Google Searches for ‘Recession’ Just Hit a Scary High

The recession panic appears to be spreading as Google searches for 'recession' hit decade-highs last week. Source: Shutterstock

Anyone with a passing interest in the financial markets knows that recession bells are ringing across Wall Street.

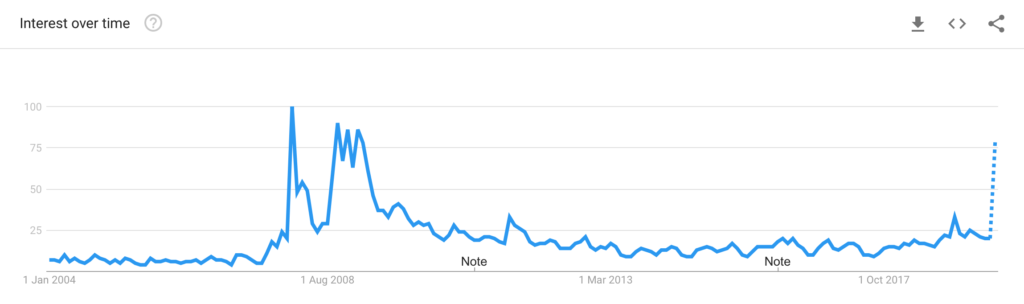

And, according to Google search trends, the panic is beginning to spread to the general public. Search volume for the word ‘recession’ shot up in mid-August as the stock market plunged. Using Google’s somewhat mysterious search data, interest went from three points to 100 in two weeks.

Zoom out and the data is even more striking. Recent search volume for ‘recession’ hit highs last seen in 2009, when America was gripped by an economic downturn.

Related search terms also soared. ‘Breakout’ terms on Google through August include:

- ‘what to invest in during a recession’

- ‘what does a recession mean for housing’

- ‘how to survive a recession’

Is a recession imminent?

As CCN.com reported, Wall Street analysts have been quietly talking about a looming recession for a number of months now. But the real trigger came on Wednesday, August 14th when the Treasury’s loudest recession indicator flashed red: the dreaded yield curve inversion.

The yield curve inversion occurs when 10-year Treasury bond yields dip lower than the two-year bonds. It’s an economic anomaly that means investors are wary of long-term investments. This indicator has accurately predicted every downturn for the last 50 years.

In reality, now is not the time to panic. The average lag from yield curve inversion to recession is 22 months, and stocks often push higher in the meantime.

The real search term warning signs

The high volume of recession-related search terms is an indicator of investor concern. But there are worse terms to look out for. According to DataTrek Research , the biggest indicators of a looming recession are words like ‘coupon’ and ‘unemployment.’

People search for these terms when money gets tight or when they think layoffs are coming. Another key indicator is ‘TV’ or ‘Netflix’ as people have more free time when unemployment hits.

DataTrek Research says these terms began to grow in 2005, a good three years before the 2008 recession took hold. All these terms are currently flat according to Google trends data.

In other words, the early concerns of recession are flashing, but there’s no sign of danger in the underlying economy yet.