Crypto Market Trims Losses as Binance Coin (BNB) Leads with Massive 20% Spike

Binance coin is making soaring gains along with the rest of the cryptocurrency market this week. | Source: Shutterstock

Major cryptocurrencies have ticked upward over the last hour, entering positive territory on the daily charts with Binance Coin ahead of the game, trading up 21.08% against the US dollar.

Key Takeaways

- Binance Coin is trading up, pumping in value even during the market-wide price corrections seen earlier today.

- Bitcoin market dominance is still over 50%

- Major coins are now ticking upward with only Tether posting losses among the top 10 coins (likely a blip).

- The market cap has regained $1 billion over the last 7 hours.

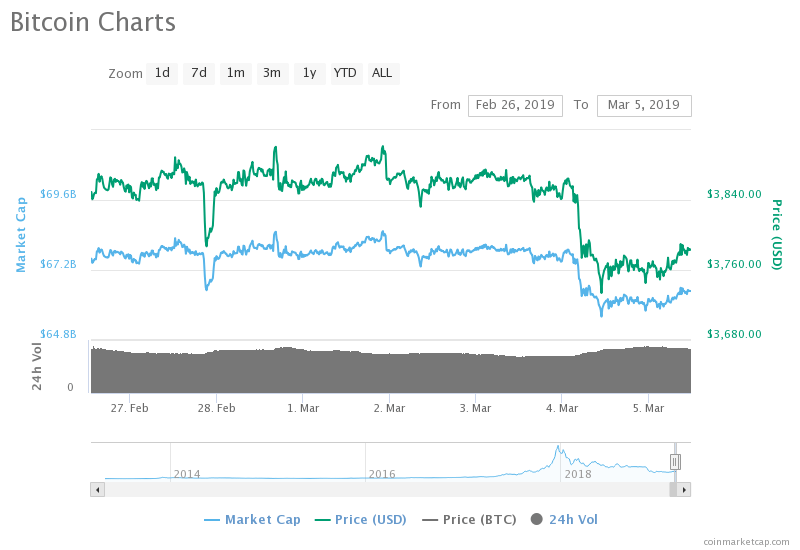

Bitcoin has recovered from earlier losses, currently trading at $3,874.59 and up 2.87% after sinking below $3,733.00 on Monday.

BNB is performing well with an 18.45% increase, more gains than any other coin in the top 10 by market cap. Litecoin comes in second with gains of $12.53%, followed by EOS at 11.97% and Tron with 9.91%.

The market cap has regained over $7 billion in the last 24 hours and is now sitting at over $131 billion USD.

Binance Coin

Binance Coin (BNB) is a cryptocurrency launched by leading crypto exchange Binance. Similar to ether’s role on the Ethereum network, BNB is used to pay fees on the Binance platform including service, trade, and listing fees.

The currency offers traders a discount on fees when used to trade, incentivizing the hundreds of thousands of active daily users to buy and trade in BNB, thus propping up its market demand and value.

The coin has been a success since its launch in July 2017, although only recently entered the top 10 cryptocurrencies by market capitalization, overtaking Stellar and Tron in the past week and currently sitting at number 8 on the list. Also performing very well with a 23.31% gain is ENJ, a utility token performing various functions on the 20-million user strong Enjin gaming platform. ENJ supports digital gaming assets on the platform among other uses.

Bitcoin Market Dominance Hovering Above 52% – Utility Tokens Becoming Immune?

Typically, even minor downward momentum in Bitcoin causes proportionally greater selling pressure among altcoins, causing a market-wide decline. This is due to BTC market dominance, the effect that Bitcoin has on the overall market (calculated by dividing the total market cap by the BTC market cap). While market dominance is not low, it’s interesting to see utility altcoins like BNB and ENJ perform well despite BTC volatility.

It could be that we’re beginning to see utility and real-life use cases stand on their own two feet, becoming increasingly independent of BTC. While traders and cryptocurrency supporters often lament the market dominance effect, a break from market dominance altogether could bode ill for Bitcoin.

However, while many of the top-ranked coins are arguably speculatively traded for the most part, those with actual utility in reputable platforms like Binance and Enjin may demonstrate anomalous behavior as their market cap grows, acting independently without threatening the health of BTC in the short-term.