Flippening? Singapore Hosted More ICOs than the US in August: Report

With the increased regulatory scrutiny on ICOs in the United States, there appears to be a move by projects towards more friendly environments.

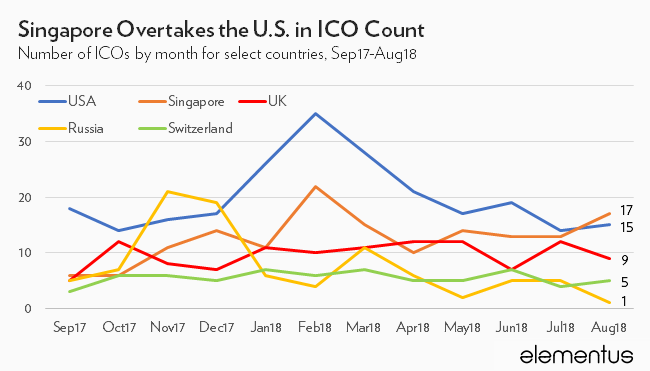

According to blockchain analytics firm Elementus, there was a decline in the number of ICOs hosted in the United States compared to Singapore in the month of August. In that month the city-state hosted 17 Initial Coin Offerings while the United States hosted 15. This was the first time ever that the tiny city-state hosted more ICOs than the world’s biggest economy.

ICO Paradise

While it remains to be seen whether this will be sustained, Singapore, which already boasts of a thriving financial sector, has emerged as one of the least restrictive countries with regards to ICOs. Other countries which also hosted a significant number of Initial Coin Offerings included the United Kingdom while had 9 ICOs while Switzerland boasted of 5 ICOs in the same month.

While conceding that consensus is lacking with regards to the amount that has been raised by ICOs over time, Elementus estimates this number to be US$28.4 billion by the close of August 2018. And even though the current bear market may lead to a sentiment that the market is heading for a collapse, the blockchain analytics firm pointed out that this is not the case.

In August 2018, for instance, ICOs raised approximately US$1.466 billion and this was nearly the same amount that was raised last year during the bull in the month of November – US$1.429 billion.

https://twitter.com/elementus_io/status/1044965668981026817

Additionally, most of the funding that has been raised in ICOs was collected this year, when the price of cryptocurrencies had fallen off their record highs.

“In fact, the majority of historical ICO fundraising occurred during the current bear market,” Elementus’ co-founder, Mike Kalomeni, wrote in the report . “Of the total $28 billion raised to date, $15.9 billion occurred between February, 2018 and August, 2018.”

Higher Standards

One trend that has emerged, according to Elementus, is that there is increasing competitiveness with regards to token sales. Last year in June, for example, the percentage of token sales which raised a minimum of US$100,000 (the threshold for an ICO to be considered a success, per Elementus) was 84% in June 2017 but this fell to 22% in August 2018. In the last 12 months, the successful ICO rate has fallen from 50% to 20%. This has been attributed to the growing selectiveness of both retail and professional investors.

Besides investors getting wiser, another indication that the ICO market is maturing is the fact that it is now harder than ever to have a pre-product startup raise more than US$100 million based entirely on a white paper. Per Elementus, this has now become the preserve of established firms.

Featured image from Shutterstock.