Bitcoin Short-Term Trend Seems to Be Down

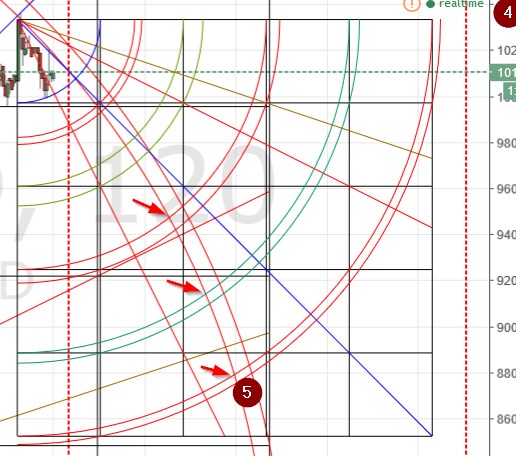

Bitcoin managed to touch the 5th arc pair of resistance on the 2-hour chart setup. This generated a sell signal. Since then it managed to re-test the arc and was rejected.

Since then it managed to re-test the arc and was rejected.

The long-term trend is still up. But the short-term trend is likely going to be down. Looking at this bull setup, a reasonable target is the 1×2 Gann angle at ~ 940. Let’s look at a bear setup from the swing high of $1050 (Kraken): I have overlaid the bear setup on top of the bull setup and have labelled the intersection of the 5th arc pair of each setup. There are arrows at each point that stand out as likely targets in the event that a correction gathers force here.

I have overlaid the bear setup on top of the bull setup and have labelled the intersection of the 5th arc pair of each setup. There are arrows at each point that stand out as likely targets in the event that a correction gathers force here.

However, while we were issued a sell signal at the touching of the 5th arc at $1050, we have not had another sell signal since then. When/if we see a close below the 1st arc (blue) and/or a close below the 1st square ($1002), we will have another sell signal.

Conversely, when/if price gets through the 5th arc on the bull setup (labelled), we will have a buy signal.

As I continue to believe that a 3rd wave of the correction that began Jan 4th must complete before the next leg of the great rally of 2017 can begin in earnest, I harbor a suspicion that prices will get to the lower end of the range before a buy signal is generated.

However, I am not one to argue with the markets. If price clears the 5th arc pair shown above, and a buy signal is generated sooner rather than later, I will happily give up my bearish thinking…

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.