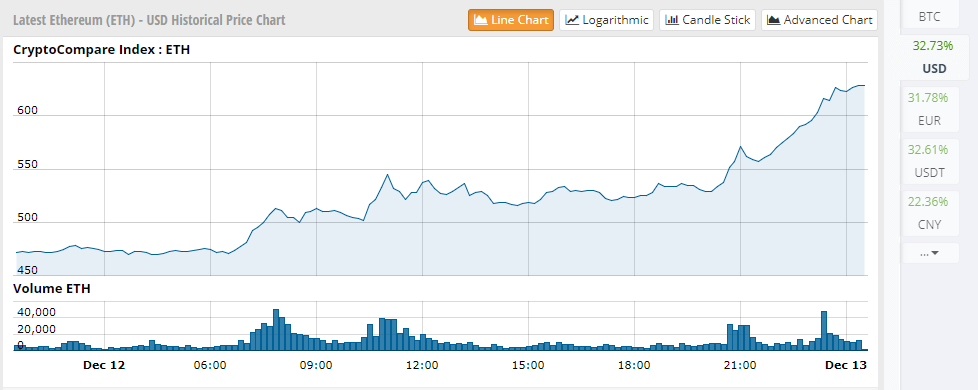

Ethereum Price Surges by 32%, Achieves New All-Time high at $635

ETC's Atlantis hard fork is less than one month away. | Source: Shutterstock

The Ethereum price has surged by more than 32 percent over the past 24 hours, achieving a new all-time high at $635 and a daily trading volume of nearly $5 billion.

Last week, CCN.com reported that the US has become the largest Ethereum exchange market, overtaking South Korea. Two exchanges, Coinbase’s flagship trading platform GDAX and Bitfinex, have accounted for more than 20 percent of global Ether trades over the past few weeks.

Since earlier this week, the popularity of Ether has begun to rebound in the South Korean market, as traders on the country’s three leading exchanges Bithumb, Coinone, and Korbit started to increasingly trade Ether. At the time of reporting, Bithumb, South Korea’s largest cryptocurrency exchange market, accounts for 11 percent of global Ether trades, with a $500 million daily trading volume.

Why is Ether Price Rising?

Throughout today, the market valuation and price of almost every single cryptocurrency in the market have surged. Some, including Litecoin, Dash, and Ether have made significant gains, with Litecoin recording a staggering 80 percent daily increase in value.

Both Litecoin and Ethereum have struggled to make major gains since September and throughout the past two months, the price of Ether and Litecoin have remained stable at around $350 and $100, respectively.

However, over the past 24 hours, the two cryptocurrencies skyrocketed in value, as the demand for cryptocurrencies from the global finance market has increased, primarily due to the successful debut of bitcoin futures on the Chicago Board Options Exchange (CBOE).

Naturally, the price of Ether, which has continuously been the second largest cryptocurrency behind Ethereum, has increased as more capital and wealth have begun to move from the traditional finance market to the cryptocurrency market.

In several major regions such as South Korea, government agencies and financial authorities have announced their plans to allow initial coin offerings (ICOs). The South Korean government for instance, plans to allow institutional investors and accredited traders to invest in ICOs in the near future, but impose a temporary ban on ICO investment for the general public.

Since late 2016, ICOs have accounted for a major portion of the Ethereum network’s transaction volume and trading volume. Hence, the legalization of ICOs in major regions will have an immediate and large impact on the short-term price trend of Ethereum.

More importantly, the Ethereum transaction volume has been increasing at an exponential rate, likely because of the growing popularity of two decentralized applications (dapps); CryptoKitties and EtherDelta.

As of current, the Ethereum blockchain network settles approximately 830,000 transactions on a daily basis, more than all of the cryptocurrencies in the market including bitcoin combined.

The growth of Ethereum in terms of user base and daily transaction volume translates to the increase in its market valuation and price, as it continues to evolve as the premier platform for decentralized applications.

Mid-Term Trend

As Litecoin creator Charlie Lee noted, given the recent performance of most cryptocurrencies in the market, a major correction will likely occur in the upcoming weeks. As such, the price of Ether could correct itself within the next week, to further stabilize the market and shake off weak hands.

Featured image from Shutterstock.