Major Hong Kong Daily Pins Bitcoin as China’s “New Darling”

In an article published today, a writer for the South China Morning Post — Hong Kong’s newspaper of record and the leading English-language newspaper in the country — explores why bitcoin is finding favor among investors in China.

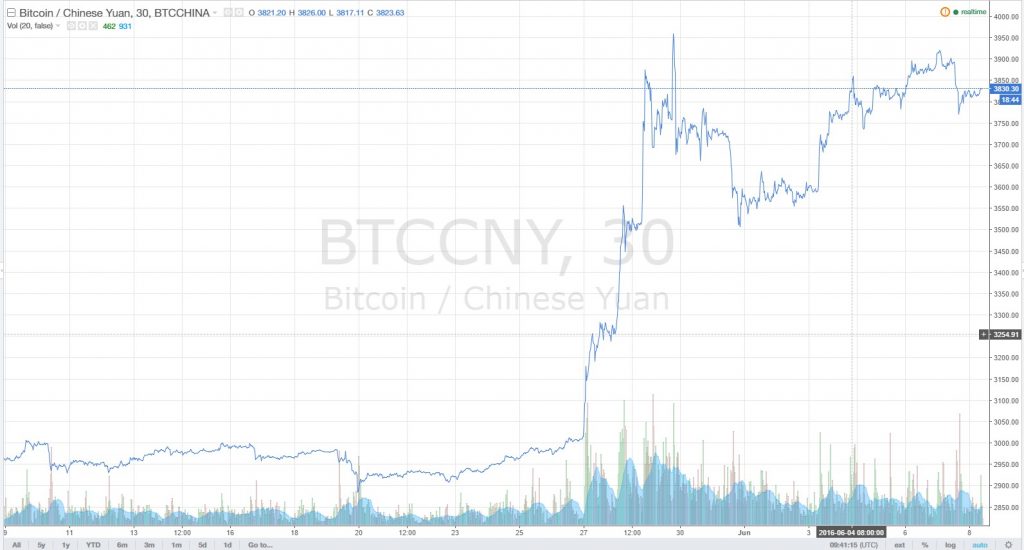

There is a heightened buying of bitcoin in China as the cryptocurrency becomes the “new darling” of investors in mainland China, writes Daniel Ren of the South China Morning Post (SCMP).

He cites a weakening stock market and the Chinese yuan’s furthering devaluation and the expectations surrounding the drop as the driving factors behind investors’ adoption of the cryptocurrency. Furthermore, it is even speculated that bitcoin may offer respite for officials who seek a way around China’s recently-mandated anti-corruption drive.

The trading volume of bitcoin from China in recent times easily comprises the majority of bitcoin trading worldwide, led by transactions via Chinese virtual currency exchanges.

Ren writes:

Indications are that a frenzied buying from mainland speculators would be enough to support upward momentum, despite worries about the safety of the investment and a lack of knowledge about the technologies behind the technology.

The increased buying of bitcoin comes from millions of small investors who, for the lack of a better word, “gamble” on products and assets on casino-style platforms, the publication revealed. Assets and products that are routinely bet on include stocks, gold, derivatives, and even postage stamps. Bitcoin joins that list.

Quoting an employee from Shanghai-based financial services firm Zillion Fortune, the article adds:

The absolute number of bitcoin traders in China might not seem to be that astonishing based on the size of the mainland economy, but that price growth is attracting fresh buying interest.

The investors or punters are likely to turn in more funds prior to the upcoming US Fed Reserve meeting that will determine the fed interest rate.

Volatility is seen as an opportunity and speculation is rife and backed up with investment from small investors, who fear that the yuan might slide even further due to central bank-imposed controls.

BTCC CEO Bobby Lee shared his views on the spike in buying bitcoin among investors from China, adding that bitcoin’s characteristics are particularly appealing for those looking to bet on the cryptocurrency.

He stated:

The investment spree is well-founded because of the rarity in bitcoins. The increased need for hedging against the yuan’s depreciation and the central banks’ continued printing of money have convinced investors of bitcoin’s investment value.

Featured image from Shutterstock.