(Op-ed) Bitcoin: 10 Years Of Survival Mode

Hello guys, how’s it going?

First, let me congratulate all Bitcoin holders. Your currency of choice to store value has been “alive” (as a whitepaper), for the past 10 years.

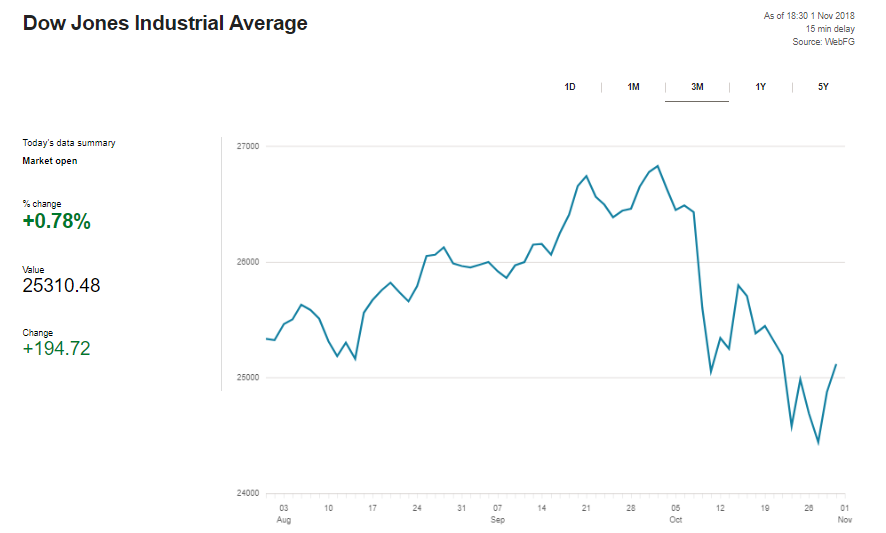

And what a crazy ride it has been. It went from 0 to about USD 6200, which represents a 6200% valuation, with the usual ongoing ups and downs. However, for the past month, Bitcoin and other cryptocurrencies have been quite more stable than traditional markets, which came as a surprise to many naysayers and no-coiners.

Despite that, crypto still remains the most speculative asset to existence; something that I personally love, as it’s the easiest way to make some money on the long-term, however, much patience is needed to overcome the hardships of so much volatility.

In celebration of the past 10 years, I would like to do an overview of the market, in terms of transaction data, as well as, to remember the many events Bitcoin survived during this 10 year period.

Disclaimer: this article shouldn’t be taken as financial advisement; it represents my personal opinion and should not be attributed to CCN.com. I have savings invested in cryptocurrency so take whatever I write with a grain of salt. Do not invest what you cannot afford to lose and always read as much as possible about a project before investing.

Bitcoin Technicalities

One of the most important aspect (if not the most) of Bitcoin’s acceptance is the security and speed of its blockchain.

My goal is to look into a couple of technical data charts, such as transactions rate, mempool transaction count, difficulty adjustment, number of wallet users, hashrate distribution and the classic price analysis, as means of understanding the network’s evolution. Figures have been taken from TA expert Mati Greenspan’s daily analysis on hacked and from blockchain.info

At the time of writing, the Bitcoin network has been steadily increasing the number of transactions. On the last day of October, almost 3 transactions per second were being processed.

Interestingly enough, most blocksize is already being used as on average 90% of blocks are full; this is, there’s about 1mb in transactions size already. Some solutions like segwit or P2P Payment channels like the Lightning Network and Liquid, as well as, alternative side-chains, have all been proposed as means to scale the network’s 1mb blocksize limit, without necessarily needing to increase the actual blocksize.

Other projects, like Litecoin or BitcoinCash, have successfully forked the network into alternative currencies for faster and cheaper payments, by altering parameters like blocksize or consensus mechanics.

Which one will win?

Hopefully, the next 10 years will help us figure that out.

Looking now into the mempool, we can clearly see the number of transactions waiting to be confirmed have been steadily declining throughout 2018. Of course there is an obvious correlation between the number of unconfirmed transactions and the price of Bitcoin, as when we see sudden spikes in demand like the ones in late 2016 and 2017, price exponentially rises, transactions get expensive to process and there is a sudden lag in the number of approved transactions, as miners cannot cope with the amount of network requests.

Of course, this also correlates to the below graph, which shows the number of Bitcoin wallet users (according to blockchain.info) has been continuously growing. By using a logarithmic scale, we can quickly see the next threshold target to be around 100,000,000 user wallets.

What a great bullish signal.

