Bitcoin Ban Blues? India Reportedly Weighs Draconian Law to Ban Cryptocurrency

Indian lawmakers do not understand bitcoin. So, they're working on banning it. | Source: Shutterstock

By CCN.com: The Indian government is working on a draft bill that would impose an outright ban on cryptocurrencies such as bitcoin, as reported by The Economic Times, in what would be the final blow to the future of crypto in the country.

The government is all set to ban cryptocurrencies

The publication reports that a draft of the “Banning of Cryptocurrencies and Regulation of Official Digital Currencies Bill 2019″ is currently bouncing between different government departments, all of whom are toeing the government’s line.

The “Banning of Cryptocurrencies and Regulation of Official Digital Currencies Bill 2019″ draft has been circulated to relevant government departments, a government official aware of details told ET.

India’s Department of Economic Affairs, the taxation board, and the Investor Education and Protection Fund Authority think that the “sale, purchase and issuance of all types of cryptocurrency” should be banned entirely, according to anonymous government sources.

The Indian government had created a panel chaired by the finance secretary last year for drafting cryptocurrency regulations. The latest reports indicate that the panel is hell-bent on killing cryptocurrencies in India. This looks like a real possibility right now as the bill could be drafted into law once the ongoing general elections in India are over.

Indian regulators consistently fail to understand cryptocurrencies

The Indian government has always tried to throttle the growth of cryptocurrency under the false belief that the likes of bitcoin are instruments meant for laundering money.

Also, the rapid rise in the price of bitcoin has led regulators in India to believe that cryptocurrencies are nothing more than get-rich-quick schemes for defrauding gullible investors. The Economic Times report says:

The ministry of corporate affairs has in its feedback to the department of economic affairs pointed out the sale purchase and issuance of cryptocurrencies such as Bitcoin, Etherium & Cashcoin etc. are being done by individuals and companies on false inducements of massive returns.

Not surprisingly, key government institutions in India that should have ideally fostered the growth of a decentralized currency have taken a negative stance.

The Reserve Bank of India (RBI), the country’s central bank, announced earlier this month that RBI-regulated banks and institutions should not allow their customers to purchase bitcoin or any other cryptocurrencies. Also, the RBI forbids Indian banks from providing services to businesses “dealing with or settling [virtual currencies].”

The RBI believes that dealing in bitcoin and other virtual currencies is risky, so it decided to take the draconian step of stopping banking services to the cryptocurrency system altogether.

Back in 2017, India’s income tax department scanned around a dozen cryptocurrency exchanges to search for people who were involved in crypto transactions. Over 100,000 customers were pulled up for cryptocurrency trading as banks were busy freezing the accounts of cryptocurrency exchanges.

India’s cryptocurrency ecosystem is on life support

India’s crackdown on bitcoin and other cryptocurrencies have crippled the growth of this industry. Cryptocurrency trading volumes are down big time in India, causing a slow and painful death to cryptocurrency exchanges in the country.

India’s best-funded crypto exchange, Unocoin, is the biggest example of what hostile government regulations have done to the crypto ecosystem in the country. Unocoin is currently in its sixth year of operation and had more than a hundred employees in February last year.

But regulatory setbacks forced Unocoin to lay off employees and it is now struggling for existence. With just 14 employees remaining and cash reserves that will last only a few more months, it might not be long before Unocoin shuts shop.

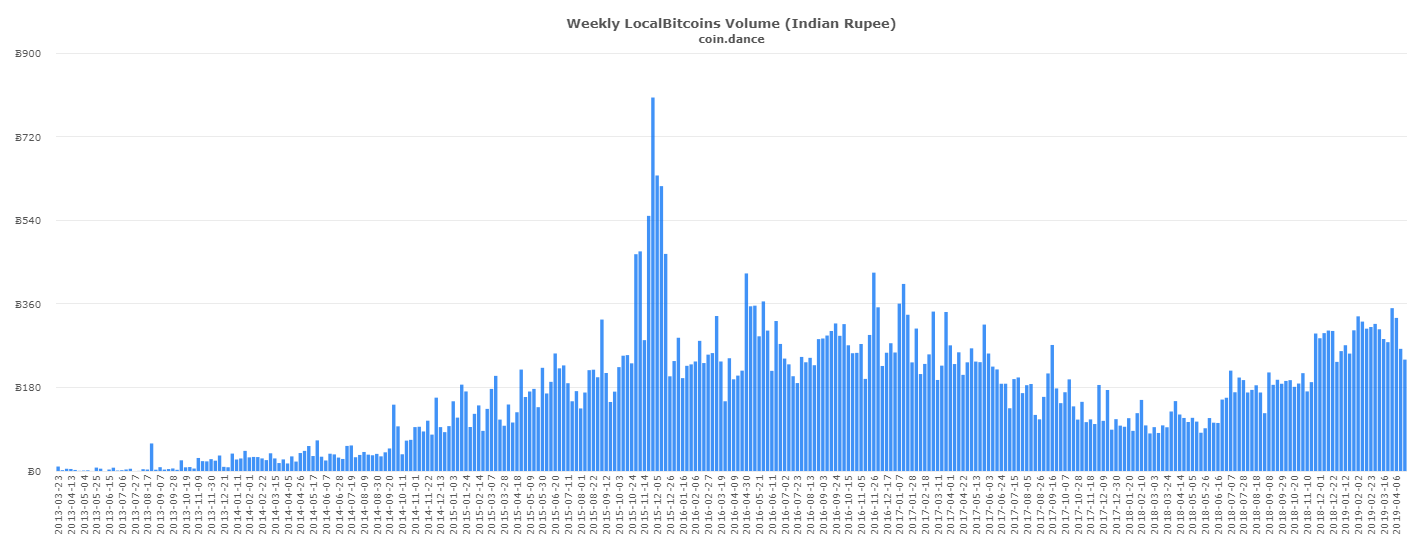

Cryptocurrency traders in India are flocking to peer-to-peer (P2P) trading platforms to circumvent the regulations as they are unable to withdraw or deposit fiat money at exchanges. This has caused a major spike in trading volumes on LocalBitcoins, a P2P trading platform, where 240 bitcoins were bought in the week that ended April 20.

However, the chart also shows that bitcoin volumes on LocalBitcoins have started dipping over the past few weeks. So it might not be long before bitcoin and other cryptocurrencies disappear into insignificance from the world’s fastest-growing economy altogether, causing it to miss out on the crypto revolution thanks to the government’s paranoia.