Bitcoin’s Impending ‘Halving’ Could Spark Meteoric Price Boom

Bitcoin's May 2020 halving could lead to a meteoric price boom for the flagship cryptocurrency. | Source: REUTERS / Dado Ruvic / Illustration / File Photo

Alistair Milne, the chief investment officer at Atlanta Digital Currency Fund, has said that the block reward halving of Bitcoin could push the price of the dominant cryptocurrency to massive gains in the next 12 months.

Why Block Reward Halving is a Fundamental Driver of Bitcoin Price

A block reward halving in Bitcoin is referred to as the mechanism that decreases the amount of Bitcoin generated by miners after mining a block.

On the Bitcoin network, miners solve complex cryptographic problems using computing power to process transactions, which are then placed in blocks to form a blockchain.

To compensate miners, every block generates a certain amount of Bitcoin which miners then can use to cover their expenses such as equipment and electricity costs.

The block reward of the Bitcoin network is expected to decrease by half in 15 months, and traditionally, a block reward halving has led the price of Bitcoin to rally because it reduces the rate in which new BTC is produced.

As Bitcoin nears its fixed 21 million supply, the scarcity of the digital asset increases, which boosts the price and the demand from the market.

Milne said:

“Just 15 months or 450 days until the next Bitcoin halving event…. can’t wait for everyone to say its already priced in for the next 12 months. It isn’t.”

According to Barry Silbert, the CEO of Digital Currency Group – arguably the largest venture capital company in the cryptocurrency sector – many retail investors are not aware of the block reward halving and the impact it could have on the Bitcoin price.

“I’d guess that upwards of half the people I know that invested in bitcoin have never heard of “halving” or know what it is. and those are the people that already own bitcoin. That guess is based on me asking folks over the past month,” Silbert noted.

Historically, the Bitcoin price has tended to move a year before the block reward halving. While some analysts claim that the halving is mostly priced in, the numbers show that it gets priced in gradually as the cryptocurrency nears its halving date.

One cryptocurrency analyst said :

“People calling for $1,000 Bitcoin don’t realize the halving pump traditionally starts a year ahead of time. The next halving is May 2020, meaning we are only a few months away from the start of the pump Are we really going to dump another -70% in the next few months? Doubt it.”

In the past, when the block reward halving of Bitcoin occurred, the circulating supply of the asset was still estimated to be close to its maximum circulating supply.

However, in recent years, due to private key losses, dormant addresses, and exchange mismanagement, millions of BTC have reportedly been lost permanently on the blockchain.

Once lost, it is virtually impossible to recover lost Bitcoin without initiating a hard fork, which the community has never considered initiating throughout the past ten years.

Lost Coins Further Reduce Supply & Bolster Demand

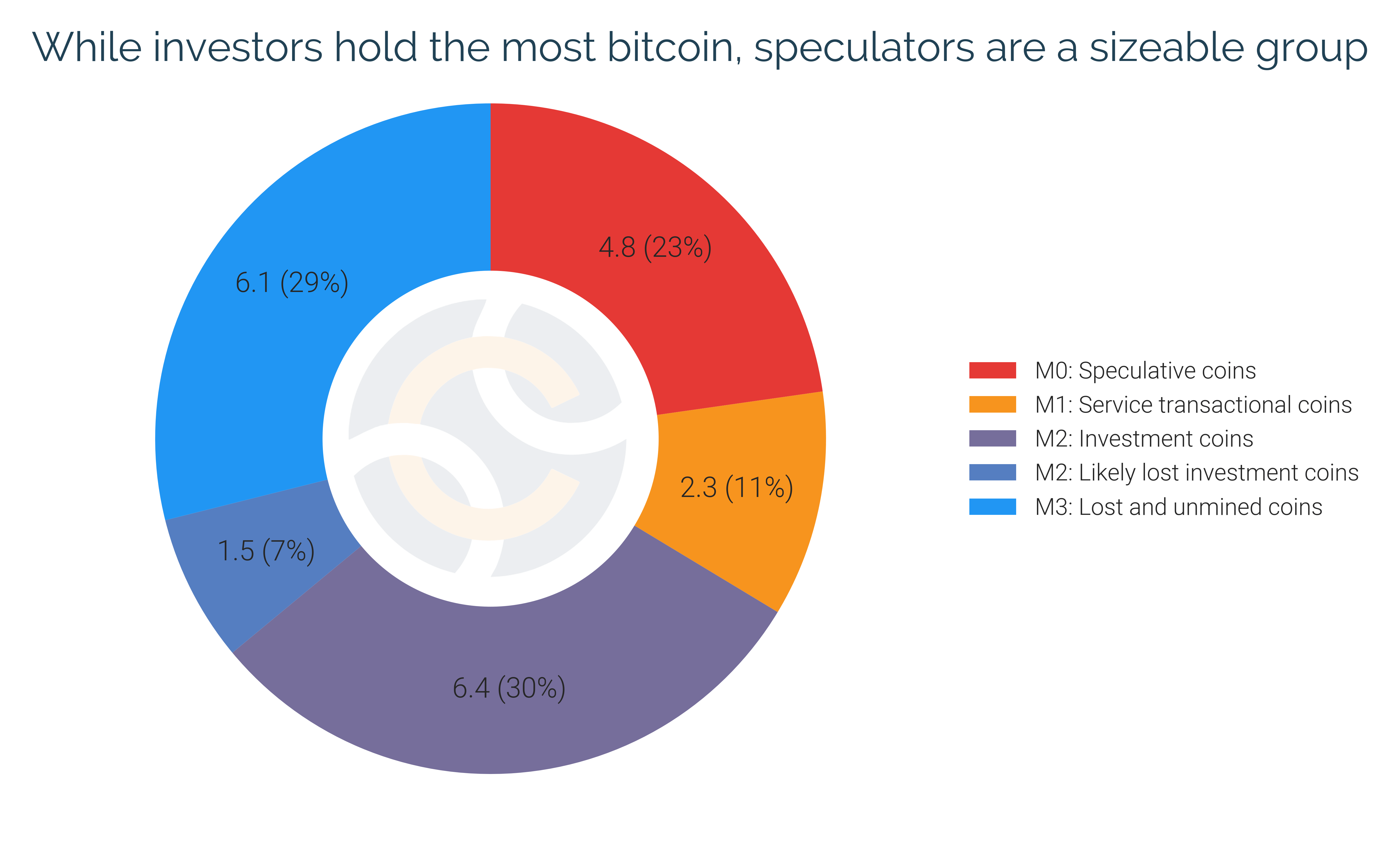

Chainalysis, a blockchain analytics company, estimated in 2017 that 4 million BTC are lost forever and are out of circulation.

At the time, Chainalysis senior economist Kim Grauer said that industry experts found the figure surprising.

“Firstly, we floated our findings to a few people and they all had different reactions about how surprising the figure was. But what I found most surprising/interesting was how when you unpack what it means to be “lost” things get even more confusing.” the researcher said .

Since then, more BTC is estimated to have been lost, and the block reward halving will only decrease the available supply of the asset.

As such, Bitcoin is actually a deflationary currency, and as the block reward of the asset declines over time, it will decrease the possible amount of crypto investors can purchase – and push up the price of BTC.