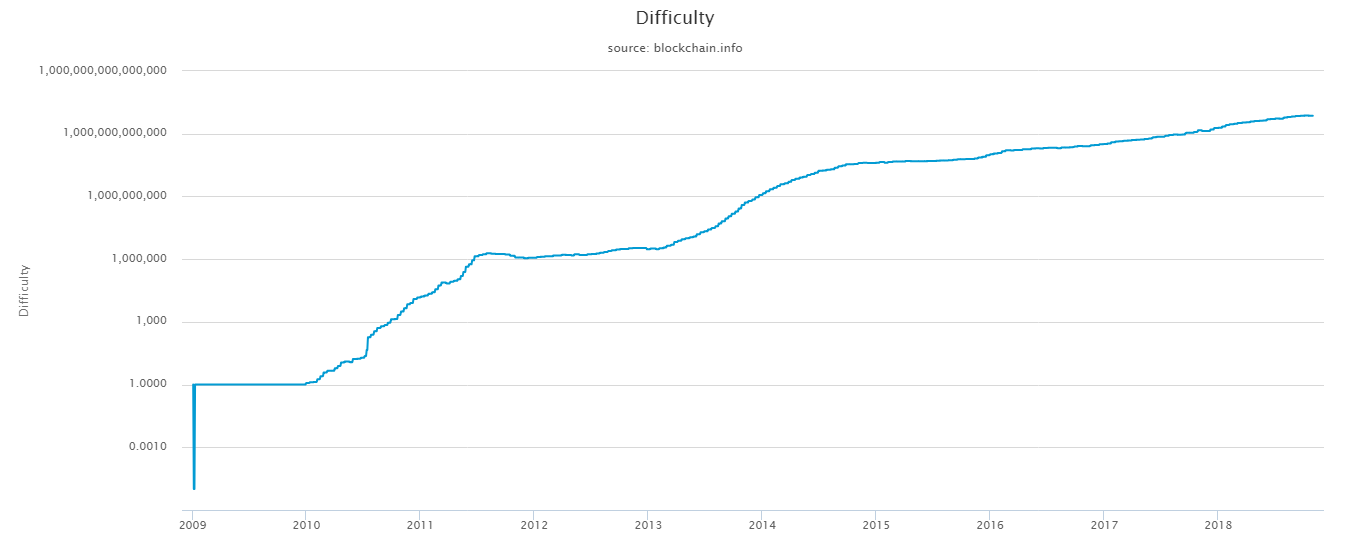

To complement the previous analysis we should look into the average blocksize and the difficulty adjustment algorithm, which dictates how hard it is for miners to find the block hash, in order to validate blocks and get the associated Bitcoin reward.

Currently, as mentioned above, blocksize has been steadily growing, although (on average) it still below the 1mb limit. Of course only about 35% of the entire network has upgraded bitcoin core software to enable segregated witnessing, meaning, there’s still room for improvements in how data is managed inside each block as miners can still, potentially, reduce the necessary blocksize for each transaction.

Now if we look into the difficulty graph, we can guess there’s space for additional miners, as the algorithm has been adjusting positively, this is, it has been getting more and more difficult to mine one Bitcoin.

We shouldn’t forget the more miners come into Bitcoin, the more secure the network gets.

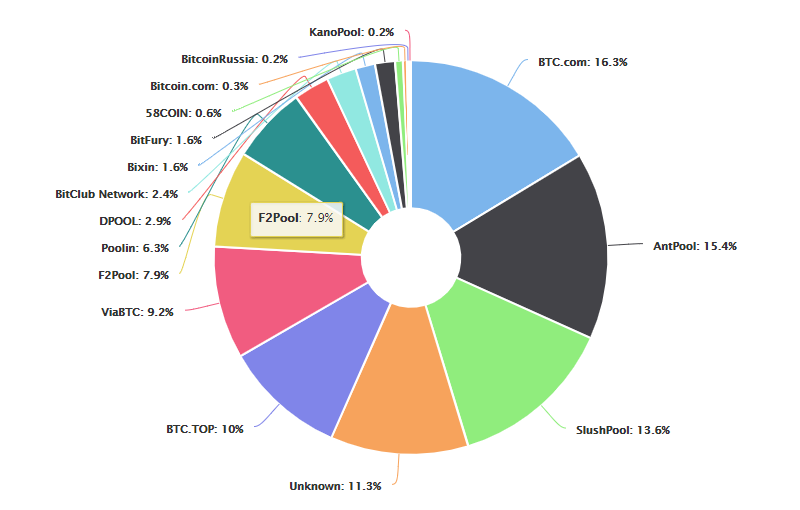

On the other hand, the actual concern from some folk is that mining operations might get too much centralized within a few big players like BTC.com, or Antpool.

