Op-Ed: A Beginner’s Guide to the Economics behind Security Token Offerings

Source: Shutterstock

The problem is not with the vehicle, the problem lies in the gold-rush mentality. When everybody starts mining for gold, the percentage of people who strike gold falls naturally. This is Economics 101.

Economics 101

Scarce resources do better in terms of valuations than abundant resources.

Take water, for example, it is an abundant resource in South Asia and is sold for $0.5 per litre in India. On the other hand, it is a scarce resource in West Asia and sells for $1.5 per litre over there. So. when everybody begins to conduct STOs (Security Token Offerings ) for “disrupting xyz industry through decentralization”, the success rate is bound to fall.

However, it is not bad for the decentralization movement. It is one of the golden principles of investing:

When the weak hands dilute their positions, the market value consolidates and rises.

So, while several ICOs will be “advised” by their expert crypto-advisors to make the transition to STOs (and cough up the associated fees. Fun fact: STO agencies charge up to 10 times the fees that they normally charge ICOs), some astute businessmen in some concrete jungle somewhere are planning their next move.

Businesses are not built and expanded on the strength of their revolutionary ideas alone, they achieve greatness by marketing it right.

Once you understand that nobody gives a shit about your revolutionary product. What people look for when they are putting in their money, is how much profit can they make from that investment and will that be their best investment decision?

ICOs going downhill since Q1 2018

During 2016–17, the investors did not have the time or did not find it relevant to read the whitepapers and do their due diligence. The most asked question on ICO Telegram groups was “When Moon” followed closely by “When Lambo”. It was a fun time while it lasted and reality caught up like it eventually does.

For the Month of June, the ICO which raised the most funds was TaTaTu — $576 million. The reason: The Founders are connected with the royal families of Europe. The second on that list was PornX — $36 million. Apart from these two, the remaining 3 on the list for June and top 5 ICOs for the month of July raised not more than $15 million apiece. Thus, we are in the midst of an outbreak of investor-not-throwing-money. This brought ICO Consultants to one of the following two conclusions:

- Keep saying that ICOs will make a comeback and commit promises that they would not be able to keep.

- Make the transition to STOs and commit promises that they would not be able to keep.

