1% of the Bitcoin Community Controls 99% of Bitcoin Wealth

Recently, I ran across this very interesting distribution table on Quora that made me reminisce about the old days of Occupy Wall Street. We are the 99%, right? Maybe in more ways than one, as the table would go on to show. It makes it all seem very clear to me that the more things change, the more they stay the same. Rumour has it that Bitcoin’s original creator, the legendary Satoshi Nakamoto himself, collected the first one million Bitcoins for himself. This would leave a mere 20 million available to the rest of us. And current Bitcoin moguls The Winklevoss Twins have said that they own about 1% of all the bitcoins in existence, as of 2013. That may give you a window into how the bitcoin wealth tends to get distributed.

99% of the Bitcoin Addresses have no Bitcoin Wealth

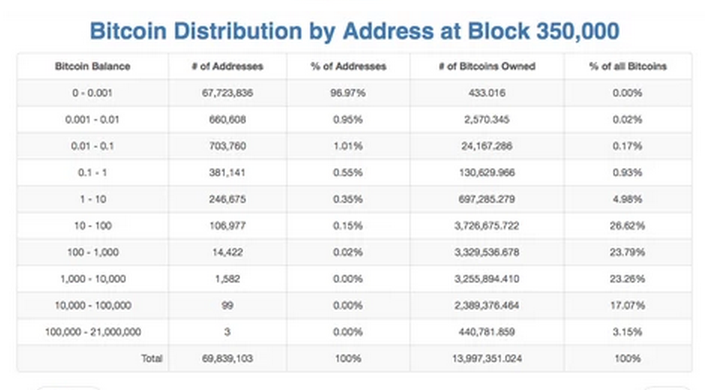

The table below is a snapshot of where the Bitcoin community, based upon all of the bitcoin addresses ever created, is when seen through the distribution of total bitcoin wealth. That it is so precise about the overall wallet content of Bitcoin community is somewhat startling, but a publicly distributed digital ledger should do that fairly well, I reckon. Anyway, this economic community photograph comes from around March 31st of 2015. That was when the amount of Bitcoin was set to pass the 14 million mark, which is exactly 2/3 of all of the bitcoins that will ever be created.

As you can see, this shows how top-heavy the Bitcoin community is. First, there are a lot of bitcoin addresses that are either dead, abandoned or lost due to forgetting passwords/keys/usernames/, etc. Or just tens of millions of test addresses that are empty and never were destined to hold bitcoin, just to exist. Almost 99% of all the bitcoin addresses have less than one-tenth of a bitcoin, which is less than $24 USD worth at present. This is pretty startling to see if you aren’t expecting it. It is hard to compare to any other store of value easily or fairly since most do not have a finite unit count built-in.

The U.S. Government has no problem making trillions of brand new U.S. Dollars every year since inflation is spread throughout the global economy. Being the “global reserve currency” certainly has its advantages, mainly you have an unlimited credit card the rest of the world’s economies help you pay off every day. Exporting inflation is so sweet! Should anything that has lost over 98% of its value over the last century be considered a “store of value?” Gold also does not have a finite limit in its mining, and there are several mining operations worldwide working on producing more 24 hours a day, seven days a week. How much gold there is also is unknown. So how much concern there should be about such an imbalance is questionable.

Funny thing is this table also may help debunk the rumour of Nakamoto holding 1 million Bitcoins. The three addresses at the top of the Bitcoin address mountain have less than half of a million BTC held. Therefore, he would have to spread that large cache across several addresses, which may or may not be the case. This at least makes the rumor slightly less likely, but we may never know.

Bitcoin hoarding is common since many believe Bitcoin value is only a fraction of what it will be in future years, as production slows and demand increases over time. The amount of Bitcoin out there versus the number of daily transactions of BTC shows this fairly clearly. The mainstream acceptance of Bitcoin has been slow if still progressing steadily. These numbers may indeed change greatly as more fiat currencies crumble under the weight of their own debt, more merchants integrate with Bitcoin, and its convenience improves in the marketplace.

The lack of Bitcoin funds issue is not an Australian problem, as I’ve reported before. Australia’s bitcoin market is so strong that every Australian, numbering almost 25 million strong, could have $15 in bitcoin if the market were spread throughout the citizenry. The people in Australia, who are into bitcoin, aren’t just giving lip service to it. They are putting their money where their mouth is. The rest of us need to look in the mirror on this one.

Are Satoshi Nakamoto and The Winklevoss Twins the three addresses at the top of the Bitcoin wealth mountain? Will the next bull market change these numbers dramatically? Will the Bitcoin community experienced a trickle-down economic windfall down the road when the heavy hitters have hoarded enough of a profit for being early adopters, and sell off their fortunes? Stay tuned.

I don’t know what to make of it, but I hope the future has a less centralized collection of wealth for the world’s leading centralized digital currency. The carpet doesn’t match the drapes.

Image provided by Quora and Shutterstock.

Should we all have more invested in a Bitcoin address than $24? What does this mean to you? Share above and comment below.