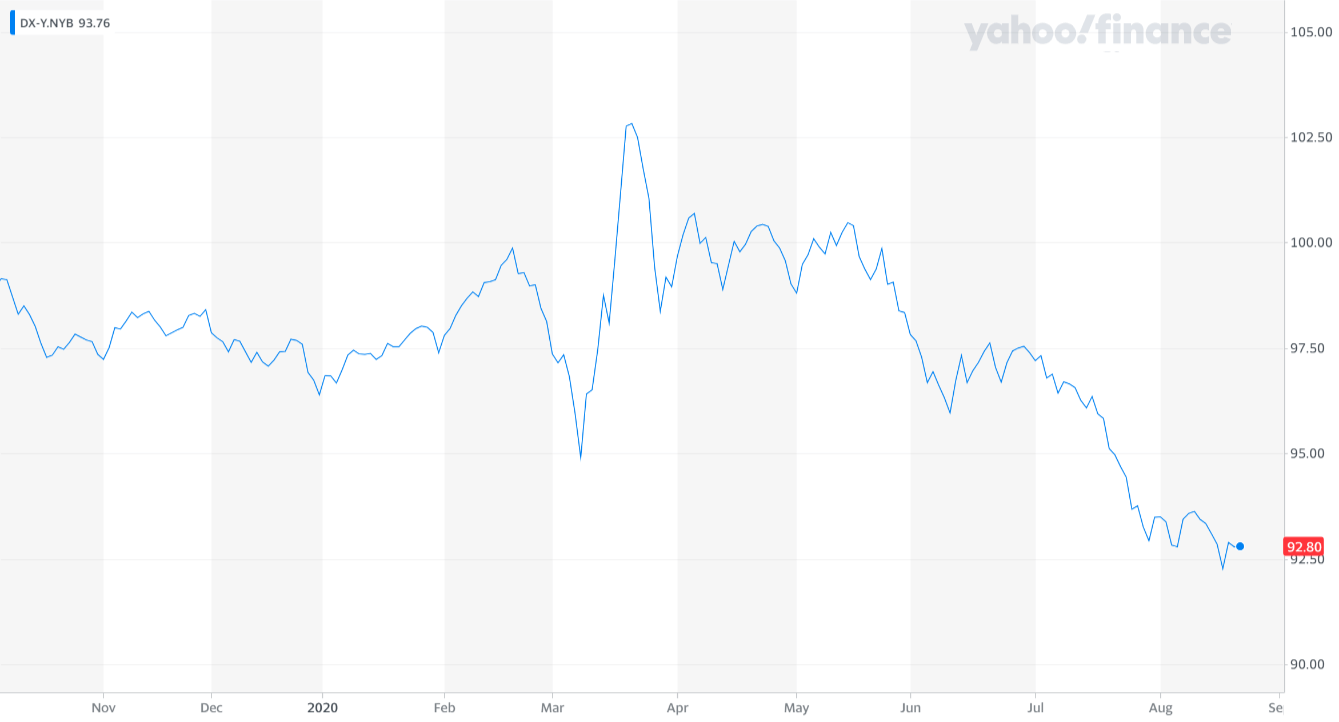

Factor #1: The Unexpected Recovery of the U.S. Dollar

On August 19, the dollar started to rebound after Fed meeting minutes.

The U.S. Dollar Index (DXY) fell by nearly 10% since its March high, from $102.94 to as low as $92.13.

While there are fundamental factors that could buoy the momentum of the dollar, strategists say the dollar’s uptrend is technical . Tempus’ vice president of dealing and trading John Doyle told Reuters:

“I think that these minutes in a vacuum wouldn’t be enough to cause that move, but that because of where we are at a technical level were seen as a reason to take profits.”

As the dollar started to stabilize at a vital support area, the price of gold began to decline.

Following its initial 7% recovery from $1,862 to $2,015, gold recorded another steep rejection. In the last 72 hours, the precious metal fell by around 3.5%.

Ahead of the presidential election in November, analysts expect the U.S. government to pass a stimulus deal.

The confluence of a new stimulus package and the prospect of vaccines, which could aid economic recovery, could fuel the dollar’s recovery throughout 2020.

Factor #2: Fund Managers Turn Cautious Against Gold

For most of August, investors were generally optimistic around gold. Hedge funds were shorting the dollar, and Warren Buffett-led Berkshire Hathaway built a position around the precious metal.

Fund managers remain positive about gold in the medium to long term. But in the short term, Mobius Capital’s Mark Mobius says a correction is likely. He said:

“The safest investments are equities and precious metals such as gold. However, I would not advise buying gold or precious metals at this time until a price correction has taken place.”

A low-interest rate , concerns about inflation, and global economic uncertainty provide a favorable macro backdrop for gold.

But in the last three months, gold has climbed by more than 33% since the March bottom. At its yearly peak, it saw a 42% gain.

Factor #3: Sharp Technical Rejection

After the first rejection at $2,085 on August 6, gold steeply rejected a second attempt at a rally.

Technical analysts describe consecutive rejections where the second rejection occurs at a point lower than before as a lower-high pattern.

When a lower-high formation emerges at a higher-timeframe, like the daily chart of gold, it suggests declining momentum in the near-term.

The precious metal has climbed so rapidly since May that it has not established clear support levels.

The sudden rejection of the vertical rally put together with the fear of missing out (FOMO)-like sentiment, raises the chances of consolidation.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.