What Would Happen if Singapore Regulates Bitcoin?

At a conference, Ravi Menon, the managing director of the Monetary Authority of Singapore (MAS), the country’s central bank, stated that the country does not intend to regulate bitcoin and the cryptocurrency market in the short-term.

In essence, Menon shared the same sentiment as European Central Bank (ECB) President Mario Draghi, who as CCN.com reported, explained that the ECB is not planning regulatory frameworks for the cryptocurrency market as of yet. Draghi emphasized that the ECB believes the bitcoin market needs to mature for the institution to consider regulating it.

Menon stated:

“We’ve taken the approach that the currency itself does not pose the risk that warrants regulation. It is a known fact that cryptocurrencies are quite often abused for illicit financing purposes, so we do want to have AML/CFT controls in place. So those requirements apply to the activity around cryptocurrency, rather than the cryptocurrency itself.”

What Happens if Singapore Regulates Bitcoin in Long-Term?

Although Menon clarified that there will be no strict regulations for the Singaporean cryptocurrency market as of yet, he reaffirmed that the MAS will continue to be “open minded” with cryptocurrencies and bitcoin. More importantly, Menon noted that in the future, if the MAS and the Singaporean government sees the necessity of regulating the bitcoin market, it will provide regulatory frameworks for businesses and investors.

As Menon explained:

“Our approach is to look at the activity around the cryptocurrency and then make an assessment of what regulation would be suitable.”

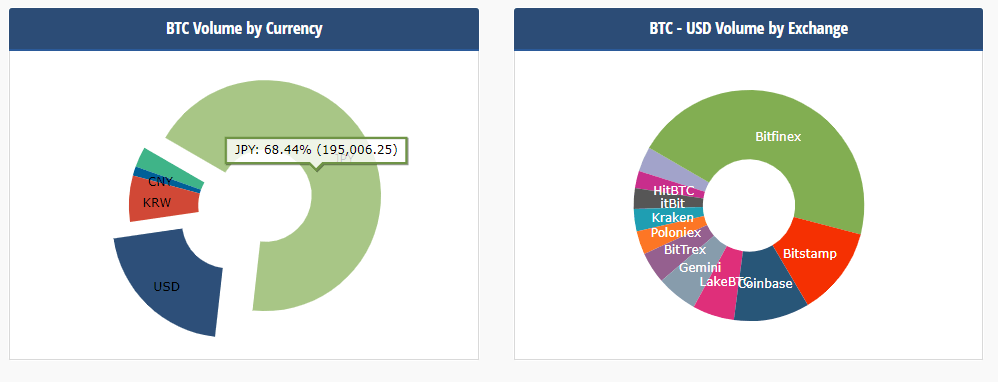

If Singapore regulates its cryptocurrency and bitcoin exchange markets, there exists a highly probability that along with Japan, Hong Kong, and South Korea, Singapore will evolve into a major bitcoin market. Consequently, Asia will likely emerge as the cryptocurrency powerhouse region, considering that Japan is accountable for at least 68 percent of bitcoin trades and that the South Korean Ethereum market remains as the largest Ether exchange market in the world.

In the long-term, if the MAS decides to regulate its bitcoin market, the Japanese government’s roadmap towards establishing a national program for cryptocurrency exchanges will most likely be implemented. Cryptocurrency exchanges will receive licenses to operate as regulated financial service providers and will be treated fairly as legitimate financial companies within the country.

When Will Singapore Regulate Bitcoin?

Upon the imposition of a nationwide ban on cryptocurrency trading by the Chinese government, as an executive of a Hong Kong-based over-the-counter (OTC) bitcoin trading platform TideBit revealed, a large number of traders migrated from the Chinese market to neighboring markets such as Hong Kong and Japan.

TideBit COO Terence Tsang stated:

“The ban did not stop them [Chinese investors] from buying cryptocurrencies. In the last few weeks, we have seen a lot of mainland customers opening up accounts at TideBit. They still want to play the game. I see a growing need in that they will come to Hong Kong or Singapore to buy cryptocurrency,” he said.

In the future, if the Singaporean government regulates its bitcoin market, there exists a high probability that traders from regions like China and Russia with ambiguous bitcoin regulations will migrate to the Singaporean market to trade and use bitcoin. Additionally, leading bitcoin companies such as India’s second largest bitcoin exchange ZebPay are already based in Singapore, due to the country’s friendly regulations for startups.

Featured image from Shutterstock.