$100 Bills Thrive in Underground Economy, Circulation Spikes to $1.2 Trillion

The $100 bill is flourishing, but not for the reasons you may think it is. | Source: Shutterstock

The $100 bill – also known as the Benjamin or the C-note – now enjoys a higher circulation than even the $1 bill, the CNBC reports.

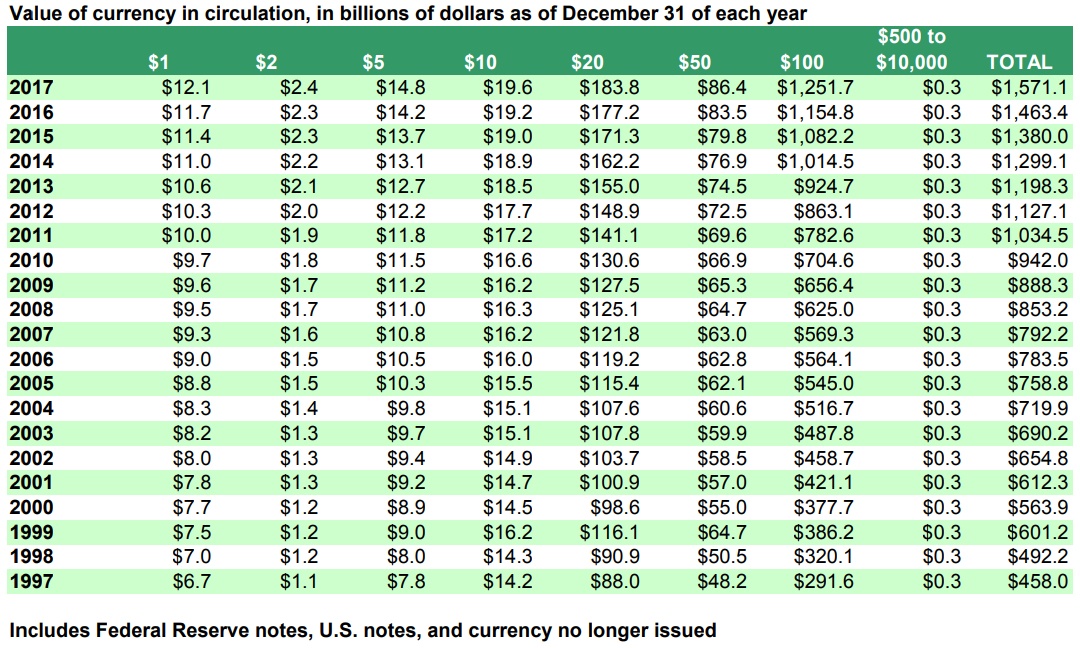

Per Federal Reserve data there are now over 12 billion $100 bills in circulation around the globe.

According to Torsten Slok, the chief international economist at Deutsche Bank, this number has doubled in the last decade. Slok believes that the demand for the C-note could be driven by demand in the underground economy. Additionally, the demand could be occasioned by its utility as a savings vehicle and a haven from negative interest rates:

It could be driven by a global fear of negative interest rates in Europe and Japan, or it could be a savings vehicle for U.S. households worried about another financial crisis, or it could be driven by more demand from the global underground economy.

The Elephant in the Room – Cash not Crypto

There are currently no figures on exactly the amount of cryptocurrencies being used in the underground economy. But it doesn’t take a genius to see that cash poses a bigger danger. With regards to the $100 bill alone, the value that is currently in circulation is more than $1.2 trillion. While that is just one denomination note of the U.S. dollar, one among the 180 currencies spread across the globe, the market cap of all cryptocurrencies is just slightly over $130 billion.

The United Nations Office on Drugs and Crime estimates that 2 to 5% of the global GDP is laundered yearly. Roughly, this amounts to between $800 billion to $2 trillion of the global GDP.

This means that even if every single cryptocurrency in existence was being used in money-laundering, a preposterous idea, it would still be between 6.5% and 16% of the entire amount that is washed across the globe.

Looking for Anonymity? Use Cash not Crypto

Besides the fact that the value of cryptocurrencies far dwarfs that of fiat currencies, cash also offers more anonymity. With cryptocurrencies, the immutable nature of blockchain ensures that all transactions are recorded and public. Thus with blockchain analysis firms it is possible to trace individuals and organizations involved in any kind of transaction.

While there are privacy coins that promise to make transactions untraceable, there have been efforts to sideline their use. Japan’s financial regulator has tried to dissuade the country’s crypto exchanges from listing privacy coins such as Monero and Zcash.

In acknowledgment of the value of high-value denomination notes in criminal activities, there have been several proposals to eliminate them. Among the proponents has been Peter Sands, a senior fellow at Harvard University and former CEO of Standard Chartered.

A Case for Doing Away with ‘Benjamins’ of the World

In a Harvard paper , Sands said getting rid of such high-value bills would combat illicit financial flows:

Our proposal is to eliminate high denomination, high value currency notes, such as the €500 note, the $100 bill, the CHF1,000 note and the £50 note. Such notes are the preferred payment mechanism of those pursuing illicit activities, given the anonymity and lack of transaction record they offer, and the relative ease with which they can be transported and moved.

Despite cash being more prevalently used in illicit activities compared to crypto, you can expect there will be more outcry and hysteria in the mainstream media when the latter are used in crimes. Even when the value of a similar crime carried out using cash dwarfs that of the crypto-related crime disproportionately.