3 Alarming Indicators Point to a Stock Market Crash

Investors have largely disregarded warnings about a US stock market crash, but these three red flags have become too serious to ignore. | Credit: Kena Betancur/Getty Images/AFP

- Ballooning government, corporate and private debt across the world will make an upcoming bear market more painful.

- Stretched valuations in the market point to an upcoming pullback.

- Geopolitical tension is looming like a dark cloud over the mark.

Warnings that a US stock market crash is on the horizon are in no shortage. Despite that, the Dow Jones and S&P 500 continued to march higher at the start of 2020. While investors have so-far turned their noses up at warnings about inflated valuations, geopolitical instability, and ballooning debt, the facts about the precarious state of the US stock market can’t be ignored. With that in mind, 2020’s gains have made the chances of a stock market crash even more likely as irrational, fearless investing has taken over.

Global Debt Crisis

Famed investor and co-founder of the Quantum Fund and Soros Fund Management Jim Rogers says that when the bear comes, it’s going to be a grizzly .

He believes that the next bear market will be the worst he’s ever seen. Sky-high debt, he says, is the reason for his pessimism.

In 2008 we had a problem because of too much debt. Since then the debt everywhere in the world has skyrocketed. The Federal Reserve, the central bank in the US increased its balance sheet by 500% in 10 years. That alone is an unbelievable statement.

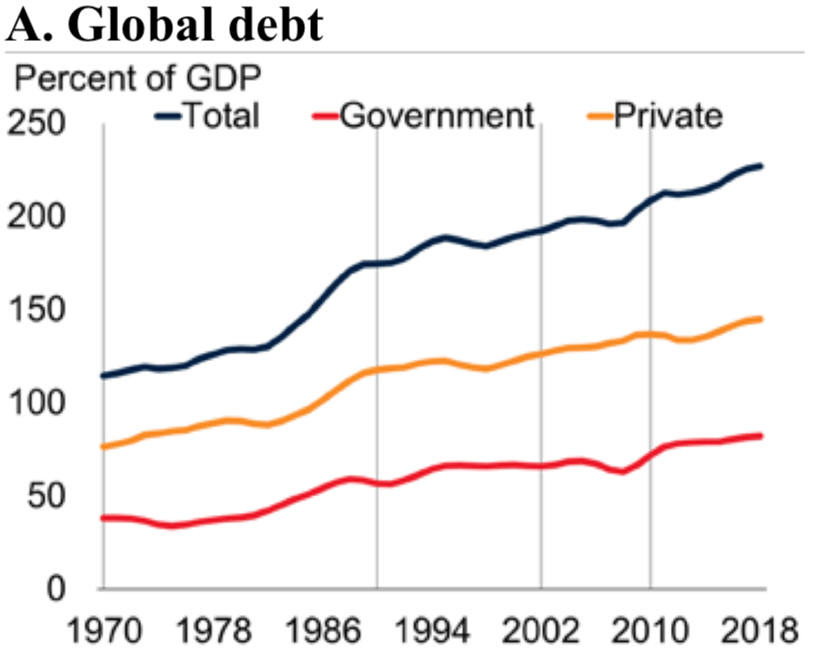

He’s not alone in his worries about global debt. In it’s bi-annual Global Economic Prospects, the World Bank warned that a global debt crisis could be on the horizon as borrowing has risen to its highest level in the past 50 years. The bank warned that although debt has become more manageable due to low interest rates, a fresh financial crisis isn’t out of the question. The risk is especially prevalent among emerging and developing economies, where total debt reached nearly 170% of GDP in 2018.

Debt across the globe has also been building to worrying levels, though. According to the World Bank report:

Since the global financial crisis, another wave has been building, with both global debt and debt in EMDEs reaching all-time highs. The latest wave has also seen the largest, fastest and most broad-based increase in debt in EMDEs. Historically, episodes of rapid debt accumulation have often been associated with financial crises.

Investors Are Overestimating US Stock Market Optimism

Another warning that a stock market crash could be around the corner came from Deutsche Bank’s Parag Thatte, Srineel Jalagani and Binky Chadha on Friday. They cautioned that,

Equity positioning, like the market itself, has run far ahead of current growth as investors price in a global growth rebound.

The three noted that numerous metrics have become very stretched in the current market.

This kind of ultra-high equity exposure is uncommon and points to an upcoming sell-off. The only time exposure was higher than it is now was back in January 2018, just before the S&P 500 lost nearly 10% of its value in a February sell-off.

It’s worth considering Chadha’s perspective – his prediction for 2019 was both the most accurate and the most bullish last year.

This year Chadha says he sees the S&P 500 ending the year at 3,250, 1% below where the benchmark closed on Friday. He points to stretched valuations as reason for his caution. The momentum that has propped the S&P 500 will be hard to sustain in the year ahead.

Chadha’s sentiment has been echoed by plenty of his peers as well. Even the most optimistic prediction, offered by Jonathan Golub from Credit Suisse, sees the US stock market offering a return 50% lower than last year’s. Golub expects the S&P 500 to finish at 3,425— a 5% increase from Friday’s close.

Geopolitical Tension

The geopolitical tension hanging over the US stock market can’t be overlooked in 2020. The most obvious disruptor is the conflict with Iran, despite the fact that investors had largely shrugged it off by the end of last week.

This weekend Iran took responsibility for shooting down a Ukrainian passenger plane, a development that will surely escalate the conflict within the region. This kind of incremental rise in tension is likely just the beginning. At some point, investors may start to get nervous resulting in a mass-exodus.

The other issue at hand is the trade war with China, which has been put on the back burner in light of the Iran conflict. But investors shouldn’t forget that the trade issues between the US and China are still unresolved, meaning there’s potential for two sides to reverse course in the year ahead. As Jim Rogers pointed out,

Historically, trade wars have always been a disaster. No one has ever won a trade war […] Trade wars frequently, or often, have led to real wars. It makes sense, you start slapping someone in the face and you slap them again and you slap them again [they’re going to fight back]. I mean they have to.

With both of those major catalysts still hanging over the market, investors are likely to react erratically to perceived bad news. That could be dangerous in a market where everyone is looking for an excuse to take profits.

Disclaimer: The above should not be considered trading advice from CCN.com.