What are Security Token Offerings — in plain English

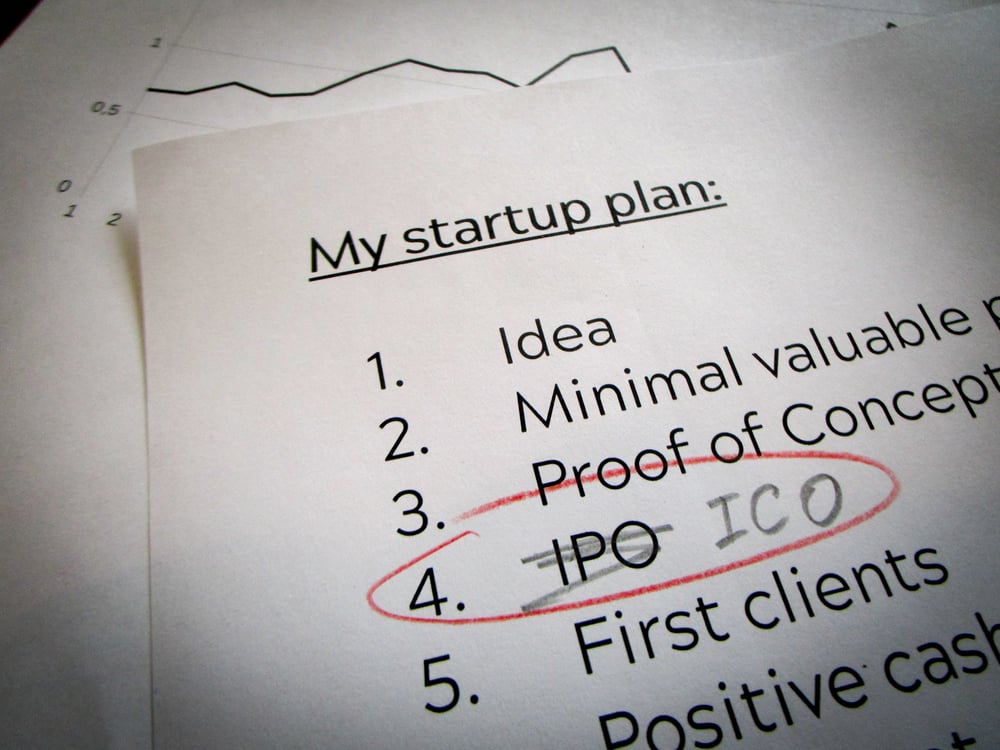

ICO + Legal Compliance = STO

I say this because most ICOs, despite their loud and vocal pronouncements have tokens that are deemed securities in most jurisdictions instead of being deemed a utility. ICOs went hoarse saying that their token is a utility because saying anything else would bring them in the regulatory realm and require several reams of paperwork and we all know —

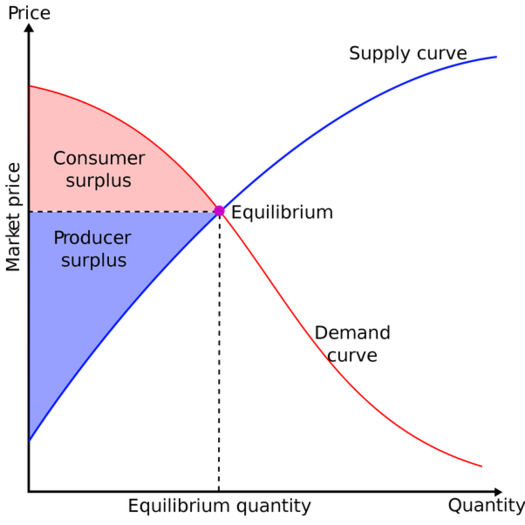

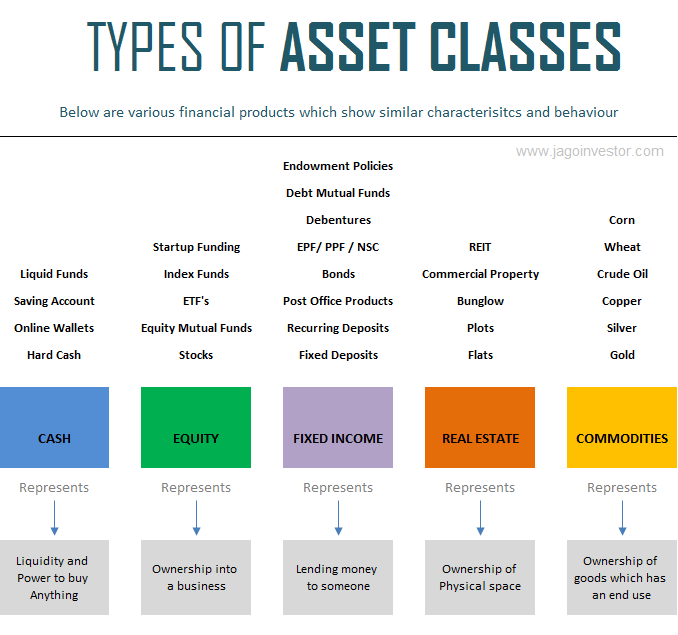

So, what exactly are the Asset Classes that are the bedrock of STOs? Asset Class is a group of physical or digital assets that possess value due to their properties or demand emanating from a larger group of people.

For example, gold is an asset because a large group of people think that it is valuable enough to go to war over and plunder entire civilizations. Similarly, currencies are an asset class, loans are an asset class. Basically, any commodity that people have a tendency to hoard is an asset class.

Building the technology behind STOs is not the hard part. The kicker is in the legal compliance. Think of a security token as a “Global Asset”. In a traditional asset, the sale, purchase, and proceeds of that asset are governed by ownership and real-estate laws governing the asset to prevent misuse. For example, when you buy a condo in a high-rise building, you become the owner of that condo, own the rights to voice your concerns regarding the maintenance activities performed in that high-rise building but you do not own the land on which the building was constructed.

