Report: Investing and Asset Management Holds Greatest Potential for FinTech

A new report has found that over half of the respondents believe that segments investing and asset management, payments, and crowdfunding/lending have the greatest potential for the future of FinTech, but that revenue development lies in blockchain companies.

The report, FinTechs in Europe – Challenger and Partner [PDF ] conducted by Roland Berger, looked at 248 FinTech companies from 18 European countries.

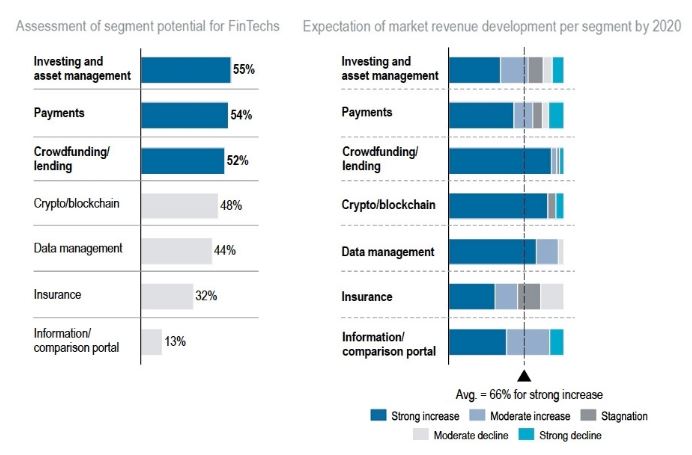

According to the report, 55 percent of those surveyed stated that investing and asset management hold the greatest potential for FinTech companies; 54 percent said it was payments; and 52 percent claim it lies in crowdfunding and lending.

However, when it comes to revenue development, optimism is in blockchain and crowdfunding/lending companies who are expectant of market revenue development per segment by 2020.

Overall, 66 percent expect a strong increase in their respective segment’s market revenue by 2020; however, for blockchain and crowdfunding/lending this number was significantly more, both indicating over 80 percent.

A Rise in FinTech Companies

Since the financial crisis in 2008, the number of financial technology companies has risen at a fast rate, as such the number of deals has also risen.

As can be seen from this graph, in 2011 there were only 457 deals valuing $2 billion; however, in 2015, that number increased to 1,162 with a total value of $19 billion.

Due to new technologies such as blockchain and the changing market, investors interest remains.

As such many European FinTech companies are confident in what it is they are doing and the revenue they will generate as a result.

This is significant news and demonstrates how far the sector has progressed since 2008.

Expansion of FinTech

According to the report, most FinTech companies initially started their operations in one country.

At present, 16 percent of companies operate in more than a handful of countries with 48 percent operating in just one. Plans, however, are in motion to increase this number in the next five years, bringing operations to more than five countries to 56 percent. The report states that the top five European countries for expansion include the U.K. and Ireland, France, Germany, Italy and Spain.

Driving Success

When asked about the key driving success factors in financial services, 71 percent of respondents cited ‘trust of customers,’ followed by 69 percent for ‘transparency of products/services.’ ‘General customer understanding’ came in at 60 percent while ‘convenient processes’ ranked at 47 percent.

Interestingly, when it comes to competition, FinTech companies assign themselves a much higher degree of capability for four out of five key success factors in retail banking and insurance.

The report found that most of the FinTech companies surveyed are very confident that they serve their customers needs and that incumbents are behind on digitization.

Collaboration

According to the report, respondents said the best way to collaborate with incumbents and other players entering the financial market on propositions was through cooperation at 86 percent while 29 percent said they would consider participation.

The most important reason for collaborating was access to a strong customer base at 78 percent.

Martin Krause-Ablass, Principal at Roland Berger, said:

FinTechs have a realistic view of their role in the market: while they are indeed changing the financial industry, they alone will not herald a revolution. What banks and insurance companies themselves can get out of collaborating with FinTechs are opportunities to drive their own digital transformation.

Featured image from Shutterstock.