Stitch Fix (SFIX) Had a Bad Quarter and Insiders Are Dumping Unicorn Shares

Stitch Fix takes a beating and a months-long insider dump does not inspire. | Source: rblfmr/Shutterstock.com

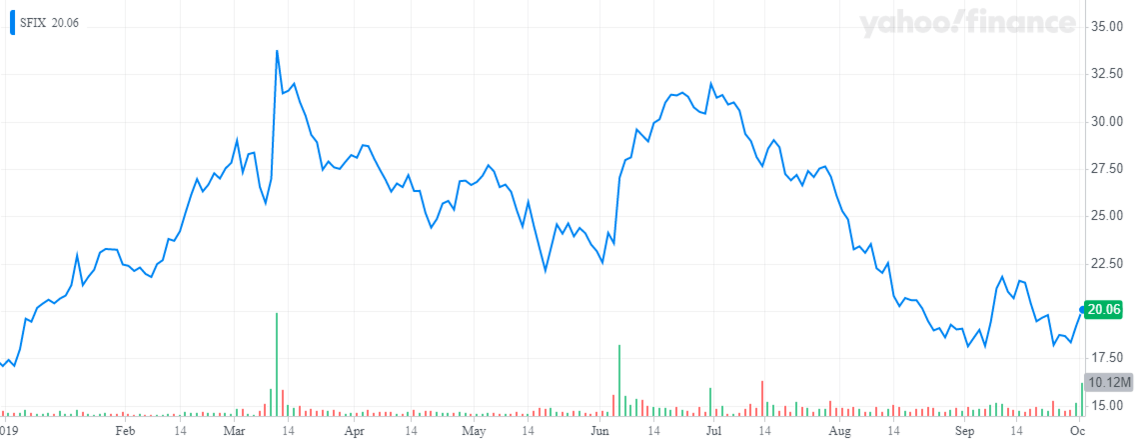

Custom-clothing online retailer Stitch Fix released its third-quarter earnings yesterday after the markets closed. The company’s stock declined by almost ten percent as the company missed the consensus revenue estimate. The decline came at a time when investors are looking closely at unicorn companies that are valued at more than a billion dollars.

Quarterly Review

The company’s numbers were actually not bad. In the quarter, the company had an earnings per share of $0.07 on revenue of more than $432 million. This revenue represented a 36 year-over-year growth when you consider that the quarter had an extra week. Without this week, the company’s revenue grew by 26%. Unlike other loss-making unicorns, Stitch Fix had a net income of more than $7.2 million. The company’s subscribers grew by almost half a million. In addition, the company launched its business in the United Kingdom and celebrated the first full year of Stitch Fix Kids.

According to Katrina Lake:

We grew our gross margins year-over-year and turned our inventory at a rate of more than 6x annually, a function of our continued scale, strengthening capabilities and the growing impact of data science such as our inventory optimization algorithm and Style Shuffle platform.

Insider Selling a Concern

I have been an investor in Stitch Fix for quite a while. Just last month, I published an article saying that the current pullback was an opportunity of a lifetime. I also believe that the company is not overvalued. The company has a price to sales multiple of 1.30, which is a bit reasonable.

Still, I see two major problems. First, there is the Amazon problem. In July, Amazon launched Personal Shopper , a service that is very similar to what Stitch Fix is offering. While Amazon might not be successful in this, I believe that Stitch Fix will be under pressure. On competition from Amazon, Lake said:

We’re differentiated in our rules with vendors and brands and brands love working with us. And we’re a channel that really helps them to preserve their brand integrity that helps them to be introduced to clients in a really authentic way and I think that’s another huge point of differentiation in our model.

Another big problem is that insiders are selling. According to data on GuruFocus , Katrina Lake has sold more than 800k shares this year. She sold the latest 100k shares just two weeks ago. Going by the current stock price, she has sold stock worth more than $16 million. In 2018 alone, she sold more than 1 million shares.

She is not alone. Other insiders, including Mike Smith (COO), Darling Scott (Chief Legal Officer), and Hansen Maka have been selling shares. In fact, a look at the company’s insider transaction data shows that no insider has bought stock ever since the company went public. In total, insiders have sold more than 2.3 million shares in the company in the past 6 months.

Source: Guru Focus

While I like Stitch Fix, I believe the insider transactions point to a bigger problem ahead. Why should anyone care to buy a stock of a company whose insiders don’t have confidence in it?

Disclaimer: The writer is invested in the company and the views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.