Crypto Spring Blooms? Bitcoin Transactions Hit Highest Level in 13 Months

Green shoots have begun to emerge in the crypto market, a Binance report suggests. | Source: Shutterstock

Positive news has been stretched thin during the “Crypto Winter,” but there are now genuine signs that the ice is beginning to thaw. With Bitcoin showing remarkable resiliency and price stability in a world that wants to write it off, there are many fundamentals to which believers in the world’s largest cryptocurrency like to pay attention. One of these metrics just went through the roof.

The SFOX Crypto Volatility Report: February 2019 was released today, and in this report, analysts try to gauge the health of crypto markets by looking at the following three metrics: price momentum, market sentiment, and the continued advancement of the sector. The report on Thursday ultimately concluded a bullish outlook in general for the cryptocurrency sector.

Celebrity Endorsements Shouldn’t Matter to Crypto Investors

Noting first of all that a significant amount of help from high-profile individuals supported prices across the board, the firm wrote:

“Some of the ‘hype’ that we mentioned was absent from the month of January appeared to resurface in February amidst pro-crypto statements from tech personalities (e.g., Elon Musk and Jack Dorsey) and crypto pundits ‘calling the bottom’ of Crypto Winter.”

I hate when celebrity endorsement is considered a fundamental (I’m aware SFOX is noting this to explain volatility, so I’m not attacking them here). No one knows what individual celebrity agendas are or aren’t. If there is one thing that investors should have learned it’s that hype in cryptocurrency has a considerable bearing on price movements, but they are nearly always temporary – especially in the thin and illiquid environment currently faced by even the biggest of the cryptos.

A kind word here and there is beneficial for a price deviation and usually nothing more. You could write a book about avoiding media hype in investments, but my favorite example was the Ripple (XRP) debacle on CNBC, and they are still at it . I’m not hating on Ripple; I’m hating on the hype that hurts retail buyers.

https://www.youtube.com/watch?v=1JMH6pgHLjc

If you ever feel your adrenaline pumping from a celebrity price forecast, calm down. You need something concrete to base your hopes on, not a throwaway comment from an exhausted-looking Elon Musk.

Bitcoin Transactions Increase, Likely Supporting BTC Price

Now down to the good stuff. In the same report, there is some tremendous news. Transactions on the Bitcoin network surged to their highest level in more than a year,

“There were also more fundamental reasons to have a positive outlook on the market: transactions on the Bitcoin network were at the highest level since January 2018.”

Great stuff. Usage has and always will be the best bullish or bearish argument for any cryptocurrency. Inherent value and liquidity all rise from this point. I could leave it there and say “Winter Over,” but that would be immature and premature. What I will say is that the transaction rate bouncing back is ultimately tremendous. With media coverage so low in the mainstream, this is an indicator of how sticky interest is in Bitcoin despite Google searches collapsing from their highs.

Can’t Ignore the ETF in the Room

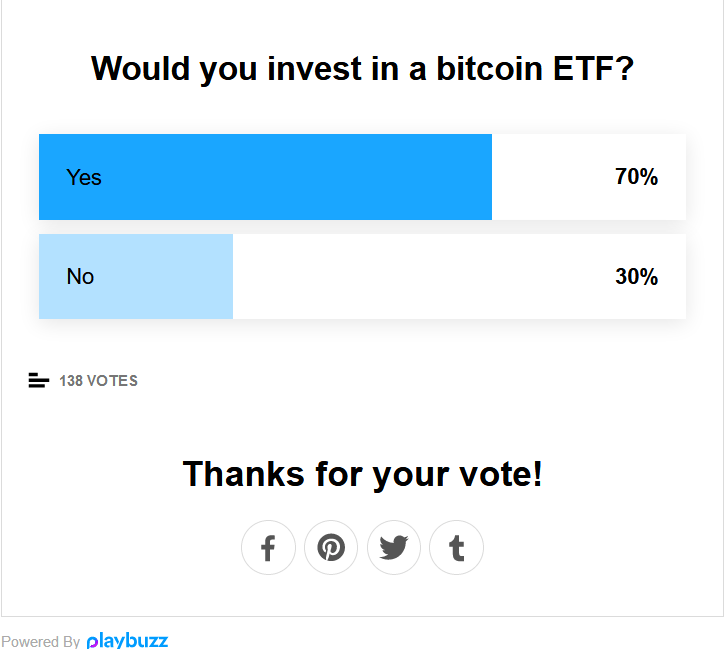

Not excited about the prospect of a Bitcoin ETF ? SFOX believe you might be in the minority, as there is evidence that this headline continues to generate substantial buying appetite in the market.

“Even while some factions within the crypto sector question the significance and utility of a Bitcoin ETF, the market still seems to be fairly responsive to news about its potential: in the two days surrounding this news, the price of BTC climbed over 7%.”

If you are a trader, not an investor, it’s almost impossible to ignore stuff like this. The market will dictate to you the reality in the short term, and so trying to fight trends like this because you “don’t care” or “it’s irrelevant” is a dangerous game to play. Instead, it’s usually better to try and find reasons why the market might be right. In this case, it seems probable that big, smart money views the ETF as another step towards broader adoption which might increase crypto usage.

In turn, this could bring institutional money flowing into the cryptocurrency market and improve liquidity. SFOX isn’t telling you this will happen, but they are trying to extrapolate what the market is telling them it believes. You’ve got to know your enemy in this game.

Usage Remains the Best Hope of Surviving Crypto Winter

Ultimately, with the price of BTC/USD bumping along near the $4,000 level, fancy price forecasts are a dime a dozen. What makes SFOX’s report valuable is that they give us something concrete to look at rather than just hopes and dreams. Building your house on the rocks and not the sand is essential – especially if you want to survive the winter storms.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.