New PayPal Policy Makes Bitcoin [an Even] Cheaper, Private Alternative

Earlier this week, PayPal announced new fees and restrictions today that could have a huge impact on the cryptocurrency space. While cryptocurrencies offer low-fee and even feeless forms of value transfer, PayPal dwarfs the competition with global adoption and brand awareness, used to transfer business and personal funds as well as handling all eBay transactions.

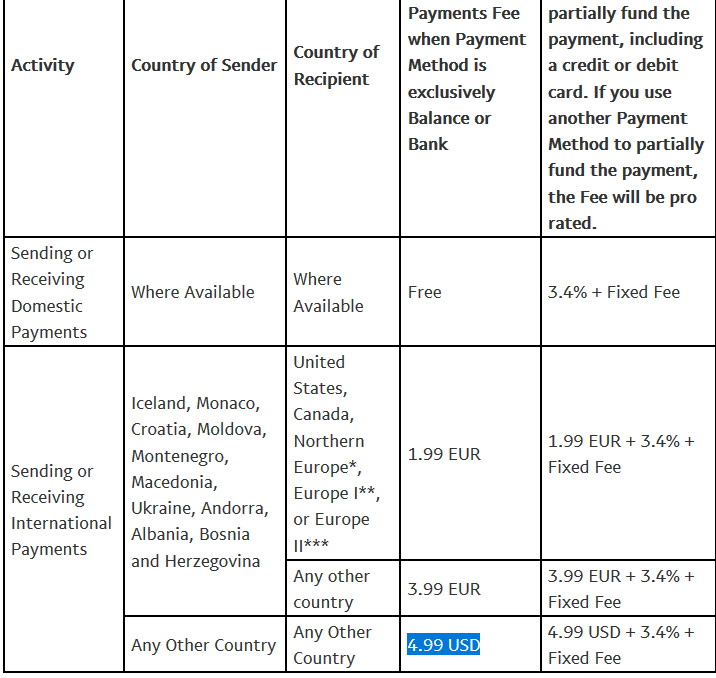

However, all of that may be about to change. PayPal’s new policies came into effect today, including a $4.99 fee for US users sending international payments, plus an additional 2.9% charge if the transaction is partially filled with a debit or credit card, and a flat rate based on the currency used. With similar measures implemented for users in other countries as well, the fees are staggering, and make international microtransactions completely unviable.

While Bitcoin once had even higher fees than PayPal does now, things have died down and a Bitcoin transaction can be made in under an hour for around $0.21 – while PayPal is currently faster, Bitcoin is now many times cheaper, and has the advantage over altcoins of massive international awareness. The high profile and growing media coverage of the cryptocurrency coupled with the newly introduced fees of the world’s leading peer to peer payment services poises Bitcoin for more mainstream adoption as a value transfer system.

PayPal didn’t stop there, seemingly dealing itself another blow in the fight to stay competitive during the rise of cryptocurrencies. Today’s announcement also introduced new policies surrounding user privacy:

“We’re changing the balance functionality for your PayPal account depending on whether we have been able to verify identifying information that you provide to us. If we have not verified your identifying information, a balance in your PayPal account can generally only be held in your PayPal account and transferred to a linked bank account or debit card.”

As linked bank cards generally require identification in the first place, this change will effectively squeeze out any unverified users, making personal identification a requirement for using PayPal. For many, financial privacy and personal data protection are a what makes Bitcoin and other cryptocurrencies so appealing, particularly in light of the recent Facebook data breaches.

The inclusion of mandatory identification and high fees make cryptocurrency a far more appealing method of interpersonal payment than PayPal in many cases, and with all eyes on Bitcoin, the timing couldn’t be any better for the godfather of cryptocurrencies as it enters a position of competing with the biggest online payment system in the world.

Featured image from Shutterstock.