Wealth Manager: Pot Stocks Will Mimic Crypto Bubble – But Won’t Crash Like Bitcoin

Carol Pepper says pot stocks can soar like the crypto market in 2017 - but they won't crash like bitcoin. | Source: Shutterstock

Wealth manager Carol Pepper says cannabis stocks are the next “huge growth area” in alternative investing. With an actual physical product, pot stocks could soar like Bitcoin in 2017, but unlike the cryptocurrency, they won’t follow that boom with a bust.

Pot Stocks Earn Bump from Legalization Progress

Recreational cannabis was legalized in Canada on October 17, 2018, opening the North American market to pot companies and laying the groundwork for cannabis-infused drinks and other products.

The US could quickly follow Canada’s trailblazing. Though it’s still banned at the federal level, ten US states and the District of Columbia have legalized cannabis. Other regions globally including Europe are investigating a once-taboo plant for its medicinal properties and the benefits of a legal and recreational market.

Even the US has legalized hemp for commercial use, although the FDA retains a ban on cannabidiol (CBD)-infused food and beverages.

Pepper, of Pepper International, this week told CNBC the crop provides “staggering” potential for investors.

Pot Stocks Already Seeing Massive Growth

Some investors have already begun to reap those profits.

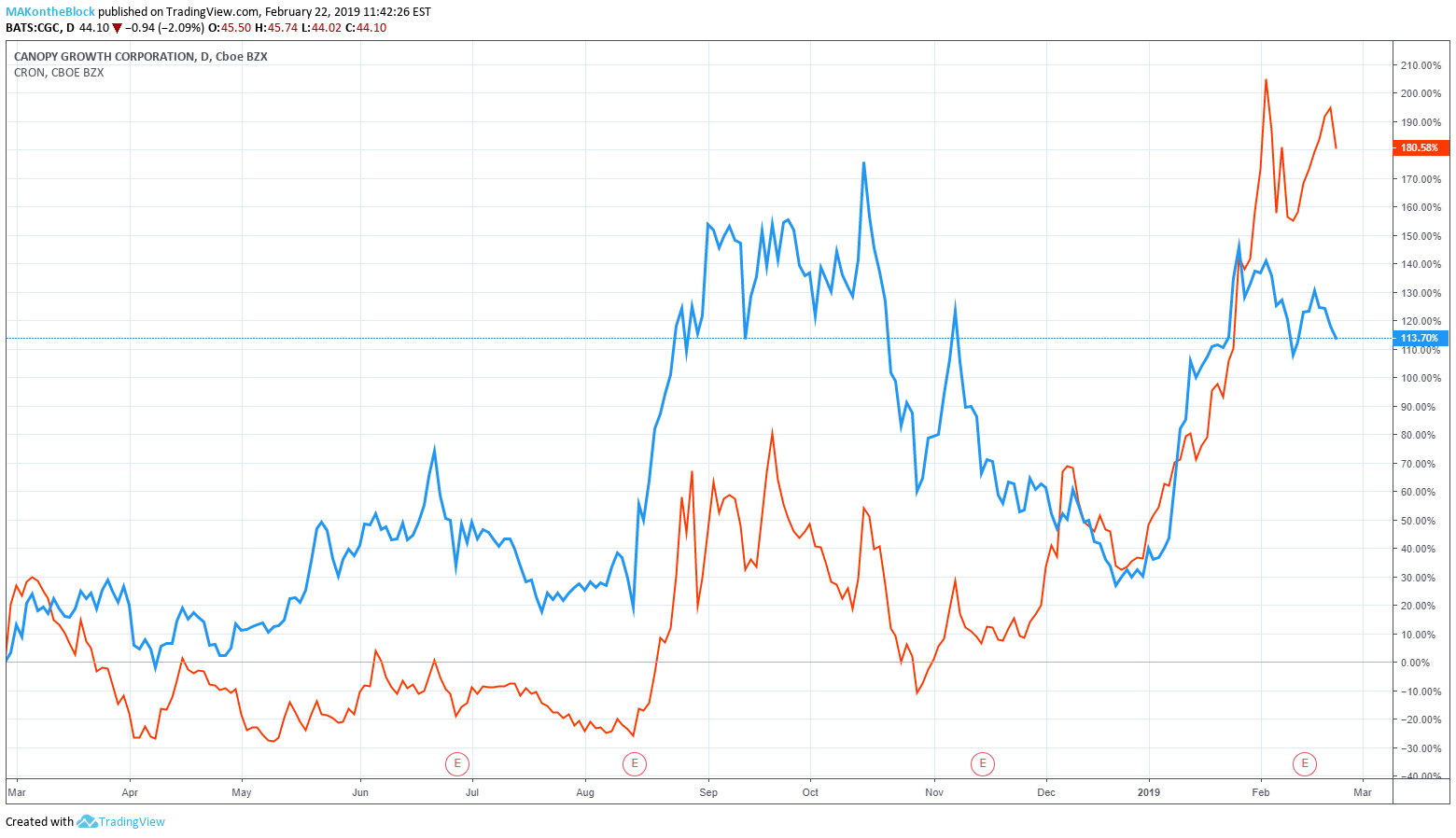

In 2018, Canopy Growth and Cronos Group went public. Shares in those two firms have soared since their public listings.

Pepper points to the crop’s effectiveness in treating conditions like epilepsy and arthritis as a driver of future demand.

“I really think this is the next huge growth area.”

She also predicts that beverage and tobacco companies will move into the market as cannabis becomes legal around the world.

Constellation Brands invested $4 billion into Canopy Growth in November 2018. At the end of January, Piper Jaffray analysts raised their price target by 50% for the company. The price-optimism followed Canopy Growth’s receipt of a license to produce hemp in the state of New York. At the time, Piper Jaffray said:

“A tangible first step forward in the US that points to the beginning of a long US growth trajectory.”

Tilray, also listed on the US stock market in 2018, signed a $100 million deal with Authentic Brands Group in January 2019 to develop CBD-infused products for its 4,500 outlets.

Bitcoin-Esque Growth Without a Slump

Pepper believes that the tangibility of pot stocks will see the market realize its growth without the risk of a Bitcoin-like slump.

Despite many industry analysts predicting a return to previous highs, the price of Bitcoin dropped from a $19,891 high in December 2017 to lows near $3,000 in recent months. Bitcoin is struggling to step back over the $4,000 mark, though proponents are still bullish.

According to Pepper, the legal cannabis market is based on a physical product, which makes it superior to intangible investments like Bitcoin.

That product that could quickly reach mainstream use, both in medicine and over-the-counter supplements. Its growing popularity and declining stigma could see CBD-based drinks purchased alongside popular soft drinks in the recreational consumer market.

Pepper says:

“If you want to be in something that’s very ‘growthy’ and actually legitimate as it is legalized and controlled properly, I think this is the place to go.”

Prolific investor Danny Moses of Moses Ventures agrees. He described pot stocks as the “next big long” for the stock market.

Piper Jaffray’s analysts put the global market for cannabis at a value of $250 to $500 billion. Research firm Seaport, meanwhile, expects the market to reach $640 billion by 2040.

Featured Image from Shutterstock