Inside Ripple’s Disastrous Year: XRP is the Worst-Performing Major Crypto of 2019

Ripple (XRP) is having a miserable 2019, so far. | Source: Shutterstock

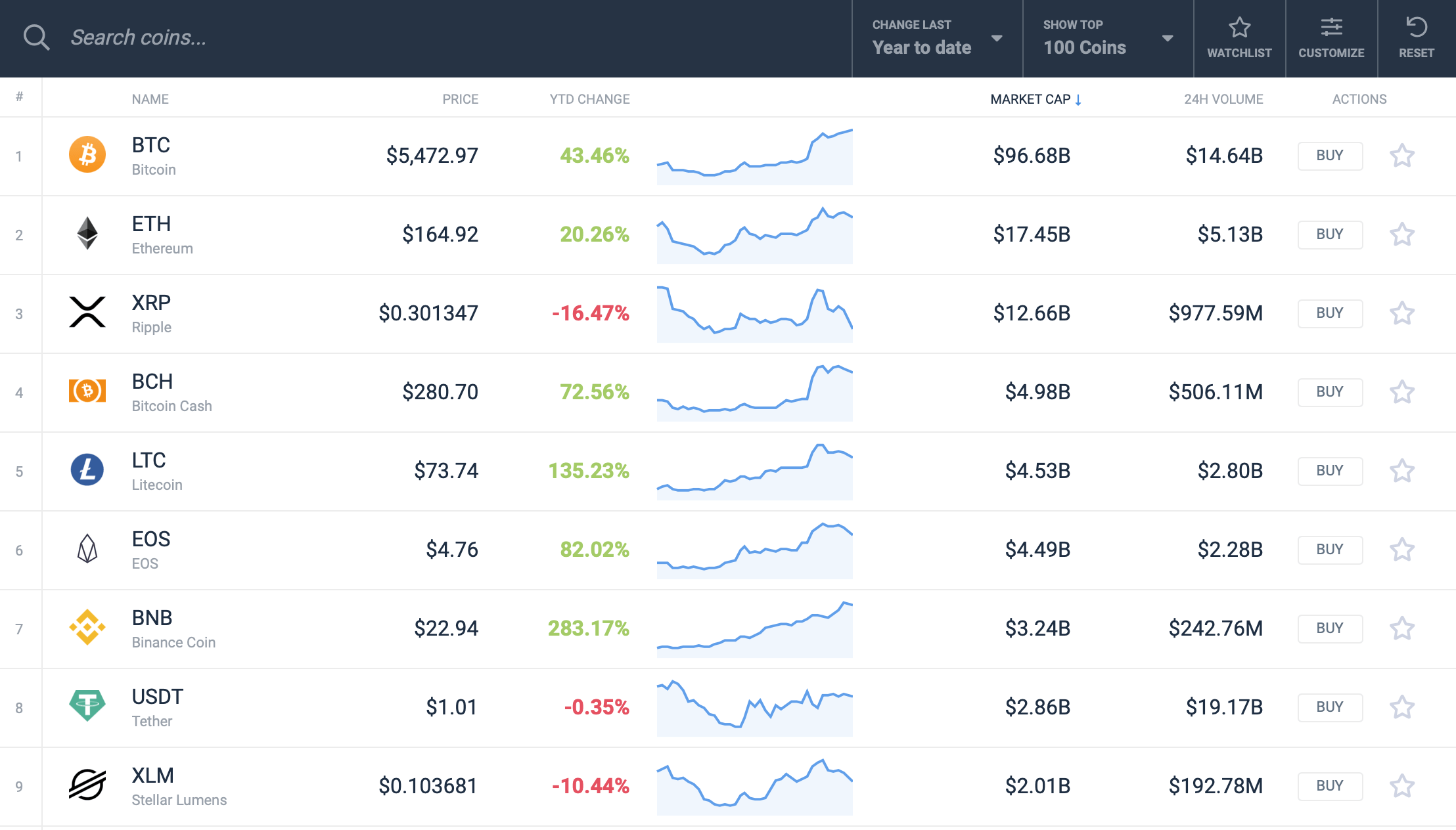

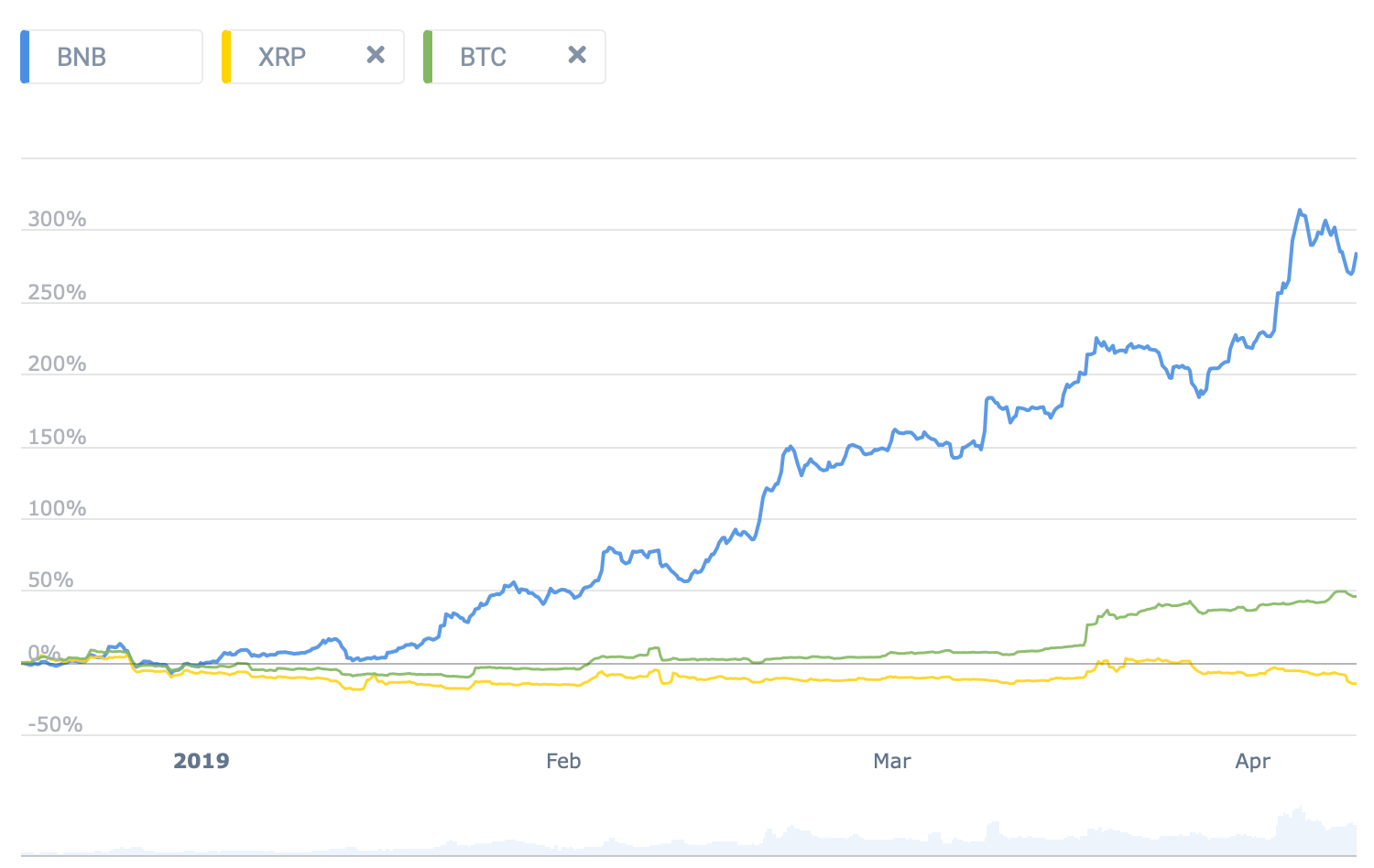

By CCN.com: Ripple’s XRP is having a disastrous start to 2019. In a year when bitcoin is storming back towards bull territory, XRP has crashed 16 percent. The third-largest cryptocurrency is now the worst-performing digital asset in the top ten.

Ripple’s woes worsened in yesterday’s trading session as XRP’s value dropped 7 percent, plunging below the key $0.30 mark. XRP is consistently underperforming bitcoin and the broader cryptocurrency market.

XRP crushed while bitcoin soars

The crypto market has staged a powerful recovery in the first months of 2019. Bitcoin has surged 43 percent this year, outperforming the stock market and every single stock in the Dow Jones Industrial Average.

Other cryptocurrencies have performed even better. Litecoin has chalked up 135 percent gains since January while EOS is up 82 percent. Crypto’s enormous 2019 success story, Binance Coin (BNB), has surged 283 percent.

XRP, however, has failed to join its peers in the epic crypto comeback. At $0.29, the cryptocurrency associated with Ripple remains stuck 92 percent below its all-time high of $3.84.

Problems at Ripple?

The lack of price action behind XRP likely lies with Ripple. The company aims to provide international remittance technology to major banks and payment providers. But despite teasing hundreds of banking partnerships, only a tiny handful are actively using the XRP token for liquidity.