In a way, the land was tokenised by the builder and sold to the buyers. To maximise profits, the builders built several floors and sold all of them separately to different buyers. To make more profits, the builders created contracts to sell the rights to collect rent to another set of buyers. Security token offerings are a similar vehicle while tokenising assets.

The various asset classes and how they are tokenised are:

Cash Assets — These assets are denominated in cash currencies. The money in your wallet is your cash asset. This asset class cannot be tokenised without making investments outside the wallet.

Equity Assets — These assets are the ownership rights over physical or digital entities. For example, if you have ownership rights of 10% in Google, you have the right to 10% of the net profits arising at Google. The ownership of the Equity asset is tokenised which can divide the proceeds of the profits from the ownership between the owners proportionally.

Fixed Income Assets — This asset class is best explained by way of fixed deposits and loans. This asset class gives you a fixed income (interest income in our case) after fixed durations. The proceeds of the investment of this asset class are used to provide a fixed income for the contributors while the rest accrue to the investment manager as profits.

Real Estate Assets — There are two ways that a real estate asset such as houses and housing societies can be tokenised. One, as equity assets by which, the real estate is tokenised into smaller chunks. Second, as a fixed income asset where the rent income from the assets is tokenised.

Commodities Assets — The pooled fund is used to buy a rare material/service and the ownership of that material/service is tokenised. If the material/service is rented to others, it can be tokenised as a Fixed Income asset as well.

The primary concern regarding the ownership of assets comes from the legal acceptability regarding transfer of ownership between counterparties. For example, Indian currency notes over a threshold amount cannot be transferred outside India, by law. Similarly, some asset classes cannot be sold to parties residing in a particular jurisdiction simply because the asset is located in another jurisdiction. For example, you cannot buy property in Jammu and Kashmir if you’re a resident of any other jurisdiction other than Jammu and Kashmir. Movable property roughly corresponds to personal property, while immovable property corresponds to real estate or real property, and the associated rights, and obligations thereon.

Now take those limitations and draw them on a global scale to understand the problem. Imagine if country A has a regulation that says its citizens can trade with country B but not with country C. If that sounds far-fetched, check out the Patriot Act of the USA that does just that.

Compounding the problem is the fact that these restrictions are not crystallized and can be changed with subsequent legislation.

Smart Contracts, on the other hand, are immutable. Once written, they cannot be changed, unless you use a different blockchain than Ethereum. Stellar, for example, allows its smart contracts to be modified. This means that when STOs take off, the utility of the Ethereum Blockchain will fall dramatically. This also means that the ERC20 tokens will go out as well. This represents a dramatic shift in the technology and will require fresh developer talent in an industry that was already up against the wall due to the unavailability of developers of Ethereum-Solidity smart contracts.

Another problem with asset classes is that they tend to become unwieldy and too expensive for most individuals to possess. Some might say that an asset by design must be scarce. If everybody can buy it, people tend to move to the next, more costlier asset class.

In a way, assets might fall in the ballpark of Giffen Goods which are defined as those goods whose demand increases as price increases.

So businesses saw an opportunity to tap the masses that could not buy those large unwieldy assets. Thus, tokenized assets were born. Mutual Funds are nothing but tokenized stocks. The only difference is that they did not create crypto-tokens to assign ownership. A higher barrier-to-entry and a robust KYC was all that was needed for Mutual Funds to become the asset class of choice for middle classes across the globe.

Security Token Offerings — ICOs 2.0

When ICOs arrived , they were regarded as the disruptors of FIAT-driven economies. Traditionally, those who held more FIAT held more power and vice versa. With ICOs, tokens could be built on utility instead of value.

However, ICOs became a vehicle for laundering money and were replete with scams, some intended and some unintended.

This led to the clamour for more regulation, mostly by the regulatory bodies themselves, in a bid to check terror financing and money laundering. While ICOs implemented KYC, it was a half-baked implementation. There was a semblance of regulation for tokens to be disbursed from the token-issuer to the buyers but there was no regulation when these buyers sold these tokens on secondary exchanges to other unverified buyers. This is why we saw several pump-and-dump exercises that inflated the value of an erstwhile shitcoin for a brief period to lure in the technical traders. Once the technical traders entered, the pumped coin was unceremoniously dumped.