Personally, I wouldn’t worry too much though. Technology keeps changing bringing more efficient players into the market and dethroning old kings. In 2016 F2Pool was leading the Bitcoin hashrate distribution. Look at where it is now.

More interestingly is what comes next.

Bitcoin technical development has been the ultimate enabler for scalability; without so many awesome developers dedicating time to improve this cyberpunk digital currency, we wouldn’t be where we are today.

More importantly, it has been these same developments which have granted bitcoin its incredible security and reliability.

For Bitcoin is definitely the most relentless asset out there. It managed to survive each single hack, network attack, double-spent attempts, scams and frauds.

Shall we take a look at some of the most devastating events and how the community chose to act?

10 Years of Bitcoin: Survival Mode Engaged

If you ask me what I like the most about Bitcoin, I would tell you what drives me nuts is that no one has ever managed to take it down. Especially, considering there have been powerful forces like China and India pushing for Bitcoin bans, although their efforts have been (and will always be) useless.

Bitcoin has proven to be way more resilient than what Mr. Satoshi could ever expect. We should definitely be thankful.

However, private accounts and exchanges haven’t been as lucky.

Let’s now take a look at a couple of delightful highlights from recent years, which could have potentially killed Bitcoin, if not for its decentralized and resilient nature.

June 2011 — First time MtGox got hacked: 2,643 btc

The first actual hack of an exchange occurs on June 19th, 2011. Mt. Gox exchange is hacked for approximately 2,643 Bitcoins during a transfer of ownership involving an account with administrator rights. Until today, the hacker remains unknown and the stolen Bitcoin were never returned. Mt. Gox took full responsibility for the hack and reimbursed all users affected.

July 2011 —Wallet service MyBitcoin disappears: 154,406 btc

And then, three days after Bitomat, a much-expected disaster finally strikes. The anonymous Mr Tom Williams appears to be making a run for it with the service MyBitcoin, which holds approximately 154,406 Bitcoin at that moment in time, worth over a million dollar. The whole service disappears from the internet on July 29th, 2011.

March 2012 — Cloud Hosting company Linode (Bitcoinica) hacked: 46,703 btc

On March 1st, 2012, a bug in the customer support portal of the web hosting service Linode was abused by hackers to gain access to Linode’s servers. The servers were then used to compromise all 46,703 Bitcoin-related websites using Linode as a service, which resulted in 8 compromised accounts. Among them was the Bitcoin exchange Bitcoinica.

February 2014 – Mt.Gox hacked (again!): 744,408 btc

The second hack occurred as of February 2014, which caused the company to go bankrupt. With 744,408 BTC missing for an unknown reason, Mt. Gox halted all withdrawals and closed its service. This was reportedly a latent hack that had lasted for years without being detected by the company’s security team. I still wonder how it went undetected.

January 2015 – Bitstamp hacked: 19,000 btc

Cybercrooks had been bombarding Bitstamp employees with phishing emails (a very popular technic) in a bid to execute malicious code on their computers. Unfortunately, this social engineering strategy resulted in compromising one of the machines on the exchange service network. By finally duping a staff member into opening a virus-tainted .doc attachment with an obfuscated VBA script in it, the perpetrators accessed two servers that contained hot wallet data.

The losses amounted to 19,000 BTC or roughly $5.2 million at the time of the breach.

August 2016 – Bitfinex hacked: 119,756 btc

The company lost 119,756 Bitcoins, which is at the time was the equivalent of more than $72 million. The attacker reportedly took advantage of a vulnerability in Bitfinex’ multi-signature system for signing Bitcoin withdrawal transactions. To Bitfinex credit, the company has offered equity to the affected customers as a reimbursement for their losses.

Conclusion

Since its inception, Bitcoin has survived many assassination attempts. Nevertheless, when we look at its price log scale, we only see a clear uptrend.

It seems to me Bitcoin won’t go anywhere but to the moon, as long as we keep the network secure and decentralized.

The last 10 years have been kind on Bitcoin, however, can you imagine how it will look when 10% of the world knows cryptocurrency and how to use Bitcoin?

Bitcoin is the Future!

As some wise people once said “It’s not a matter of if, but when”.

To conclude this celebratory article, I would like to leave you with my not-expert prediction:

- We’re on the verge of a new global financial crisis, which will destroy a great quantity of fiat-money through hyperinflation (2019-2020).

- People will look-up for alternative forms of storing value like gold and cryptocurrencies.

Both happenings will make Bitcoin’s price skyrocket as more and more people see it as the easiest form of sound-money to own.

I’m definitely looking forward to the next 10 years of Bitcoin.

Featured image from Shutterstock.