Ripple CEO Brad Garlinghouse once boasted that “dozens ” of banks would be using Ripple’s xRapid service, which taps XRP as a bridge currency, by the end of 2019. Thus far, only one licensed bank is using xRapid . Other clients are localized payment providers.

Simply put, xRapid and XRP liquidity is not yet the game-changer Ripple claimed it would be. Traders are coming back down to Earth after exaggerated claims.

Pressure from JP Morgan’s JPMCoin and Facebook Coin?

Ripple’s unique selling point has been weakened by the entrance of JP Morgan and Facebook in the cryptocurrency arena.

The industry mocked JP Morgan’s controversial new cryptocurrency JPM Coin when it was revealed this year, including Ripple’s CEO. But JPM Coin has likely played a part in choking XRP’s price action.

Why? Because JPM Coin threatens to do what XRP does. JPM Coin is designed to make bank transfers faster and cheaper. It could one day be used for inter-bank remittance payments, too.

At the same time, Facebook revealed plans for a cryptocurrency that would facilitate remittance payments in India . Indian remittance payments is one of Ripple’s most important markets.

In other words, Ripple and XRP just got some huge, well-established competitors.

Ripple’s ongoing lawsuits and “security” confusion

Ripple is also battling a class action lawsuit over its relationship with XRP. Ripple maintains that it did not create XRP, nor does it have any direct connection with the cryptocurrency. But legal documents beg to differ .

As a result of Ripple’s close ties to XRP, many argue it should be classified as a security. The Securities and Exchange Commission (SEC) is still quiet on this issue. The confusion around XRP’s classification is likely making some investors wary of the asset.

For now, XRP lags the broader crypto market.