Google Searches for ‘Bitcoin Price’ Sink to Three-Year Low

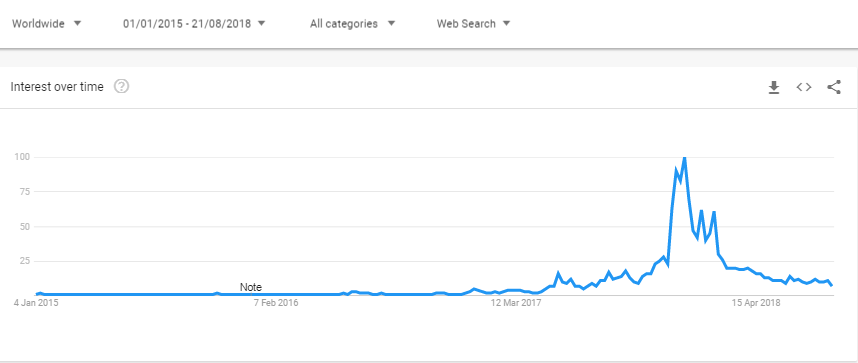

Fewer people are looking up the term “Bitcoin Price” on Google than at any point for more than a year. Data from Google Trends reveals that the search term is approaching historically low levels of popularity not seen since 2015.

Market Slump’s Effect on Google Searches

Google Trends describes itself as a public web facility that gives users insight into the frequency of specific search-terms relative to the total volume of searches carried out by internet users around the world. Using its service, it is possible to get an idea of the level of interest in bitcoin trading by using search frequency as a proxy.

The available data shows that from 2013 up until early 2017, search frequency for the term was mostly flat, with a few minor spikes from time to time. This all changed from May 2017 as bitcoin embarked on its record breaking bull run, at one point touching $20,000 at the end of the year.

The peak period for ‘bitcoin price’ searches was the period between December 2017 and January 2018 when bitcoin achieved its record price, attracting frenzied investor attention in the process. The period between December 24 and December 30, 2017 recorded the highest number of searches for the term.

Just two months later in February 2018, the frequency of the search term halved as bitcoin shrank to less than half of its peak price. The search frequency then continued on a steady downward trend, interrupted only briefly by a short-lived uptick between June 10 and June 16, tracking a short-lived bitcoin price rally.

Presently, the worldwide ‘bitcoin price’ search frequency stands at 7 out of 100 – its lowest point since July 2017 – and falling. Barring a sudden bitcoin price bull run, it would seem as though the search frequency is destined to hit 2015 levels which peaked at 2 out of 100.

Such a market rally does not look to be on the cards at the moment, as bitcoin remains stuck stubbornly around $6,500, with the wider crypto market also not showing any signs of sustained upward movement.

The Curious Case of ‘Hodl’ and ‘Rekt’

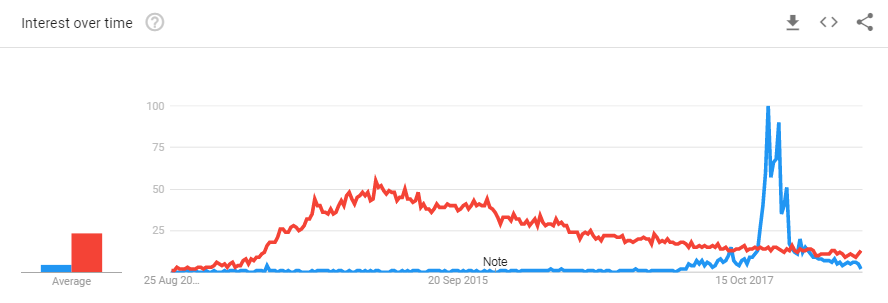

Interestingly, Google Trends data also shows that the search frequency of ‘Hodl’ – a typo turned internet meme-cum-investment terminology – is also dropping noticeably.

Used to denote resistance to selling in the face of losses while hoping for a bull run, ‘Hodl’ also achieved its peak search frequency in late December 2017.

Since February 2018 however, it has fallen drastically, eventually overtaken in July by ‘Rekt’, another unofficial crypto market terminology that signifies huge trading losses.

More information on bitcoin investment search queries by Google Trends can be found here.

Featured image from Shutterstock.