We’re Trapped in a Stock Market Bubble. Here’s How You Can Profit

The U.S. stock market is in a bubble, but that doesn't mean value plays don't exist. Investors can still profit from the current market environment - even if a pullback ensues. | Image: Drew Angerer/Getty Images/AFP

- Even the bulls agree that the Fed has inflated a stock market bubble.

- Equities can keep rising as long as the bank continues to support markets.

- While the market is frothy, investors can still find value.

With last week’s stock market correction still fresh in investors’ minds, talk of U.S. equity markets being in bubble territory has dominated the headlines. Even the bulls seem to concede that financial markets are in a bubble—the question now is when, or whether, that bubble will pop.

Bears worry that the November elections could be the pin that pops the equities bubble, while others say as long as the Fed maintains its dovish stance, share markets will continue to rise . In either case, caution is key to making money in today’s stock market. Volatility is likely to continue, and for that reason, holding a bit of cash makes sense.

Most analysts agree, stepping out of the stock market entirely for fear of a bubble burst is the wrong strategy , especially for long-term investors. Instead, looking for pockets of value and finding ways to bet on the future are great strategies to profit from this frothy market.

Finding Value in a Frothy Stock Market

Value stocks are few and far between these days, but that doesn’t mean they don’t exist. Even in the bloated tech sector, it’s possible to pick up a stock that manages to balance growth and value.

If you’re worried about a bubble burst, there are a few places to steer clear. One is the so-called safe-haven tech sector, where investors have been rushing over the past few months. While companies like Facebook and Netflix make for great stay-at-home plays, they have soared to unreasonable levels considering the current environment.

Short-term, the tech-heavy hitters could continue to deliver as coronavirus uncertainty weighs on the market. But for value investors who have a longer time-frame, there are better options.

Take Qualcomm stock, for example. The semiconductor firm is poised to be a huge beneficiary of the 5G revolution, which should help the stock continue to climb for years to come.

The firm is trading at just under 18 times its forward earnings—compare that to any of the ever-popular FAANG plays, and QCOM stock looks like a good balance between growth and value in the tech space.

Betting on a Covid Recovery

For those playing the short game, the current environment is stress-inducing. Fund managers and the handful of day-traders that have been riding the stock market’s impressive wave are now trying to time the top. But investors with a three-to-five-year timeline have an opportunity to pick up beleaguered stocks that will return to growth in a post-pandemic world.

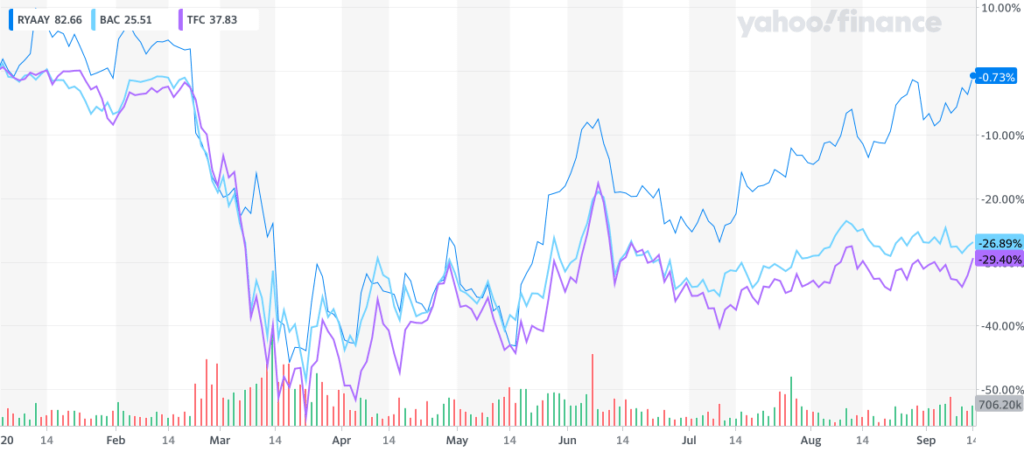

Bank stocks are one place to go looking for value for long-term investors. RBC Capital Markets’ managing director Gerard Cassidy says Bank of America and Truist Financial are good financial stocks for investors who have time to wait out some volatility:

Based upon the valuations and the outlook for the economy in 2021, we believe bank stocks can be purchased with the expectation the group outperforms the general market over the next 12-18 months.

For those with a stronger stomach, airlines could be the way to go. While it’s true that airlines are facing a crisis of epic proportions, those that withstand this pandemic will be poised to grow exponentially.

Causeway Capital fund manager Jonathan Eng points to Europe’s low-cost Ryanair Holdings as a potential value play because of the company’s stronghold in the region and solid financial base:

They were massive disruptors of the industry 10 years ago and a thorn to competitors. We think that will be the case coming out of this recovery.

Caution Ahead

If there’s one lesson that past stock market bubbles have taught us, it’s that diving headfirst into a frothy market can have dire consequences. Some are starting to predict a K-shaped recovery in which the rich get richer and America’s working-class struggling to make ends meet.

For now, no one knows for certain exactly how the pandemic will pan out, so its wise to proceed with caution and keep some cash on hand to buy any dips.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.