Debunked: How Nouriel Roubini Failed to Attack Crypto with Cherrypicked Data

Noted bitcoin-basher Nouriel Roubini was at it again in Davos, claiming that blockchain is no better than an Excel spreadsheet. | Source: Shutterstock

Recognized economist Nouriel Roubini, a professor at Stern School and NYU, recently launched a series of attacks against the crypto sector.

All of the False Claims Roubini Made

He claimed Bitcoin is a Ponzi scheme, Ethereum co-creator Vitalik Buterin amassed a wealth of a billion dollars by creating a pre-mined blockchain network, and said public blockchain protocols are unusable due to $60 fees — all of which are completely false.

Buterin disclosed that he had never held more than 0.9 percent of Ethereum’s total supply and had nowhere close to a billion dollars. Bitcoin fee is estimated to be around $0.1 according to Blockchain, not $60.

First claim: Bitcoin transaction fee is $60

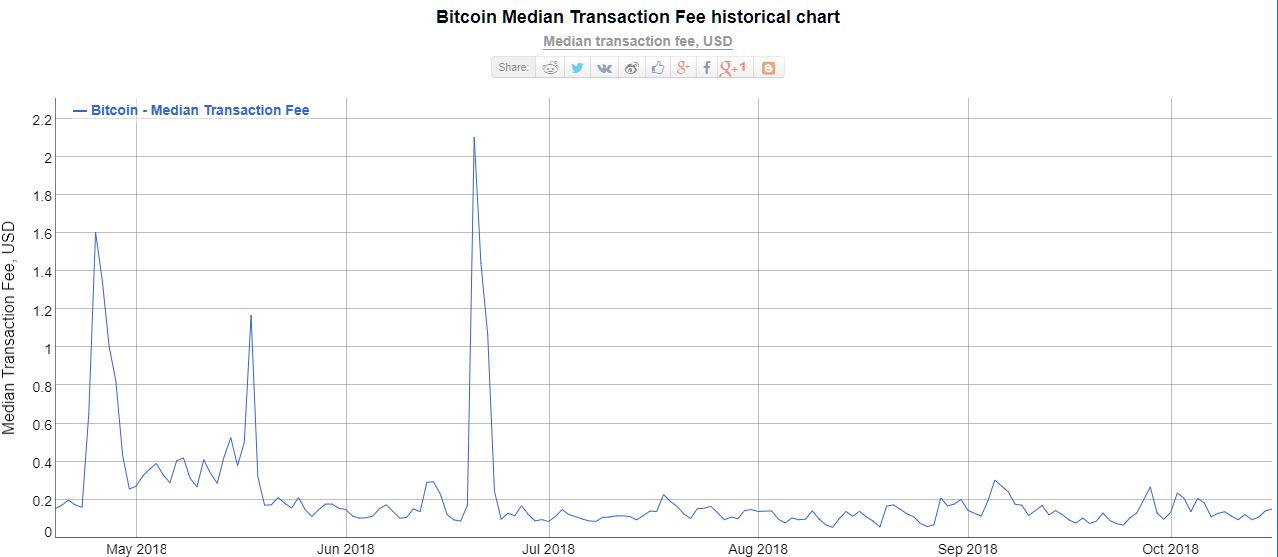

Absurdly, Roubini decided to utilize a narrative that Bitcoin’s transaction fee is $60 and to pay for products of less value such as a cup of coffee, it costs upwards of $63.

For instance, Roubini stated that to purchase a Starbucks latte, which costs $2.9, one would have to pay $63 to buy with BTC.

However, the transaction fee of BTC is publicly available and verifiable data, which can be easily refuted. Hence, as Blocktower co-founder Ari Paul said, it remains unclear why Roubini led his criticism against crypto with a piece of information that can be refuted by anyone with ease.

“BTC fees are less than $0.10, easily verifiable. If you value truth, you’d provide a public correction. If your goal is to mislead people with simply false statements, carry on. There’s nothing to research. Fees are publicly viewable from many sources (googling it works.) I find it better not to provide a specific source because then regardless of source, the source gets attacked,” Paul said.

More importantly, an investor of BTC recently moved 29,999 BTC worth $194 million on the Bitcoin blockchain with a fee of $0.1. With legacy systems, it costs over a hundred thousand dollars to move an amount that is larger than $10 million.

Second claim: Crypto is printed out of nowhere

Bitcoin, Ethereum, and many public blockchain protocols utilize a consensus algorithm called Proof of Work (PoW), which requires miners to verify transactions and generate cryptocurrencies with a large amount of energy and hardware costs.

Currently, at the price of $6,500, BTC mining is nearly at a breakeven level, which means miners are generating BTC without any profit by foreseeing an increase in the value of the BTC in the long-term.

Hence, the claim that crypto can be printed out of nowhere is false as miners need to cover significant expenses required to maintain a blockchain network.

Third claim: Buterin stole 75% of Ethereum’s supply

Earlier this month, Roubini claimed Joseph Lubin and Vitalik Buterin, the two co-creators of Ethereum, stole 75 percent of the supply of ETH, the native cryptocurrency of the Ethereum protocol.

“Vitalik Buterin was the ringleader – together with Joe Lubin – of the criminal pre-mining sale/scam that created Ether. They stole 75% of the Ether supply and became instant ‘millionaires’ of fake wealth.”

In response, Buterin reaffirmed that he had never held more than 0.9 percent of Ethereum’s supply, instantaneously refuting the claim of Roubini. The third claim was also easy to disprove because through blockchain explorers, anyone on the network can publicly and transparently verify wallets and transactions.

“I never personally held more than 0.9% of all ETH, and my net worth never came close to $1 billion. Also, I’m pretty sure there are no criminal laws against pre-mining,” said Buterin.

Why did Roubini do this?

It remains unclear why Roubini, who is respected in his field of economics and finance, decided to attack an industry with a series of arguments and claims that can be disproved with sufficient evidence and data that is available to the public.

Featured Image from Shutterstock