$3 Billion: Initial Coin Offering Fundraising Hits Another Milestone

Initial coin offering (ICO) fundraising crossed another significant milestone this month, racing past the $3 billion mark for the year despite increased attention from regulatory agencies across the world.

Initial Coin Offering Fundraising Tops $3 Billion

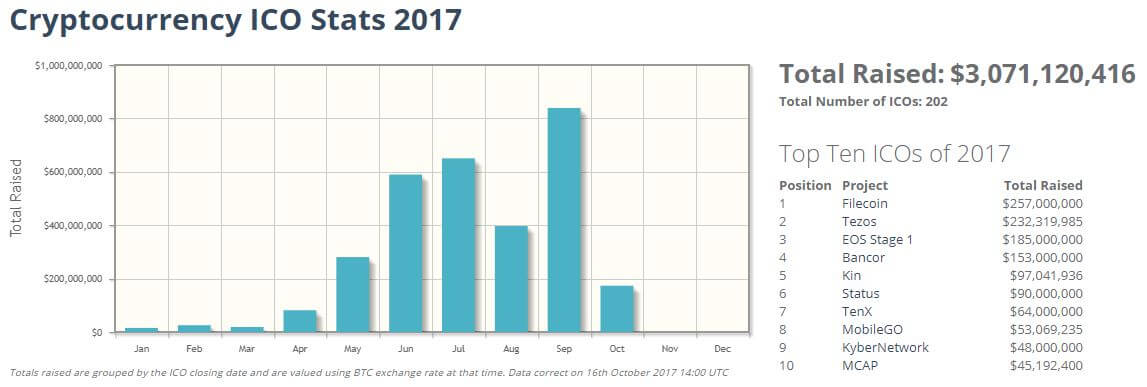

Initial coin offerings have come along way since 2013 when J.R. Willett raised $500,000 to develop Omni (then known as Mastercoin). According to data obtained from CoinSchedule, there have now been more than 200 ICOs held during 2017 alone. Those initial coin offerings have raised a combined $3 billion, with more than $800 million of that coming from ICOs concluded in September.

Filecoin’s $257 million ICO continues to lead all crowdsales, while the $232 million worth of bitcoin and ether raised by Tezos has reportedly grown in value to $400 million, even as the project has been beset by infighting that has boiled over into a public feud. Altogether, the top 10 year-to-date initial coin offerings have raised a combined $1.2 billion. However, these impressive fundraising numbers may soon be eclipsed by the tZERO initial coin offering, which Overstock chief executive Patrick Byrne predicts will “raise a fortune”, potentially $500 million — or more.

Infrastructure projects such as Tezos and EOS have attracted more than 39% of ICO contributions, while trading and investment products — such as AirSwap’s decentralized token exchange — account for another 14%.

ICOs Gallop Ahead Despite Regulatory Attention

ICO contributions have ramped up throughout the year, even as regulators across the world have begun to observe this nascent fundraising model with increasing scrutiny. China triggered a temporary market crash after regulators ruled that ICOs were illegal, and South Korea later banned domestic startups from engaging in this fundraising model.

In the U.S. both the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have taken steps to increase their oversight of the ICO markets. Since ruling that some ICO tokens are subject to federal securities laws, the SEC has made ICO oversight one of its top priorities. Toward this end, the SEC established a cyber task force that will, among other things, scrutinize startups that attempt to flout securities laws by describing their tokens as “utility coins” even though they bear the properties of a security.

Despite these regulatory concerns, blockchain startups continue to use ICOs to raise capital, and even established companies such as Kik Interactive have turned to this funding model in lieu of traditional venture capital. With two months left in the year, it would not be surprising to see ICO contributions pierce the $4 billion barrier before the end of 2017.

Featured image from Shutterstock.