$100 Billion Softbank Fund Flops After CEO Exposes Monster Bitcoin Loss

Fresh off his $130 million bitcoin blunder, Softbank's Masayoshi Son faces grave problems as investments sour and key partners abandon him. | Source: REUTERS/Issei Kato/File Photo (i), Shutterstock (ii). Image Edited by CCN.com.

By CCN.com: Just months ago, Japanese tech behemoth Softbank was on top of the world, and CEO Masayoshi Son added $5 billion to his net worth following a well-timed stock buyback program. But fortunes have turned for Softbank and Mr. Son. Softbank stock has slumped nearly 20 percent since its April highs, its Uber investment is looking shaky, and new fundraising efforts are failing. Meanwhile, Mr. Son revealed his monstrous losses from a disastrous bitcoin bet.

Softbank Founder Suffers Bitcoin Blues

In April CCN.com reported on Son’s brief but regrettable investment in bitcoin, writing that:

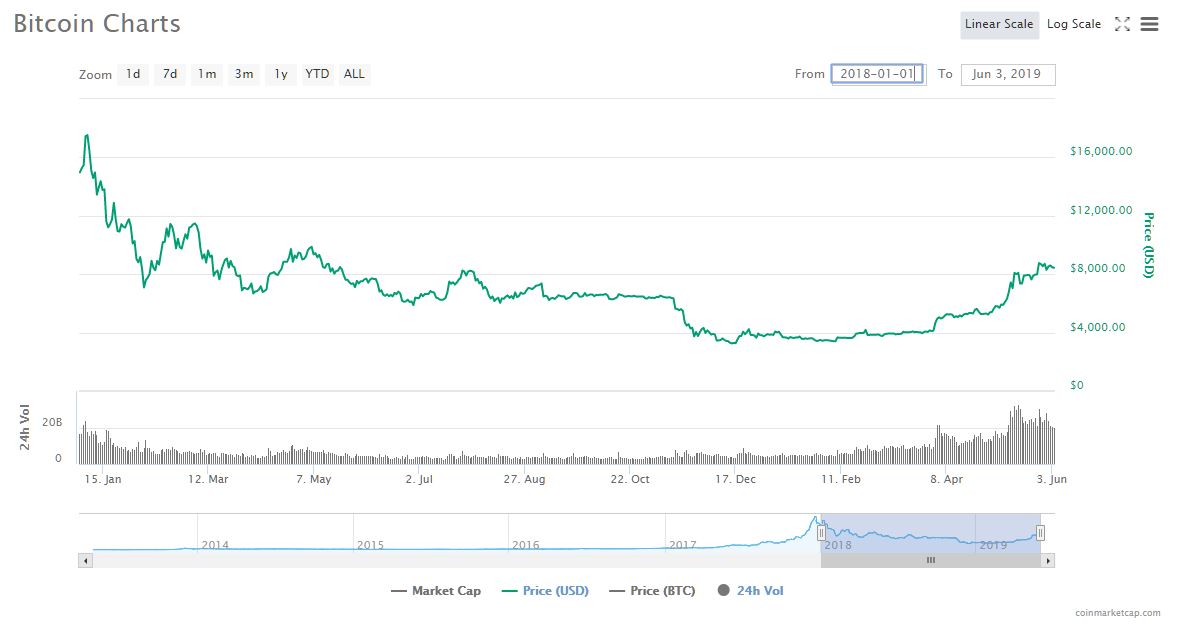

“It is not known exactly how much Masayoshi Son, worth an estimated $24 billion, poured into bitcoin. But he appears to have bought in late 2017 as the bitcoin price approached a record high of $20,000. He sold early in 2018 as the price collapsed, taking a $130 million loss.”

For someone worth $24 billion, a $130 million hit isn’t the end of the world. But even for him, it’s not chump change. And unfortunately, Son and Softbank may face worse losses in the future.

Softbank Strategy: Buy High, Sell Low?

Son’s bitcoin trading could be an ominous warning of what’s to come. That’s because Softbank is heavily invested in a bunch of tech unicorns that are losing enormous sums of money. For example, Softbank has a massive stake in the controversial WeWork co-working space company. The New York Times reported on Softbank’s latest capital infusion into the company:

“The latest investment — which is coming from SoftBank itself, not its nearly $100 billion Vision Fund — values WeWork at $47 billion, and brings SoftBank’s total investment in WeWork to about $10.5 billion, they said.”

Ominously, the article noted that Softbank was looking at putting as much as $16 billion into WeWork but scaled it back to just $2 billion. Still, with more than $10 billion committed to WeWork, Mr. Son has a big problem if the company crashes and burns, as some expect:

WeWork isn’t Softbank’s only troubled investment.

They invested heavily in Uber after its valuation had already soared. Softbank was looking at doubling its money on the Uber IPO; instead, the IPO pricing plummeted, taking Softbank’s potential gains with it.

If Uber’s rocky ride continues, Softbank could instead end up with large losses on Uber and the company’s other ride-hailing investments such as China’s Didi Chuxing.

If that wasn’t enough, Softbank also put $1 billion into Wirecard, a German company who has been accused of fraud and whose shares slumped 9 percent on Friday.

Investors Reject Softbank’s New $100 Billion Tech Fund

This all comes at an inconvenient time for Softbank.

They are out marketing for their Vision Fund II, which intends to invest $100 billion in tech start-ups. But with Uber struggling and WeWork looking like a fiasco in the making, investors have lost interest.

The Wall Street Journal reported that the Saudi Arabia Public Investment Fund declined to invest in the Vision Fund II. That’s a huge blow, as Saudi Arabia was a leading backer of the original Vision Fund, ponying up $45 billion. Other high-profile names, such as the Canada Pension Plan Investment Board also want nothing to do with Vision Fund II.

Meltem Demirors, Chief Strategic Officer at CoinShares, wondered what Softbank’s grand strategy is and suggested trouble could be coming:

In theory, Softbank could cough up much of the money for the fund itself. But its balance sheet is loaded with debt and the company’s plans to sell its Sprint business to T-Mobile are under fire due to antitrust concerns. The DoJ’s new crackdown on Google shows that the government is getting serious about fighting monopolies.

Masayoshi Son Is Ambitious, But Can He Execute?

Mr. Son has huge plans. For example, he’s one of the leading futurists out there, along with Elon Musk, Jeff Bezos, and Mark Zuckerberg.

But like Mr. Musk, Son might want to spend a little more time focusing on his business dealings before getting lost in the stars. Investor patience is running thin.