Coinbase ‘Pump’ Fails to Boost Zcash in 17% Drop from Daily Peak

On November 30, Zcash (ZEC), a privacy-focused cryptocurrency, was integrated into Coinbase Pro, a U.S.-based regulated digital asset exchange operated by Coinbase.

The exchange told investors that throughout the foreseeable future, withdrawals of Zcash shielded transactions, private or anonymous transactions on the Zcash network, will not be supported.

Coinbase said :

“Initially, we will support deposits from both transparent and shielded addresses, but only support withdrawals to transparent addresses. In the future, we’ll explore support for withdrawals to shielded addresses in locations where it complies with local laws.”

Insider Trading Unlikely

The integration of Zcash was met with mixed reactions from investors in the cryptocurrency community. While the implementation of a privacy-focused cryptocurrency from one of the most strictly regulated exchanges in the global market is considered a significant milestone for the sector, the process of implementation has been criticized by some investors.

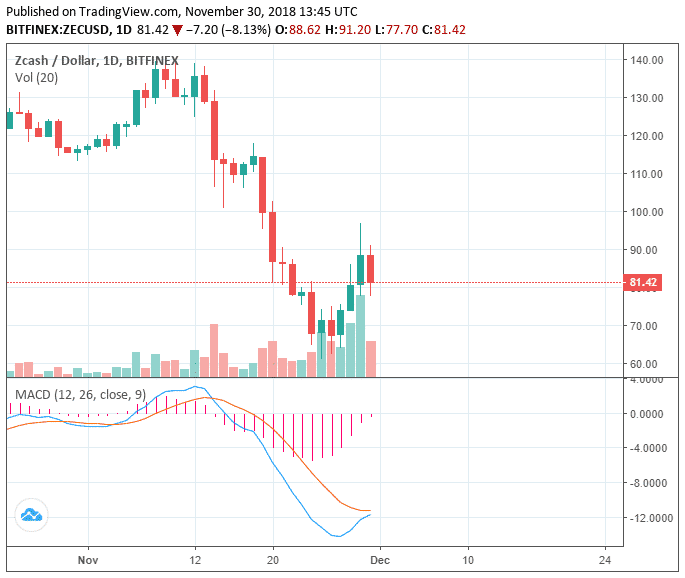

Prior to the listing of Zcash, as was the case with the integration of Bitcoin Cash by Coinbase, the price of the asset started to surge after being on a clear downtrend for more than two weeks.

Abruptly, beginning November 27, the price of Zcash started to spike from around $64, recording three daily candles with overwhelming buy volume. Within a three-day span, the price of ZEC increased from $64 to $97, by 52 percent.

In the past three days, Bitcoin recorded a solid increase in momentum by demonstrating a 13 percent increase in price on November 28, on a single day. The newly established momentum of Bitcoin could have led ZEC to rise in value prior to its listing and in consideration of the market’s generally positive movement two days prior to the listing, the argument against insider trading is fairly weak.

However, on November 27, Coinbase users reported that ZEC was added to some features on the Coinbase application, which hinted investors to purchase the asset. Whether the addition of ZEC to an existing feature on Coinbase was a coincidence or not remains unclear, but some investors suspect that the addition of Zcash on the app tipped investors to purchase the asset prior to the listing.

Coinbase “Pump” in Question

The listing of a crypto asset by Coinbase represents a clearance from the U.S. Securities and Exchange Commission (SEC) as a non-security. In May, when Coinbase initially announced its intent to list five digital assets, it emphasized that it will not list any asset that does not obtain the approval from the SEC.

In the sense that every asset listed on Coinbase is essentially a non-security under U.S. laws, the listing could have a positive impact on the long-term growth of the asset.

However, as seen in the price trend of 0x (ZRX) and Basic Attention Token (BAT), two tokens listed on Coinbase, subsequent to the listing, tokens tend to plummet significantly in value.

Zcash, for instance, fell by more than 17 percent from its daily peak, merely minutes after achieving its new monthly high.

Featured image from Shutterstock.