Why the Mid-Term Trend of Bitcoin Price Relies on Japan and South Korea

Following the exit of the Chinese cryptocurrency exchange market caused by the Chinese government’s imposition of a nationwide ban on cryptocurrency trading platforms, Japan and South Korea have evolved into major bitcoin exchange markets and industries.

Emergence of Japan and South Korea as Major Bitcoin Markets

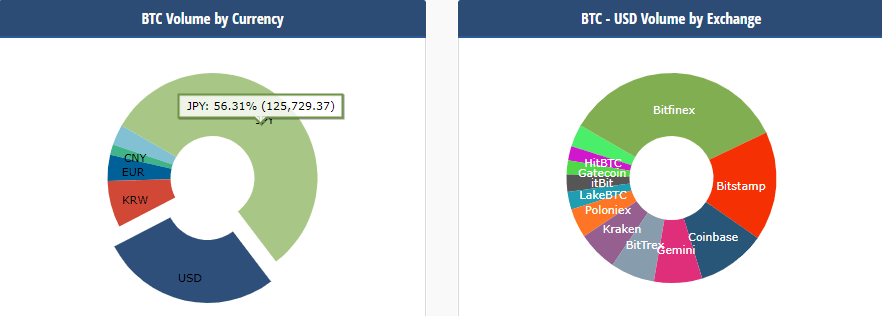

According to various cryptocurrency market data providers including CryptoCompare, Japan has secured 56.25 percent of the global bitcoin exchange market share, processing more than twice as much bitcoin trades as the US market.

Over the past week, the trading volume of the Japanese cryptocurrency exchange market increased substantially following the authorization and licensing of 11 cryptocurrency trading platforms by the Japanese government and its financial regulator, the Financial Services Agency (FSA).

Some of the world’s largest cryptocurrency trading platforms such as BitFlyer gained legal status, and received permission to operate as regulated financial service providers in Japan. Upon the introduction of a national licensing program for cryptocurrency trading platforms, BitFlyer CEO Yuzo Kano stated:

“Japan has been exploding with demand for both bitcoin trading as well as virtual currency services. The FSA’s approval for bitFlyer to operate as a Registered Virtual Currency Exchange, and the agency’s openness and forward thinking regulation could not come at a better time for the blockchain space.”

As CCN.com previously reported, it is highly likely that the Japanese government’s authorization of cryptocurrency trading platform would influence US financial regulators to take a similar approach. Already, Keith Noreika, the acting Comptroller of the Currency, revealed that the US Treasury is considering the possibility of authorizing cryptocurrency exchanges through the imposition of a national licensing program.

“I wouldn’t be adverse to those people coming in and talking to the [Office of the Comptroller of the Currency] about how a charter could make sense for them. But that is a long process they’d have to go through, and just because you get in the door doesn’t mean you’re going to get out the door on the other side,” said Noreika.

Mid-Term Price Trend of Bitcoin, Reliance on Japan and South Korea

The mid-term price trend of bitcoin most likely will depend on the Japan and South Korean markets. Throughout the past month, the bitcoin price has been able to sustain upward momentum due to the optimistic regulatory frameworks and rapidly increasing adoption in the two markets.

Without Japan and South Korea, the global cryptocurrency exchange market including the bitcoin market would have struggled to deal with the exit of the Chinese cryptocurrency exchange market, which has been responsible for 10 to 13 percent of global trades prior to the ban.

But, it is optimistic for the long-term growth of bitcoin that the majority of trades are being processed in regions such as Japan and South Korea, which have implemented efficient and practical regulatory frameworks for the benefit of both businesses and investors.

The South Korean government is also planning on legalizing bitcoin and creating a national licensing program for cryptocurrency trading platforms in the upcoming months. Upon the release of new regulatory frameworks on bitcoin and cryptocurrencies, institutional and retail investors in the two countries would likely drive the bitcoin price up in the mid-term, allowing the price of bitcoin to achieve new highs.

Featured image from Shutterstock.