$120 Billion: Bitcoin, Ethereum Lead Cryptocurrency Market Cap to New Record

Another day, another record-setting bitcoin price. Bitcoin broached the $3,400 level for the first time in history and has $3,500 in its sights. Ethereum, meanwhile, is gradually approaching $300, empowering the cryptocurrency market cap to cross $120 billion and set a new record of its own.

In short, it’s a great time to be a holder.

Cryptocurrency Market Cap Tops $120 Billion

The cryptocurrency market cap began August below $90 billion but has experienced a full-blown eruption in the days that have followed. On August 2, the crypto market cap broke through $100 billion following the UAHF that created bitcoin cash. By August 5, it had passed another checkpoint – $110 billion. Two days later, it climbed past $117 billion to set a new all-time record.

Today – on August 8 – the crypto market cap set yet another high-water mark, vaulting over $120 billion for the first time. At its height, the total value of all cryptocurrencies reached $121.8 billion, although it has since dipped to $121.3 billion.

Bitcoin Price Crosses $3,400 to Continue Record-Setting Advance

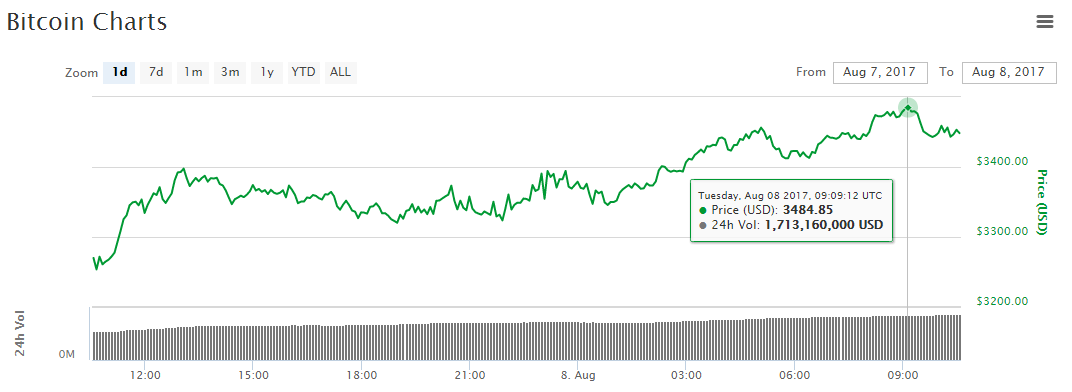

On Monday, the bitcoin price climbed over the $3,300 threshold for the first time. It has continued its record-setting pace since then, bursting through $3,400 on Tuesday and rising as high as $3,486 before receding to its present value of $3,433. Bitcoin now has a market cap of $56.7 billion.

Ethereum Price Continues to Climb

The ethereum price is still a long way from the records it set in June, but August has brought investors a welcome recovery. On Tuesday, the ethereum price rose 6% to advance past $280 for the first time since July 1. The current ethereum price is $282, giving ether a market cap of $26.5 billion.

2017 has been the year of the initial coin offerings, and investments in Ethereum-based ICOs are approaching $2 billion. Financiers have even begun abandoning lucrative careers to chase ICO wealth. Nevertheless, some in the mainstream financial sector remain skeptical. Alex Lehmann, chief operating officer of UBS, recently told Business Insider that the jury is still out on ICOs and that he does not currently see dramatic economic opportunities in that sector.

Obviously, investors in the cryptocurrency ecosystem feel differently.

Bitcoin Cash Price Eyes Recovery

The bitcoin cash price rose for the second straight day, increasing from $259 on Monday to $350 on Tuesday. That movement represents a daily increase of 33%. Bitcoin cash continues to hold the 4th spot on the market cap charts with a valuation of $5.8 billion. This moderate recovery comes as Bitcoin Cash has adjusted its mining difficulty to make it easier to find blocks.

This bitcoin cash recovery is icing on the cake for bitcoin holders. If you had a balance of 1 BTC on August 1 and you have not sold your airdropped BCH, the total value of your bitcoin investment is $3,784.

NEM Leaves Litecoin in the Dust

The altcoin markets were mixed on Tuesday, but the majority of currencies moved in the right direction. The Ripple price was an exception to the general trend, declining about 1%.

Aside from bitcoin cash, NEM posted the best gains of any top 10 coin, following up last week’s 69% climb with an 11% advance on Tuesday. The current NEM price is $0.289. NEM recently kicked litecoin out of the top five and has begun to leave it in the dust. With a $2.42 billion market cap, Litecoin needs $180 million to close the gap.

Seventh-ranked Dash increased about 3% to $198; the Dash price appears poised to break through the $200 threshold once again. The ethereum classic price was stable on Tuesday; it rests at $15.37. The IOTA price rose 4% to $0.48.

NEO rounds out the top 10 with a 12% decline. Considering that the NEO price grew more than 160% last week, this moderate dip should not concern investors too much.

Ripple’s Market Share Continues to Shed Weight

Market cap distribution was mostly stable on Tuesday. Bitcoin continues to claim about 47% of the total market cap, while ethereum’s share is 21.6%.

The real story over the past few weeks has been the gradual decline of Ripple’s hold on the market. As recently as July 1, Ripple controlled more than 10% of the total crypto market cap. Since then, it has experienced almost-daily declines. These declines are rarely significant in isolation, but they have culminated to reduce Ripple’s share by nearly 40% in the past month alone.

Featured image from Shutterstock.