Key Bitcoin Indicators Rage Bullish as Crypto Gains $40 Billion in 1 Month

Bitcoin and the wider crypto market gains are accelerating. | Source: Shutterstock

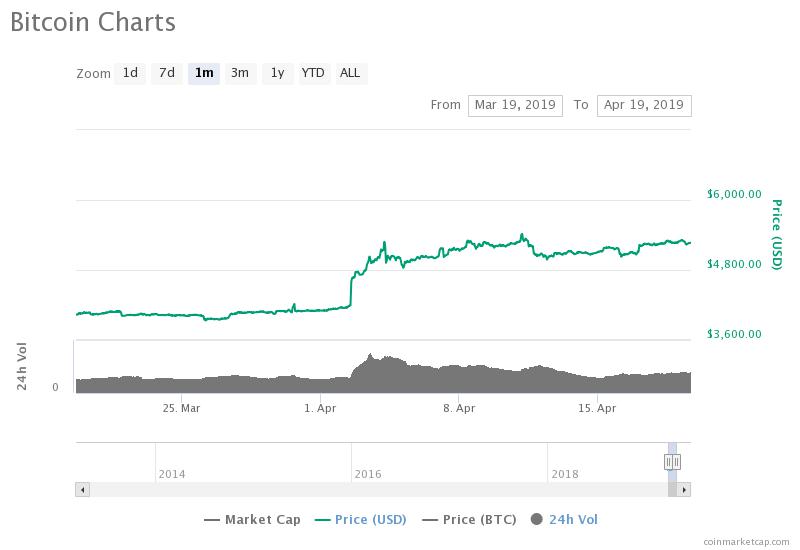

By CCN.com: Over the past 24 hours, the bitcoin price briefly surpassed the $5,300 mark in a short-term spike but retraced back to the $5,200 region.

In the past 30 days, as the bitcoin price gained 31.3 percent against the U.S. dollar, the valuation of the crypto market increased by $40 billion.

Strong performances of alternative cryptocurrencies such as Enjin Coin and Binance Coin, which recorded 404 percent and 266 percent year-to-date gains respectively, pushed the momentum of the crypto market further.

Technical Indicators Showing Bullish Trend For Bitcoin

For the first time since May 2015, a technical indicator called the 2-week moving average convergence divergence (MACD) indicated a positive trend for bitcoin according to a technical analyst.

“The 2W MACD has crossed in a buy signal on BTC. We opened at approx $4,000. The last time it happened? May 2015. Bitcoin opened around $240. We can still drop in accumulation, but the bottom is in ‘folks,” the analyst said.

As bitcoin cleanly broke out of $4,200, which was a crucial resistance level for the dominant cryptocurrency and recovered to $5,000, it reversed many technical indicators that identify long-term trends.

Year-to-date, since January, the bitcoin price has surged by 41.7 percent against the U.S. dollar, demonstrating strong momentum in a relatively short time frame.

The Rhythm Trader, a bitcoin trader, said that bitcoin has gone 123 days without retesting its low, which can be considered as a step towards a proper rally in the months to come.

Emphasizing that bitcoin is up 65 percent since December in about four months, the trader said:

“Bitcoin has now gone 123 days without a new low. It’s up 65% from December. Don’t get caught picking up a penny in front of the steamroller that is a bitcoin bull market.”

In the near-term, traders generally expect bitcoin to remain stable in the $5,000 to $5,200 range as it rests from a strong rally earlier this month.

Wouldn’t Stability be Bad For Bitcoin?

According to cryptocurrency investor Josh Rager, if bitcoin shows stability in its current range in the near-term, it would create a solid foundation to support the next upside movement of the asset.

Previously, when bitcoin was unable to break out of an important resistance level at $4,200 for more than 3 months, analysts were concerned about the lack of movement in the cryptocurrency market.

However, bitcoin has already surpassed key levels and it has been less than three weeks since BTC recorded a 20 percent increase in price.

“The longer BTC ranges between $5,000 to $5,200, the stronger support it becomes after the next push up Though this equally becomes a stronger resistance if a breakdown occurs in my opinion, Bitcoin likely stays in the price range of this chart for weeks to come,” Rager said .

The stability of BTC could benefit alternative cryptocurrencies in the short-term, especially assets like Binance Coin that have performed strongly against both BTC and the USD in the past month.

BNB remains as the best performing cryptocurrency throughout the 16-month bear market, recording a mere 11 percent drop from its all-time high.

In contrast, Ethereum (ETH) has dropped 88 percent from its record high and Ripple (XRP) has dropped 90 percent from its all-time high.

BNB recorded another 5 percent increase in price on the day and its momentum likely stems from the launch of the Binance Chain mainnet on April 18.