Will the Longest Bull Market in U.S. History Lead to Economic Ruin? History Says Yes

If history is anything to go by, prolonged bull markets often lead to painful corrections and even recession. | Source: Johannes EISELE / AFP

- When the U.S. stock market saw extended bull markets throughout history, it was met with intense pullbacks.

- Data indicates that equities are currently overvalued.

- A steep downturn can be avoided if strong numbers pertaining to the economy continue to roll out.

The U.S. stock market is officially in the longest bull market in history. The last time there was a decade-long rally, a tragic economic downturn followed.

The bull run before the Great Depression in 1929 lasted for around eight years. As the stock market boom came to an end, the U.S. economy endured arguably the worst economic turmoil in history .

State of the Stock Market is Different, But Still Cyclical

Fundamentals are important, but every market runs on sentiment and cycles. After a major rally, a correction tends to follow as the overvalued market stabilizes.

Whether the U.S. stock market is due for a severe crash in the imminent future is still premature to determine given strong unemployment numbers and the accommodative stance of the Fed.

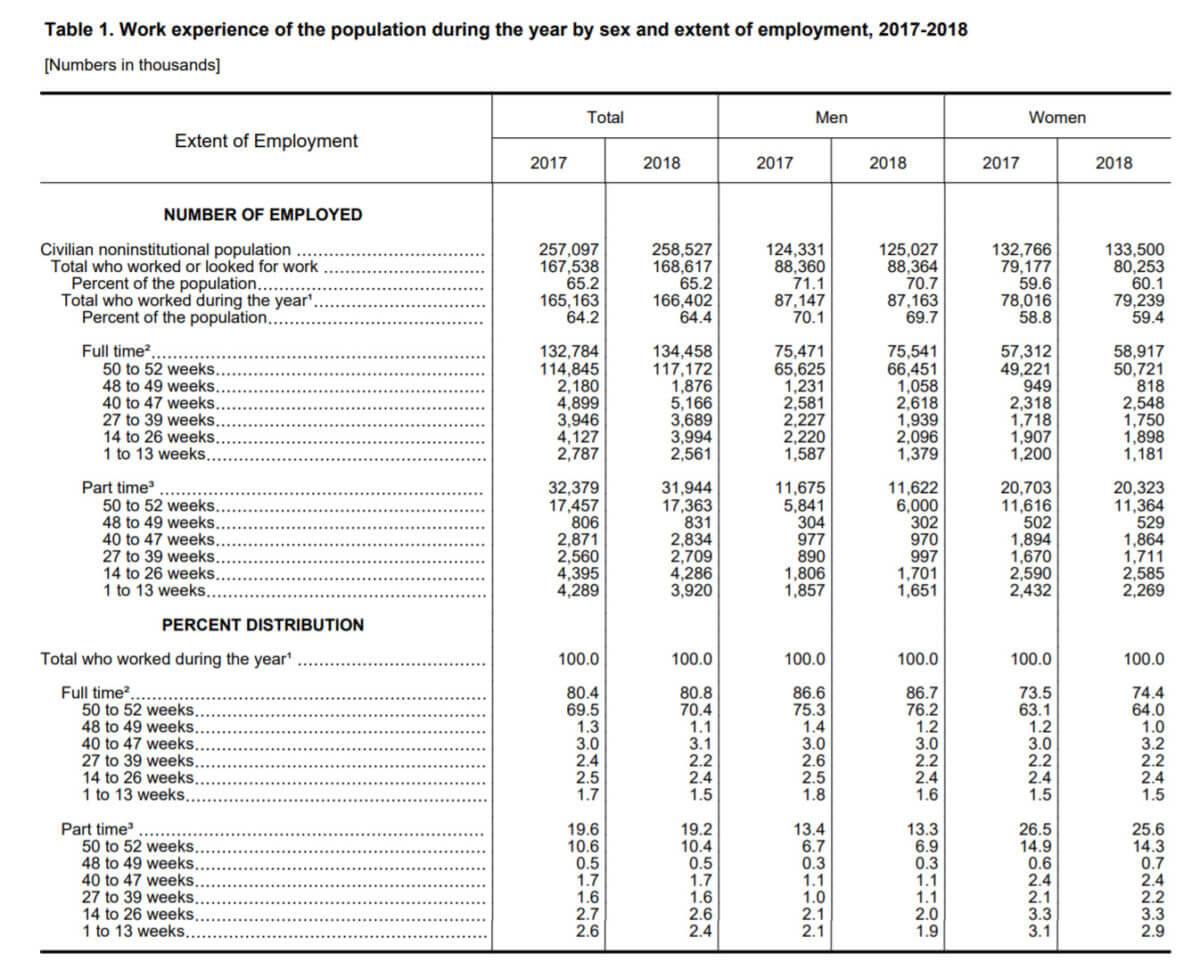

According to official data from the Bureau of Labor Statistics , the number of employed individuals increased by 1.1 million since 2018 and unemployment dropped by 1.3 million.

The Bureau said in its December report:

“Overall, 168.6 million persons worked or looked for work at some time in 2018, up by 1.1 million from the prior year. Of those, 13.2 million experienced some unemployment during 2018, down by 1.3 million from 2017. (See table 3.) The work-experience unemployment rate (those looking for work during the year as a percent of those who worked or looked for work during the year) continued to decline.”

As interest rates remain low and companies continue to hire, especially in key sectors like manufacturing and technology, the inflated stock market has expanded consistently throughout the past 11 months.

Markets in Asia have also performed relatively well throughout 2019, with the Nikkei 225 and SSE Composite both up year-to-date.

https://twitter.com/DavidInglesTV/status/1202865521135276032

Overvalued Market

Organizations like the International Monetary Fund (IMF) are beginning to sound the alarm on an overvalued stock market.

The IMF said in its October report that policymakers need to employ a long-term strategy to lessen variables that can trigger the next economic downturn.

According to the IMF:

Against this backdrop, medium-term risks to global growth and financial stability are still firmly skewed to the downside. Policymakers urgently need to tackle financial vulnerabilities that could exacerbate the next economic downturn.

Key investment firms like Berkshire Hathaway have been cautious in leading major multi-billion deals in recent months. The careful stance of firms indicates that the market is likely to be overvalued.

How a Big Downturn Can be Prevented

As said by Scott Melker, a trader at Texas West Capital, the stock market is only one of many metrics that demonstrate the strength or weakness of the economy.

Melker recently tweeted :

The stock market hitting all-time highs is a criminally misleading metric for the strength of an economy or country for its citizens. 55% of Americans own stock, including retirement accounts provided by employers. Some of those own only a few dollars worth.

If the U.S. government continues to focus on providing a productive environment for businesses to continue hiring, it may eliminate key vulnerabilities that could negatively affect the stock market in the medium to long-term.

Such efforts, which would require a carefully planned strategy from the central bank, could prevent a paradigm-shifting correction in the years to come.