Cryptocurrencies Decline on Christmas Eve: Bitcoin, Ethereum, Ripple Down 10%

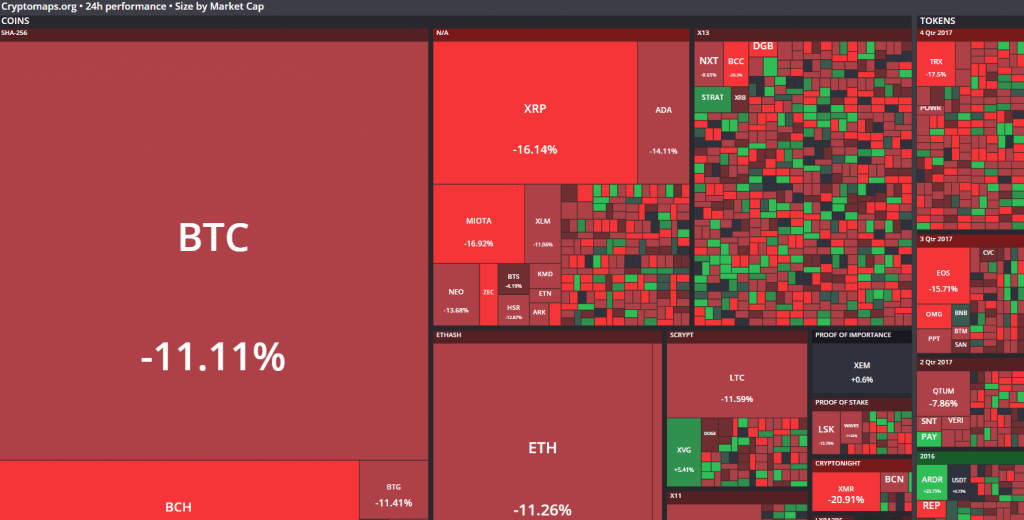

On Christmas Eve, December 24, the price of leading cryptocurrencies fell by large margins. Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, along with every other cryptocurrency in the market with the exception of a few have declined substantially in value.

Out of the 10 most valuable cryptocurrencies in the market, Bitcoin Cash and Ripple have recorded the largest losses, falling by 18 percent and 17 percent respectively. The two cryptocurrencies have also surged in value earlier this week, resulting in a bigger correction than other cryptocurrencies in the market.

Bitcoin, Ethereum, and Litecoin recorded a price correction of over 10 percent, as the price of bitcoin fell below $14,000.

Why Did a Correction Occur?

Historically, the market valuation of cryptocurrencies had surged during holiday seasons, especially throughout Christmas and new year’s. Analysts have attributed to the tendency of cryptocurrencies like bitcoin rising during holiday seasons to the introduction of new family members and friends to the cryptocurrency market.

As bitcoin and cryptocurrencies become hot topics, more individual and casual investors engage in bitcoin and cryptocurrency trading.

On December 23, prior to Christmas Eve, the cryptocurrency market recovered from a major correction, which led to the price decline of every single cryptocurrency in the market. Bitcoin fell by around 25 percent, while others fell by nearly 50 percent.

After a speedy recovery, on December 24, the cryptocurrency market recorded another correction, which was unforeseen by most analysts and experts. Highly regarded and respected investors including billionaire hedge fund legend Mike Novogratz stated that with the recent recovery, the price of bitcoin will likely initiate a new rally and surge in price in the short-term. However, the cryptocurrency market recorded another major correction prior to Christmas.

For newcomers, the latest cryptocurrency correction could be a crucial opportunity to understand the nature of the cryptocurrency market and risks involved in trading. Every market is affected by a bear cycle after a bull run, as Litecoin creator and former Coinbase executive Charlie Lee had explained.

This year, the cryptocurrency market has surpassed the expectation of even some of the most optimistic, enthusiastic, and long-time entrepreneurs, analysts, and investors. In April 2017, ShapeShift CEO Erik Voorhees predicted the market valuation of cryptocurrencies to surpass $300 billion in 4 years.

In April 2017, ShapeShift CEO Erik Voorhees predicted market cap of cryptocurrencies to surpass $300 billion in 4 years (2021).

7 months later the market cap of #bitcoin alone is over $300 billion and cryptocurrency market cap is nearing $600 billion. 🚀https://t.co/rvHl9TVWiz

— Joseph Young (@iamjosephyoung) December 18, 2017

By December, bitcoin alone had already achieved a $300 billion market cap and the combined market valuation of cryptocurrencies surpassed $600 billion.

Correction is Necessary

Major price corrections prevent short-term bubbles from occuring. The price trend of bitcoin and other cryptocurrencies in the market is optimistic because it always has managed to recover from major corrections, supported by rising demand from investors and large volumes.

On December 11, Lee wrote:

“Every crypto bull run I’ve seen has been followed by a bear cycle. The market needs time to consolidate. That’s just my experience from 7 years of watching this space. How low and how long it will be is TBD. People need to be aware of this possibility and invest responsibly.”

Currently, the cryptocurrency market is seeing a correction of the three-month bull run bitcoin and the cryptocurrency market have demonstrated.

By December, bitcoin alone had already achieved a $300 billion market cap and the combined market valuation of cryptocurrencies surpassed $600 billion.

Featured image from Shutterstock.