Why BYND Stock May Not Be Dead Meat

Beyond Meat stock has fallen off a cliff. But management will have the stage to plead their case Monday during the earnings call. | Credit: Reuters/Brendan McDermid

- Beyond Meat stock may have gotten the wind knocked out of it, but that doesn’t mean it’s down for the count.

- Right now, investors are showing little appetite for BYND, but the stock is still up by a double-digit percentage year-to-date.

- The alternative meat company is a first-mover, and it will have an advantage if the sector gains traction.

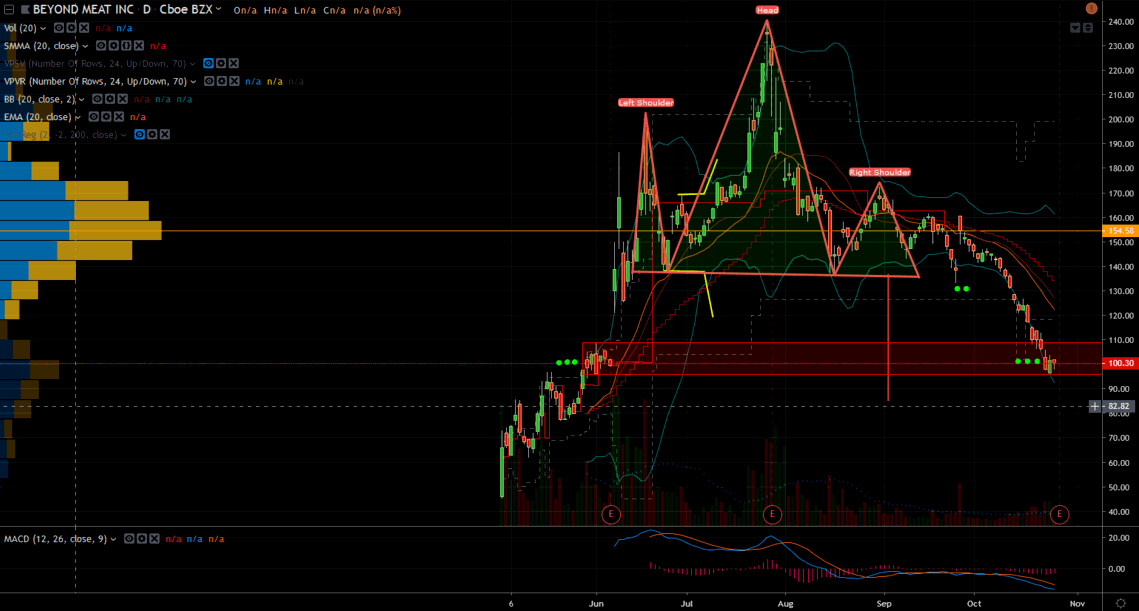

Beyond Meat (NASDQ:BYND) stock is almost 60% off its highs. But the story is not done yet. This is a concept that is likely to linger for decades. While Beyond Meat stock is going through a period of malaise, it doesn’t mean that it is necessarily game-over. There are important technical milestones coming and an opportunity for management to plead their case.

Beyond Meat stock update

In spite of a correction that started in July, Beyond Meat is still up more than 50% year-to-date. So unless investors were late chasing the hype, there are still plenty of profits in the stock. This could be good because sharp corrections usually shake off weak hands and the ones remaining to hold the stock have better conviction. But it could also mean that there is much more froth to shed.

Once BYND was no longer trading at $134 per share, it triggered a bearish pattern that targeted the $90 zone. This correction brings the price within striking range of it, but it has still been a falling knife. The stock is still making lower highs and lower lows, and there is no evidence of stabilization yet. So the bearish pattern appears to be still unfolding.

What is making matters worse is that the botched IPO of WeWork left Wall Street investors hating stocks of new entrants like Beyond Meat and Uber (NYSE:UBER). So they needed little reason to sell it. Beyond Meat stock sports a very frothy valuation, so it is vulnerable. This is normal for a new concept, but investors now have little appetite for it. But it might not always be the case. The idea of an alternative to meat is a viable concept. The reasons for it are many and are not only tied to health matters. Eating vegetable-based meat could also be good for the planet.

This whole sector could thrive in the years to come, and BYND may get some benefit from being the first mover into it. They will have a lot of work to do, but they are on the stage and Wall Street is watching. BYND management will report earnings Monday after the market closes. Typically, the short-term reaction to earnings is binary. But if they guide well for the rest of the year, maybe they can start reversing the damage that October brought. Investors will be watching how management addresses the wave of competitors that are coming after it. Given the current environment, traders will exercise little patience for sob stories.

Some hope for BYND stock from the technicals

The June earnings reaction launched a massive spike in Beyond Meat stock. The important part is that they did it from about the same level as where the stock is today. Typically, these pivot zones lend support on the way down.

Both bulls and bears will want to fight it out once more down here, thereby creating congestion in price.

Disclaimer: The above should not be considered trading advice from CCN.com.

Comments below