Now that the STOs are here and people are excited once again by the potential they represent. Asset classes represent trillions of dollars worth of daily trade and if tapped, could give a huge boost to the cryptocurrency markets. However, STOs have similar shortcomings that have existed since the first ICOs were floated, and nobody is talking about these shortcomings. These shortcomings are:

- Crypto-tokens are a lot like FIAT currencies in function — As the popular adage goes, if it ain’t broke, don’t fix it. Since the demand for tokens is based more on their value and future valuation, it acts as a store of value more than a medium of exchange for the designated goods and services. As long as exchange-listing of tokens continues, people will continue to “bet” on future prices of the tokens. STO tokens promise to create a regulated mechanism for such exchange-listings and trade. The only problem is that they are prone to the same problems that affect traditional equities’ markets. More than half the trades will be performed via algorithmic trading and edge out the retail investor. This breeds centralization which is opposite of what Satoshi and his ilk had envisioned.

- Offerings are still being designed by technologists and shamans instead of Subject Matter Experts — Would you trust the hippie down your street with your entire life savings? No? You are not alone. Crypto-investors who bought into the hype of 2016 bought a ton of altcoins ideated, created, and sold by technologists. These projects are still years away from coming out with functional MVPs. When project development starts and the problems outside your domain begin to crop up, the tendency to give up is staggering.

- Tokenomics and Token Utility are still calculated on Excel Sheets instead of real-world modelling — Tokenomics and tokenization models are at the heart of tokenized product offerings. Most ICOs still follow the methodology of pulling a hard-cap out of thin air and then back-calculating the token allocation, token value, and the number of tokens to be created. It should be the other way round. Upcoming STOs with their Class A shares and whatnot are also making the same mistakes.

So, are Security Token Offerings dead on arrival?

Not necessarily. Asset classes are the largest block of traded goods based on daily volume. What sets them apart from security token offerings is that they spent years making mistakes, getting sued, and bringing economic depressions before they reached the shape that they are in today. The current crop of STOs are trying to piggyback on the success of traditional asset classes by bringing them on the Blockchain.

That is a peculiar solution when assets are already highly regulated. Blockchain itself was intended to be the universal regulatory mechanism, maintained by the community, incentivised by the community.

The implementation of regulatory protocols on top of the regulatory protocols of Blockchain is, in plain English, overkill. Traditional asset classes are so tightly regulated that Blockchain will add no further value to the ecosystem.

The actual need for decentralized solutions is in the realm of resource management, the even less excitement-inducing cousin of supply chain management. The blockchain is a natural fit for those enterprises and industries where multiple ledgers need to be maintained and each ledger must update the data on its book in real-time.

In such cases, Blockchain is a natural fit as it maintains the data in the same state, immutably and permanently.

The current crop of ICOs and their successors, the STOs is glorified platforms that create an unnecessary token to create an access-based ecosystem that would probably be better-served by non-blockchain solutions. However, kudos to human optimism because these ICOs and STOs found buyers and backers for a better part of the last two years.

These offerings failed not because of their make-profits-by-charging-platform-fees model but due to improperly developed and under-nurtured token economies.

Basically, once I buy a token, my choices for using it were limited:

- Buy item X sold non-exclusively from the platform at a price that is considerably higher than the price in FIAT if we consider the gas prices involved.

- Register as a seller on the platform, pay the highest-ever transaction fees because I believe in the future of crypto, and receive more tokens from sales that have virtually no utility for me.

- Sell the tokens on a crypto-exchange because the platform won’t be developed in the near future.

Unless offerings, whether ICOs or STOs, solve the problem of haphazardly designed token economies, their tokenized ecosystems are bound to fail, irrespective of the hype that they drum up on Telegram and such social media channels.

Once this battle is won, and it will be won eventually, decentralization can march forward unhindered.

About the Author: Utsav Jaiswal is a Senior Blockchain Expert at Turing Labs.

Disclaimer: The views expressed in the article are solely that of the author and do not represent those of, nor should they be attributed to CCN.com.

Featured Image from Shutterstock